This document summarizes changes to central excise, customs, and service tax introduced in the Indian Union Budget. Some key points include:

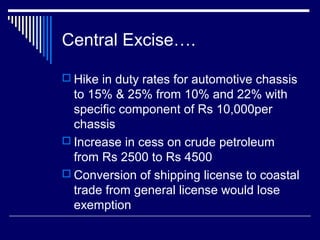

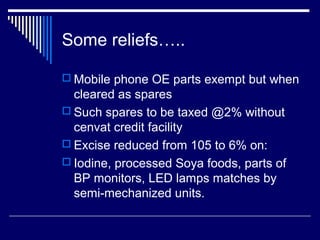

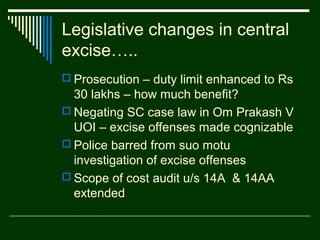

- Central excise duty rates increased from 10% to 12% across most goods. Select goods saw duty hikes from 1-5% to 2-6%.

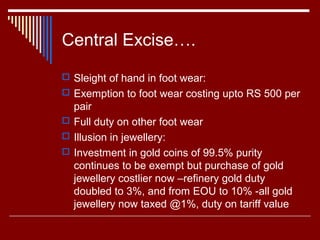

- Cement, automobiles, cigarettes, pan masala faced higher duties. Gold jewelry is now uniformly taxed at 1%.

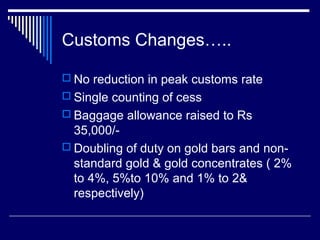

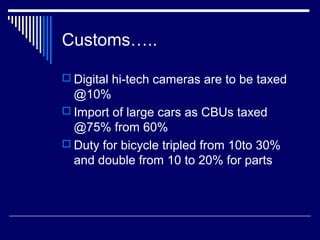

- Customs duties on gold bars, large cars increased. Duties on bicycles tripled and doubled for parts.

