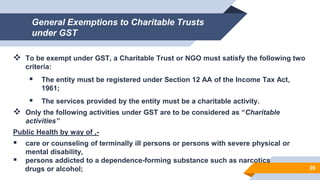

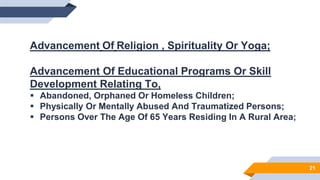

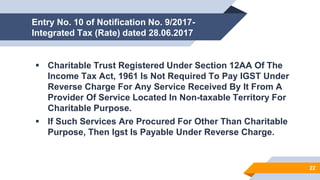

The document outlines the implications of the Goods and Services Tax (GST) on charitable trusts, establishing that such entities are classified as 'persons' under GST and thereby subject to taxation depending on their activities and turnover. Charitable trusts must register for GST if their annual turnover exceeds INR 40 lakhs, although certain activities may qualify for exemptions if they are classified as charitable under specific provisions of the Tax Act. Additionally, the document details various specific exemptions available to charities, including those for religious ceremonies, health care services, and educational programs.

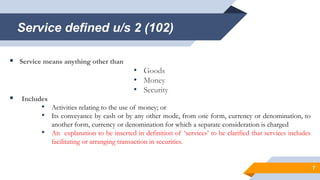

![Goods defined u/s 2 (52)

Every kind of movable property

Other than:

• Money [Sec. 2(75)]

• Securities [Sec. 2(101)]

But includes

• Actionable claim [sec 2(1)];

• Growing crops, grass and things attached to or forming part of the land which are

agreed to be severed before supply or under a contract of supply.

In addition to above, Schedule II deems certain supply to be that of goods

6

Clause 6 of Schedule III:

Actionable claims other than lottery,

betting and gambling are neither to

treated as supply or nor supply of

survice](https://image.slidesharecdn.com/gstimpactoncharitabletrust-190313110943/85/Gst-Impact-On-Charitable-Trust-6-320.jpg)

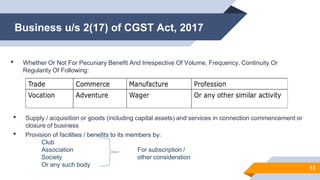

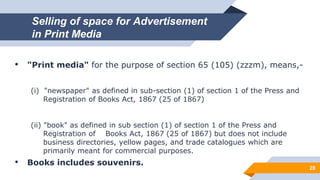

![14

Business includes– [section 2(17) of CGST Act)]:

• Admission of person(s) to any premises for consideration

• Services supplied by a person as the holder of an office which has been

accepted by him in the course or furtherance of his trade, commerce or

vocation

• Activities of a race club including by way of totalisator or a license to

book maker or activities of a licensed book maker in such club

• Any activity undertaken by CG or SG or local authority in which they are

engaged as public authorities](https://image.slidesharecdn.com/gstimpactoncharitabletrust-190313110943/85/Gst-Impact-On-Charitable-Trust-14-320.jpg)

![Exemptions for Conduct of religious

ceremony

Entry No. 13 Of Notification No. 12/2017-central Tax (Rate), Dated 28th June,

2017 [Clause (A)]

The Activity Of Conducting Any Religious Ceremony Is Exempt Under GST.

The Exemption Is Available Provided The Entity Is Registered Under Section 12AA Of

The Income Tax Act, 1961.

Any Income By A Charitable Or Religious Trust For Conducting A Religious Function

Would Not Be Liable To GST.

All Income From Religious Ceremony Is Not Exempt. Services Other Than By Way Of

Conduct Of Religious Ceremony Are Not Exempt.

The Income Of Any Other Nature Like Getting Advertisement Charges For Allowing To Put

Up The Hoarding Even During Conduct Of Such Religious Function/Pujas Would Be

Taxable Under Gst. 27](https://image.slidesharecdn.com/gstimpactoncharitabletrust-190313110943/85/Gst-Impact-On-Charitable-Trust-27-320.jpg)

![Exemptions for Renting of religious place meant

for general public

Entry No. 13 of Notification No. 12/2017-Central Tax (Rate), dated 28th June, 2017

[Clause (b)].

Renting Of Rooms Where Charges Are One Thousand Rupees Or More Per Day;

Renting Of Premises, Community Halls, Open Vacant Area, And The Like Where

Charges Are INR 10,000 Or More Per Day;

Renting Of Shops Or Other Spaces For Business Or Commerce Where Charges Are

INR 10,000 Or More Per Month.

30](https://image.slidesharecdn.com/gstimpactoncharitabletrust-190313110943/85/Gst-Impact-On-Charitable-Trust-30-320.jpg)