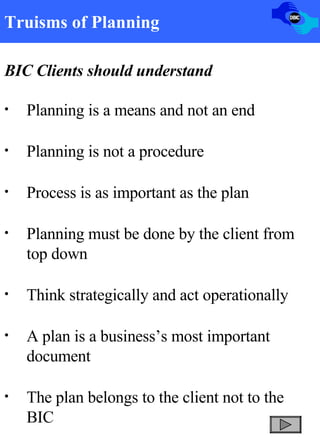

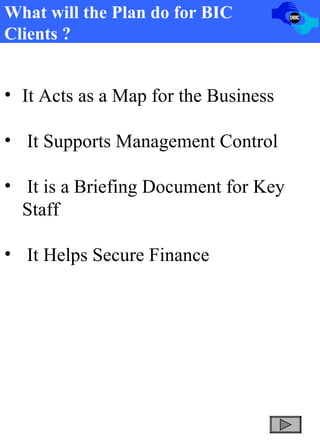

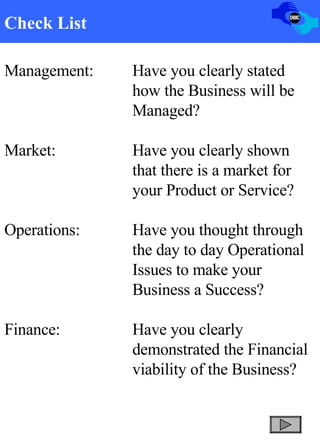

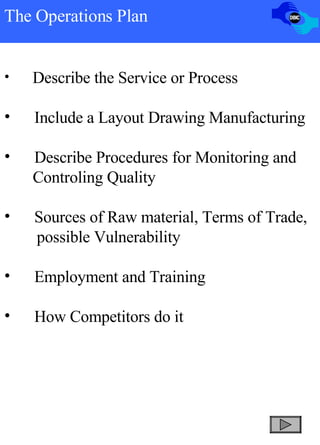

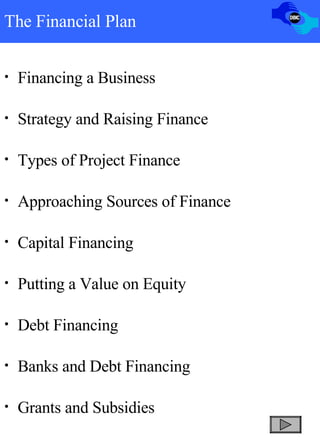

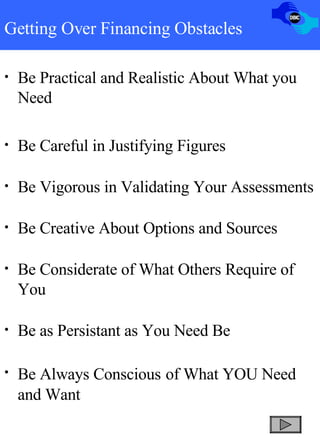

The document provides an overview of strategic planning principles, business planning, and how financial planning and software can assist business innovation centers (BICs). It discusses the importance of strategic planning for BIC clients and outlines key elements that should be included in strategic business plans, such as taking a medium-term view, focusing on strategic matters, and being written down and reviewed periodically. The document also summarizes various aspects that should be considered when preparing a business plan, such as the structure, operations plan, financial plan, and projections.