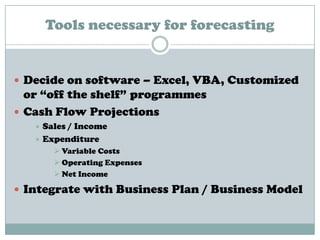

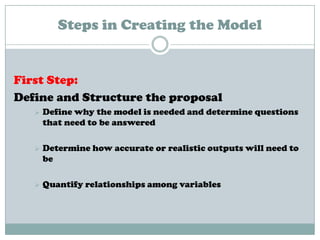

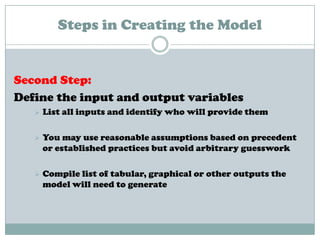

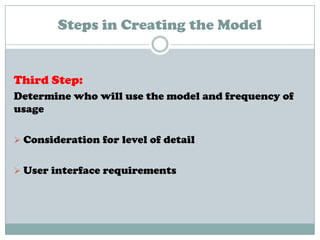

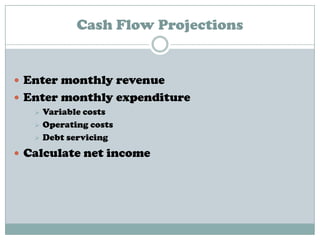

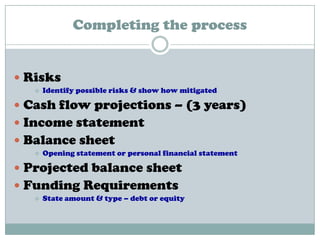

A financial model is a quantitative representation of a business's financial information that can be used to forecast the future, value a security, determine the benefits of a merger, and answer "what if" questions. It models relationships between variables in mathematical terms. Creating a financial model involves defining inputs and outputs, structuring cash flow projections over multiple years, and identifying risks. The model benefits businesses by identifying weaknesses, optimizing profits, evaluating risks, and saving time in documentation.