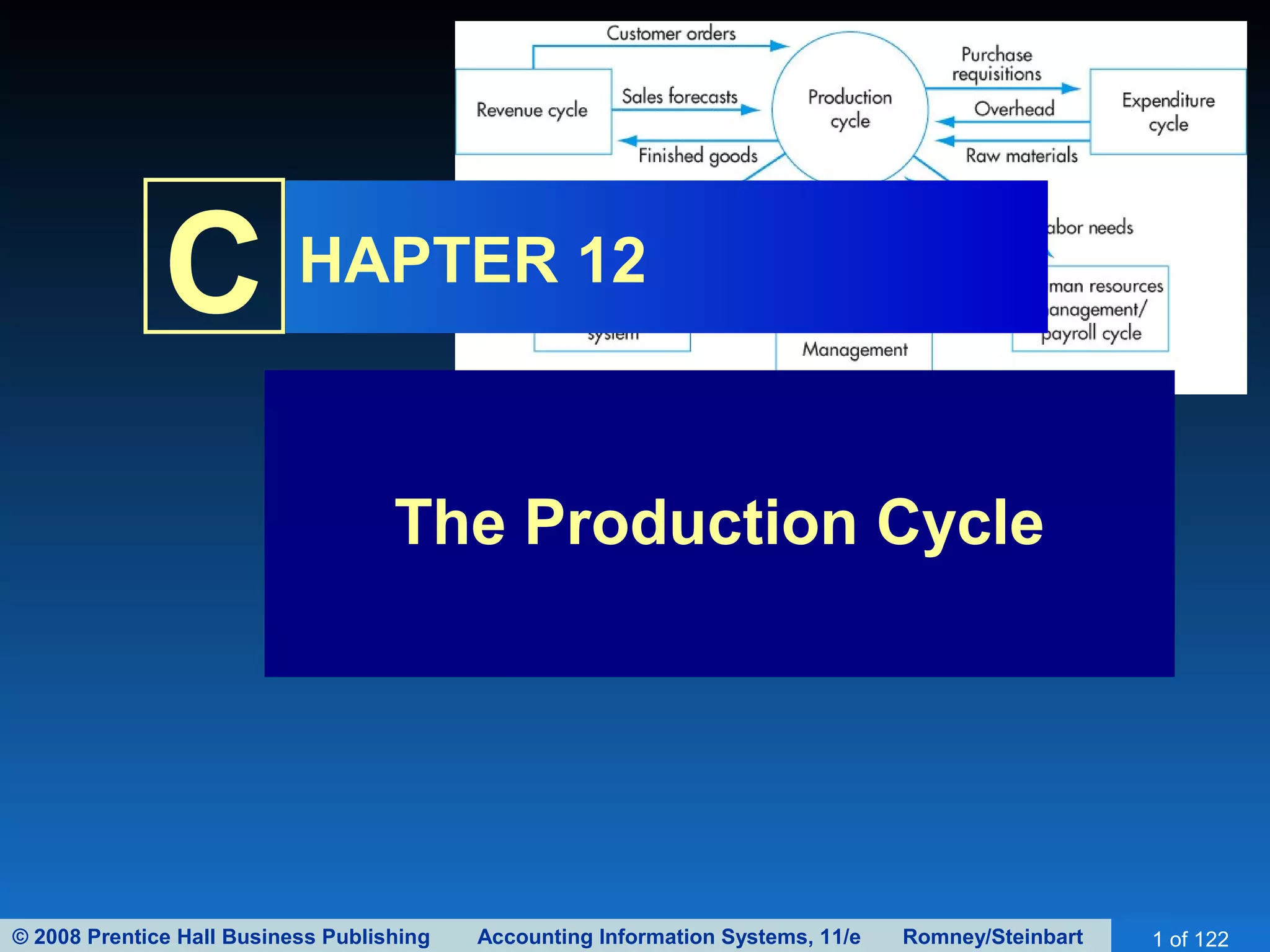

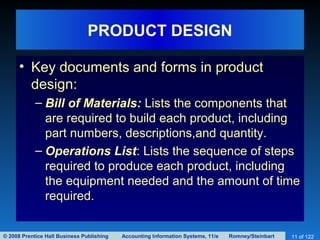

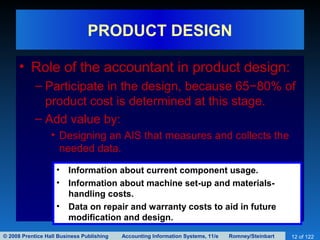

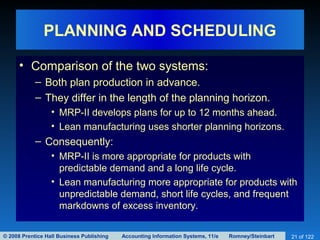

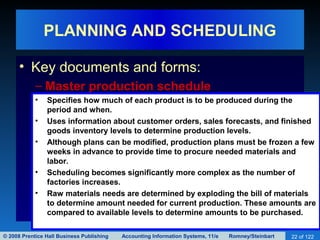

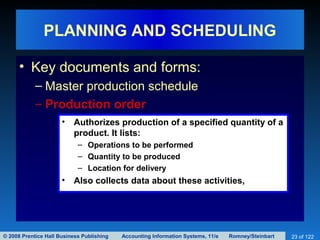

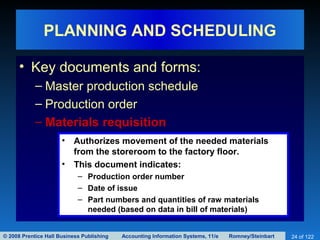

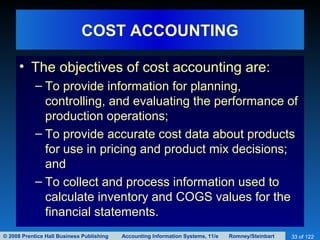

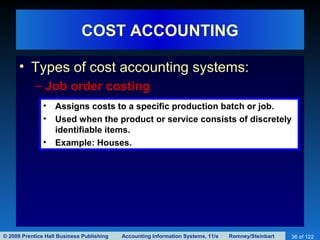

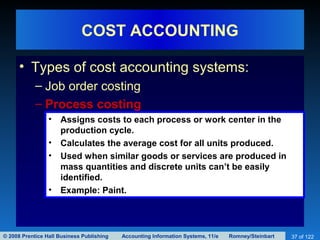

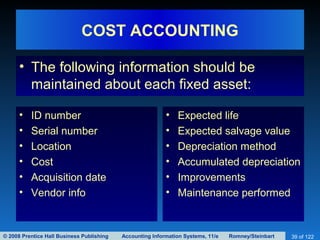

The document discusses the production cycle of a manufacturing business. It describes the four main activities in the production cycle as product design, planning and scheduling, production operations, and cost accounting. Accountants are primarily involved in cost accounting but must understand the entire production cycle. The document outlines the objectives and key documents/forms used for product design and planning/scheduling.