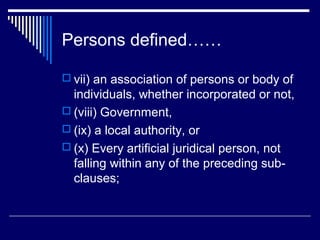

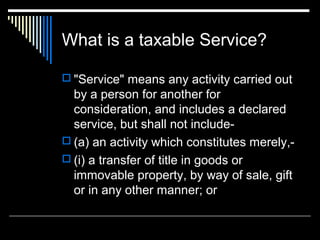

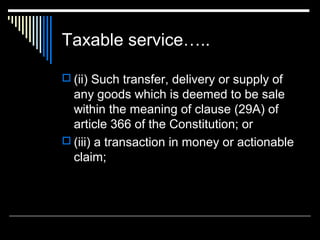

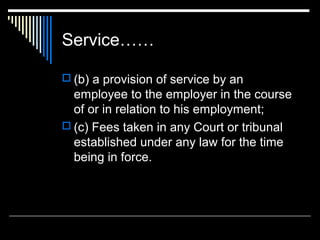

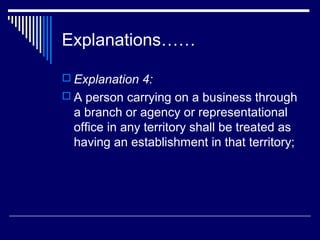

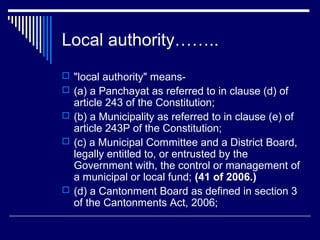

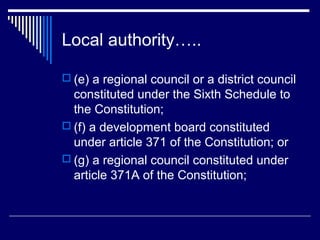

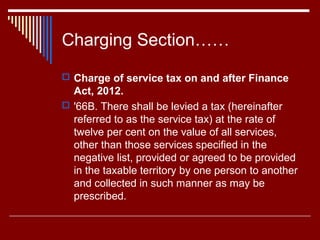

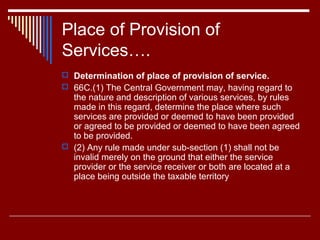

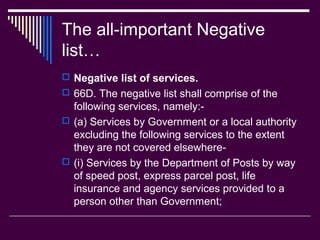

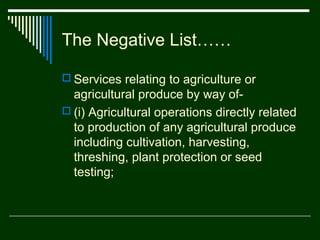

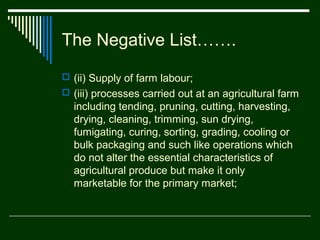

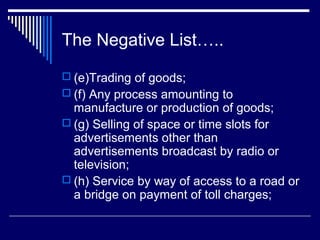

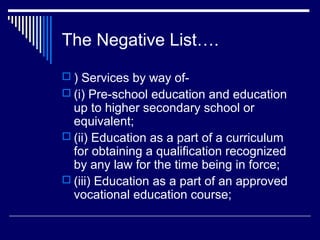

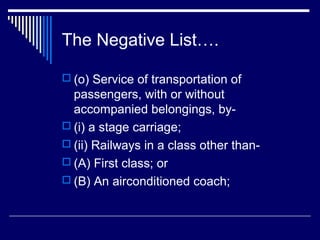

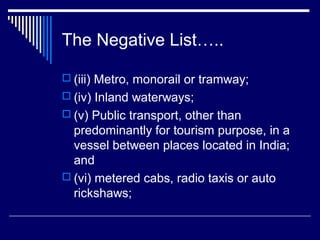

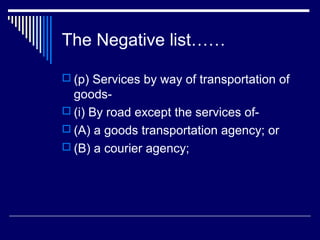

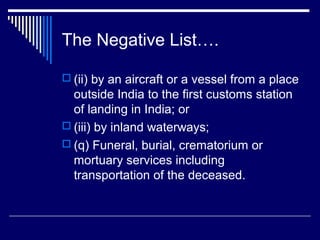

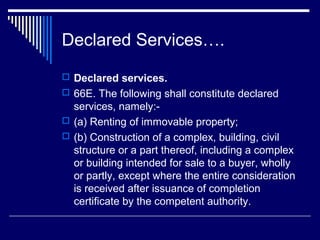

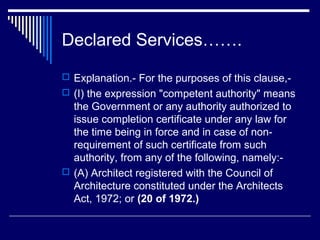

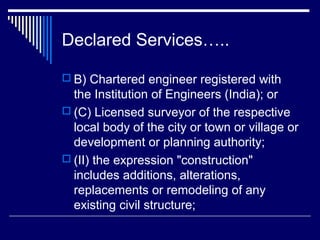

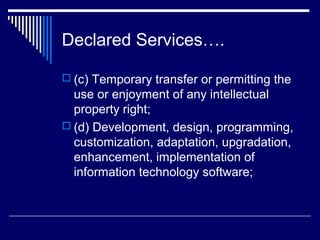

