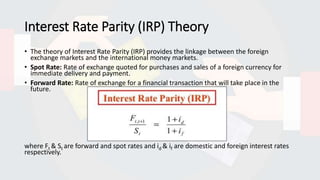

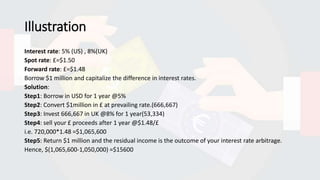

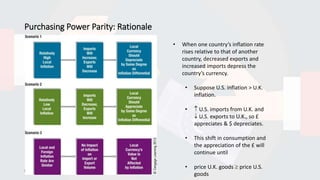

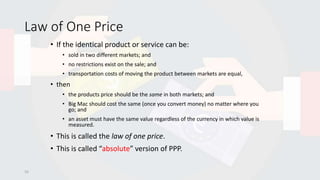

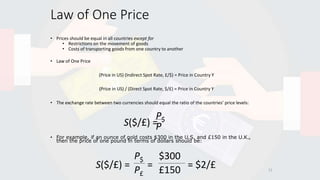

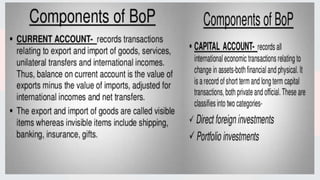

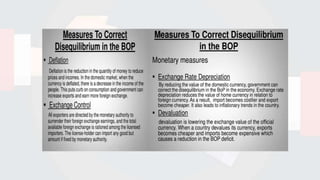

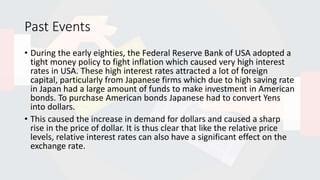

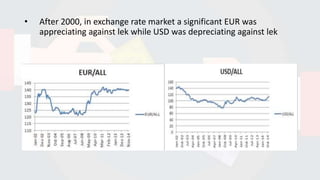

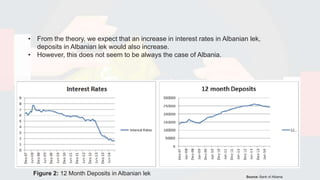

This document summarizes a macroeconomics project on the relationship between inflation, interest rates, and exchange rates. It defines key terms like foreign exchange markets, exchange rates, and interest rate parity theory. It then discusses theories of interest rate parity, purchasing power parity, and the balance of payments. Case studies on Albania and Kenya analyze the relationship between domestic interest rates and currency exchange rates. The impact on the Indian economy and future policy suggestions are also covered.