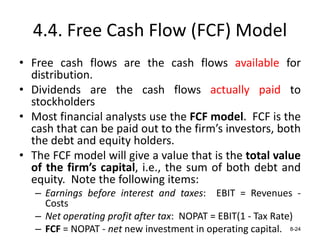

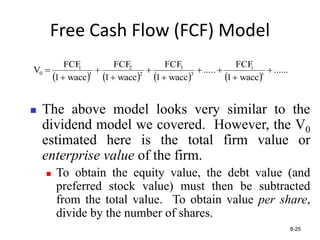

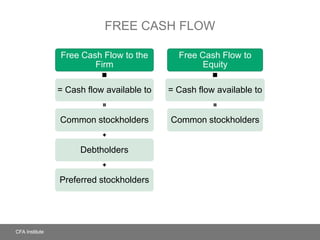

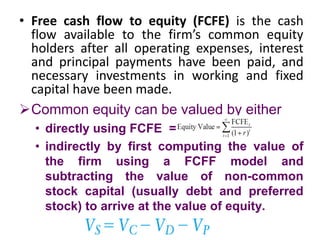

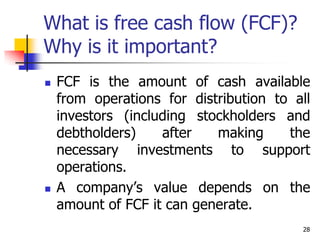

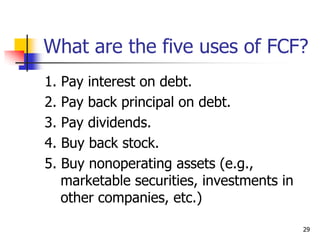

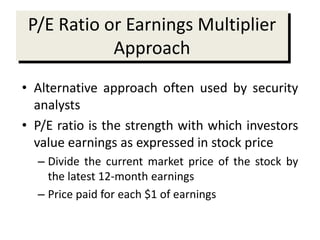

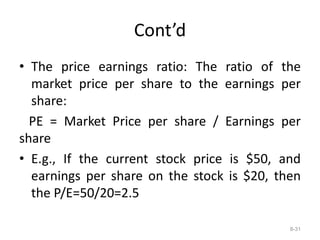

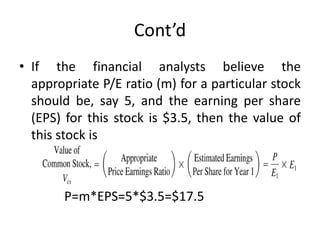

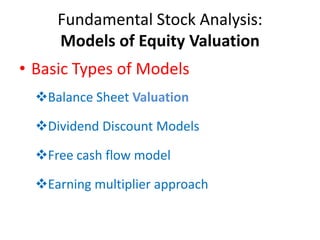

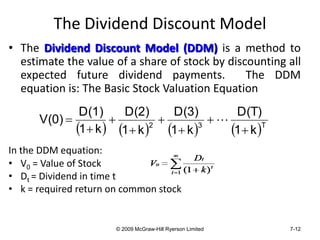

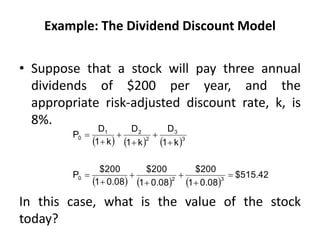

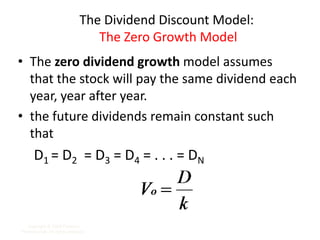

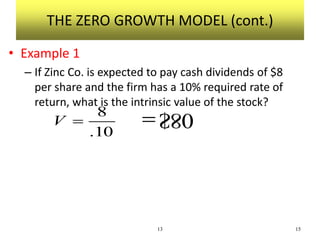

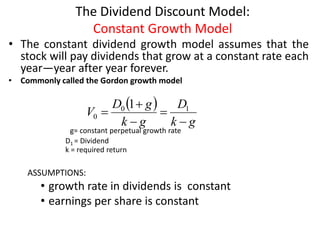

The document discusses the characteristics and valuation of common and preferred stocks, emphasizing dividend policies, the residual claim in liquidation, and limited liability for stockholders. It explains various equity valuation models, such as the Dividend Discount Model (DDM), Constant Growth Model, and Free Cash Flow (FCF) model, highlighting their formulas and appropriate use cases. Additionally, it addresses the Price-Earnings (P/E) ratio as an alternative valuation method, identifying the implications of high and low ratios on market expectations for companies.

![Solution

8-23

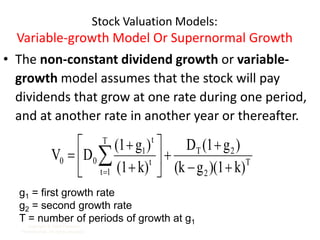

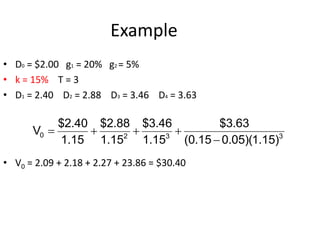

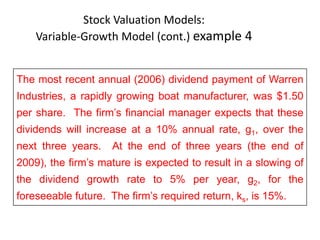

D0 = $1.5 g1 = 10% g2 = 5%

k = 15% T = 3

First, calculate the total dividends over the “supernormal” growth period:

=17.96

Year Total Dividend: (in $millions)

1 $1.5 x 1.1 = $1.65

2 $1.65 x 1.1 = $1.815

3 $1.815 x 1.1 = $1.9965

V(3) = [D(3) x (1 + g2)] / (k – g2)

= 1.9965x(1.05)/.15-.05 =20.96325

3

3

2

k

1

V(3)

k

1

D(3)

k

1

D(2)

k

1

D(1)

V(0)

3

3

2

0.15

1

$13.9255

0.15

1

$1.9965

0.15

1

$1.815

0.15

1

$1.65

V(0)

](https://image.slidesharecdn.com/chapter5-250202171254-22bd1438/85/chapter-5stock-and-stock-valuation-models-pdf-20-320.jpg)