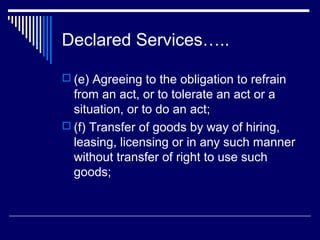

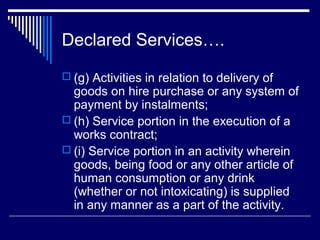

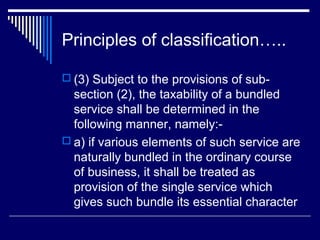

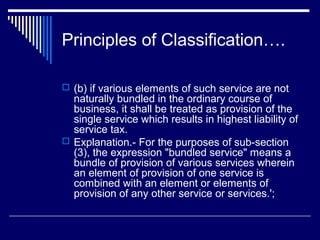

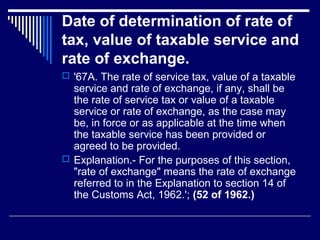

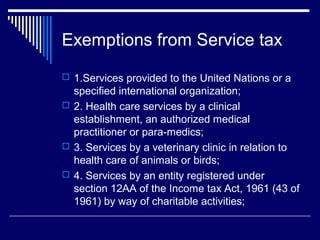

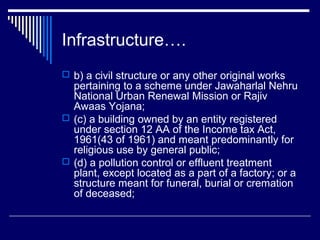

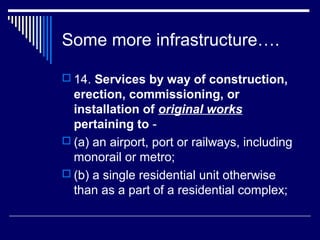

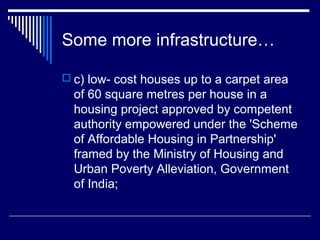

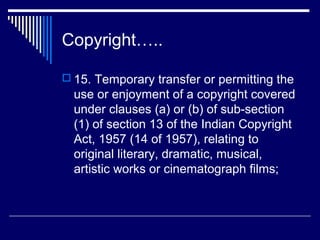

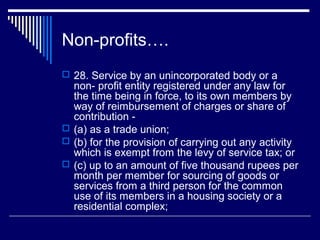

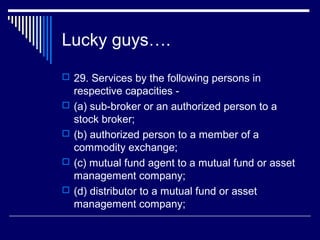

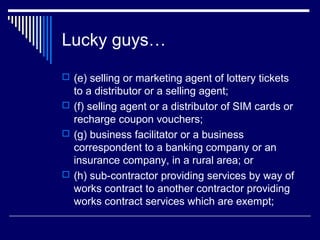

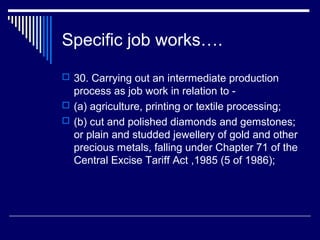

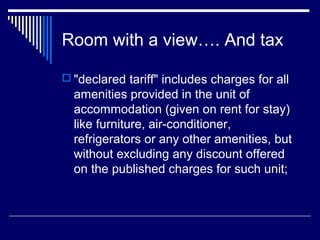

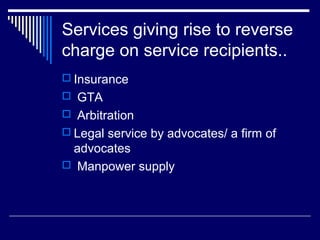

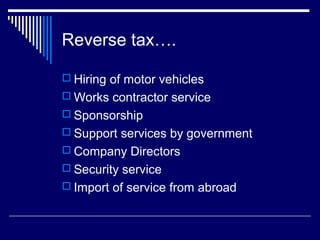

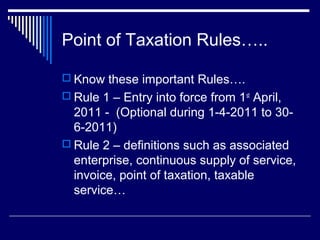

- Service tax definition expanded. Negative list of exempted services includes most government services but excludes express postal services.