This document discusses the charging of GST under various sections and scenarios. Some key points:

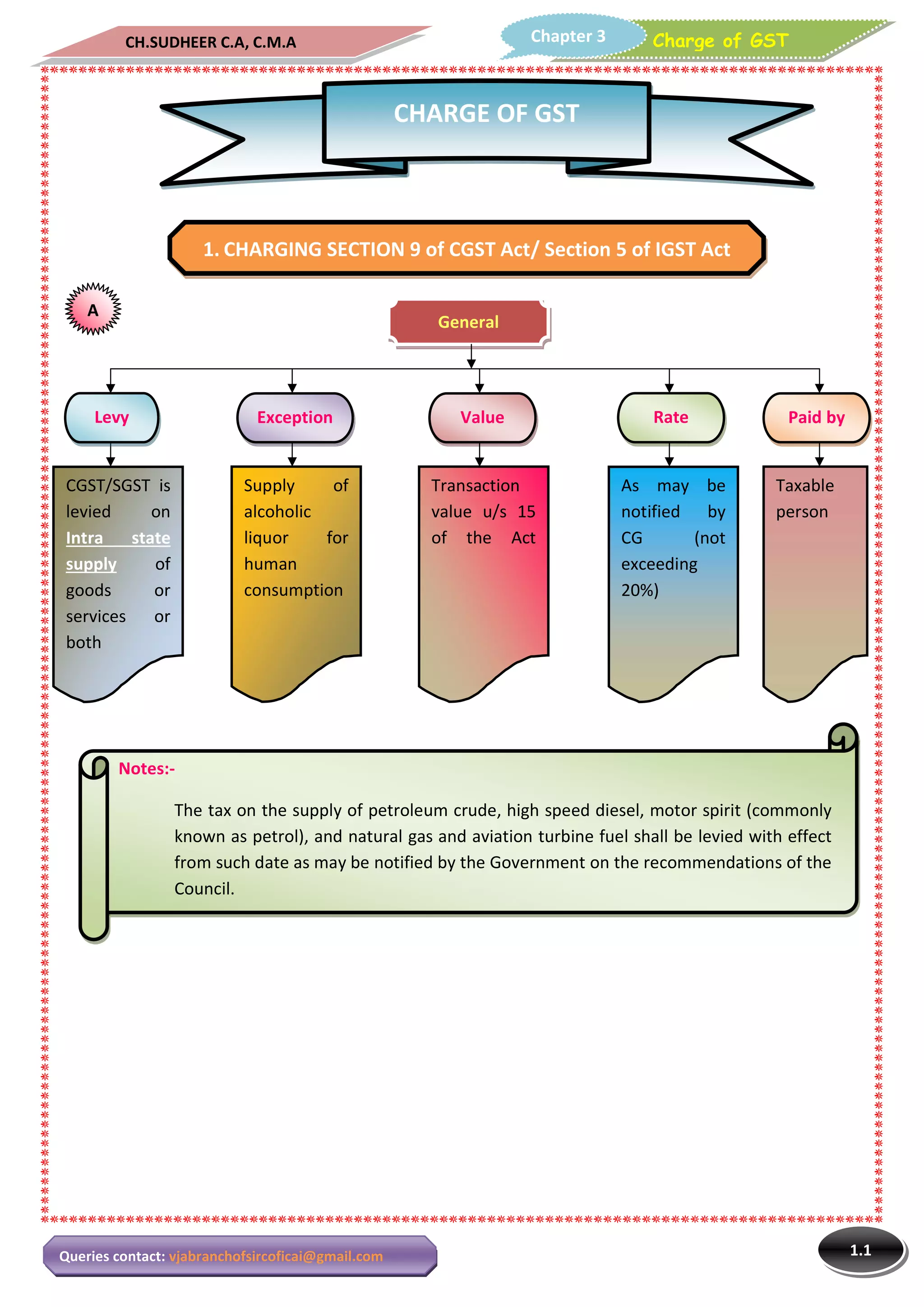

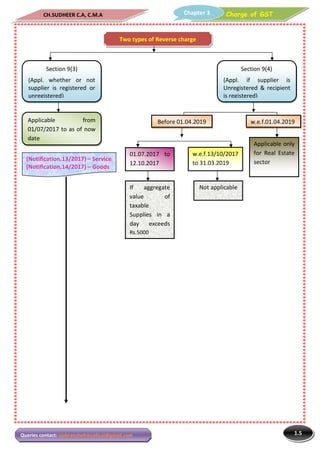

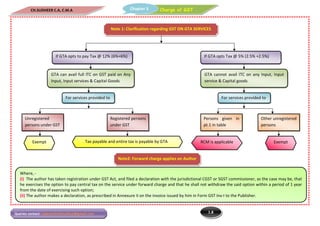

1. CGST/SGST is levied on intra-state supply of goods/services at a rate up to 20%, paid by the taxable person. Reverse charge applies in some notified cases where the recipient pays instead of supplier.

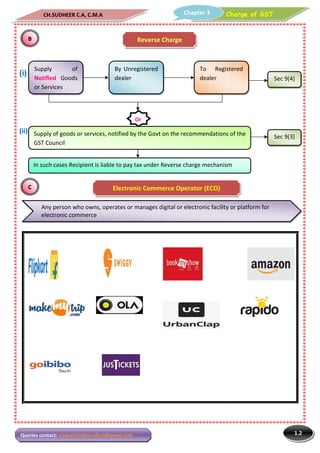

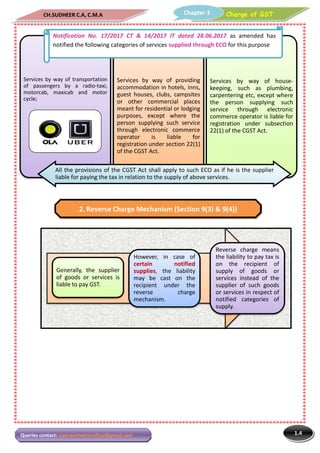

2. E-commerce operators facilitating sales through their platforms are liable to pay tax on certain notified services as if they are the supplier.

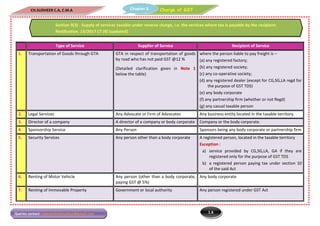

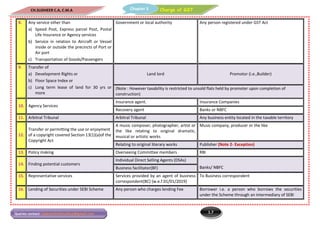

3. Reverse charge applies in some cases of Business to Business transactions as per notifications, with the recipient paying the tax instead of the supplier.

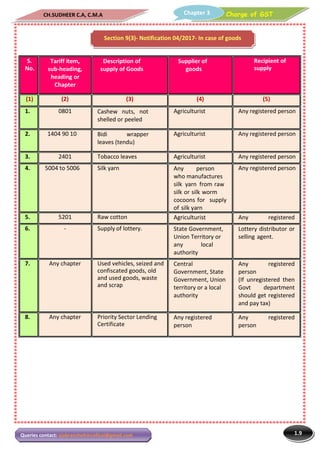

4. Eight categories of goods are notified where reverse charge applies if supplied by unregistered