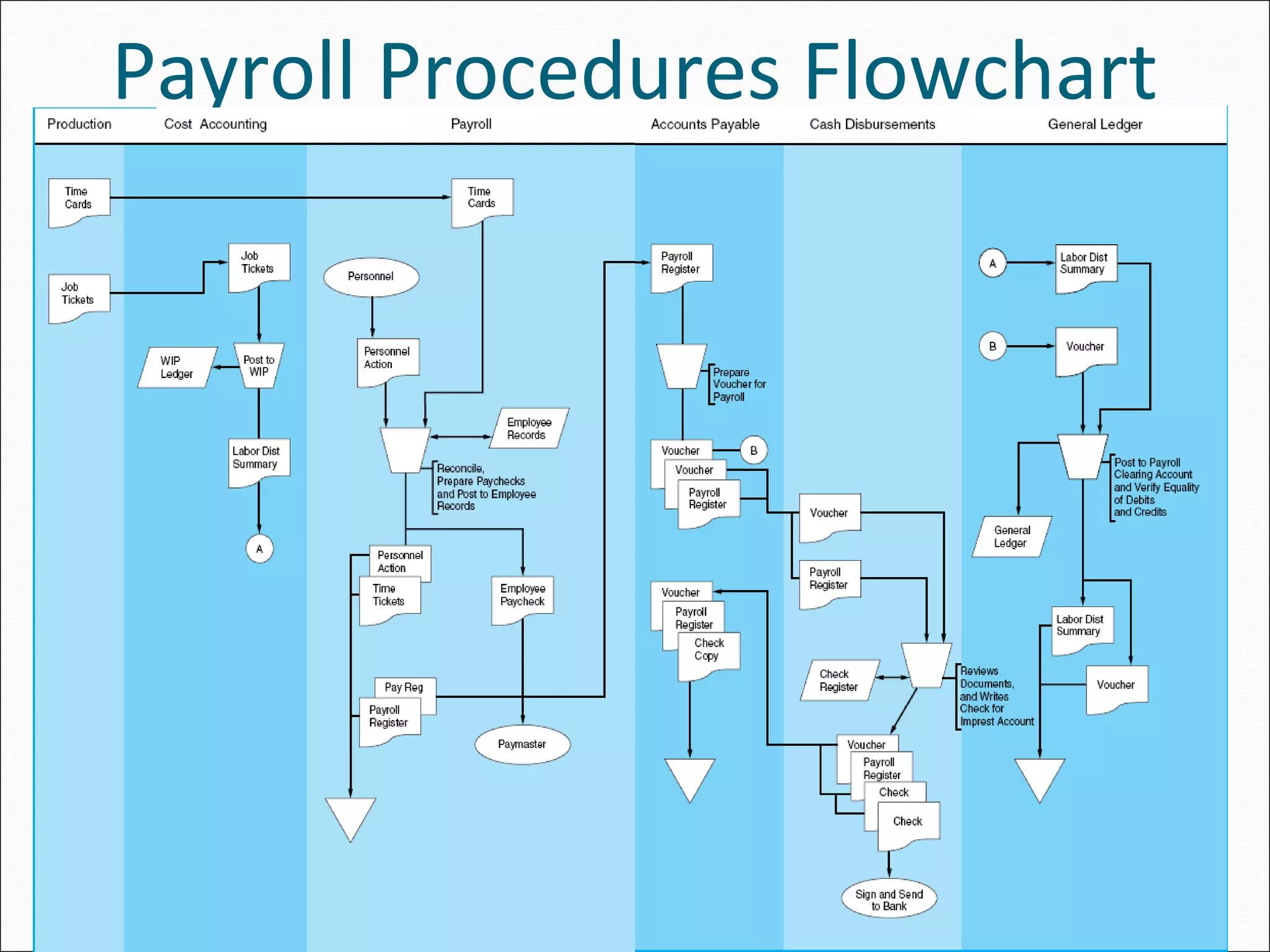

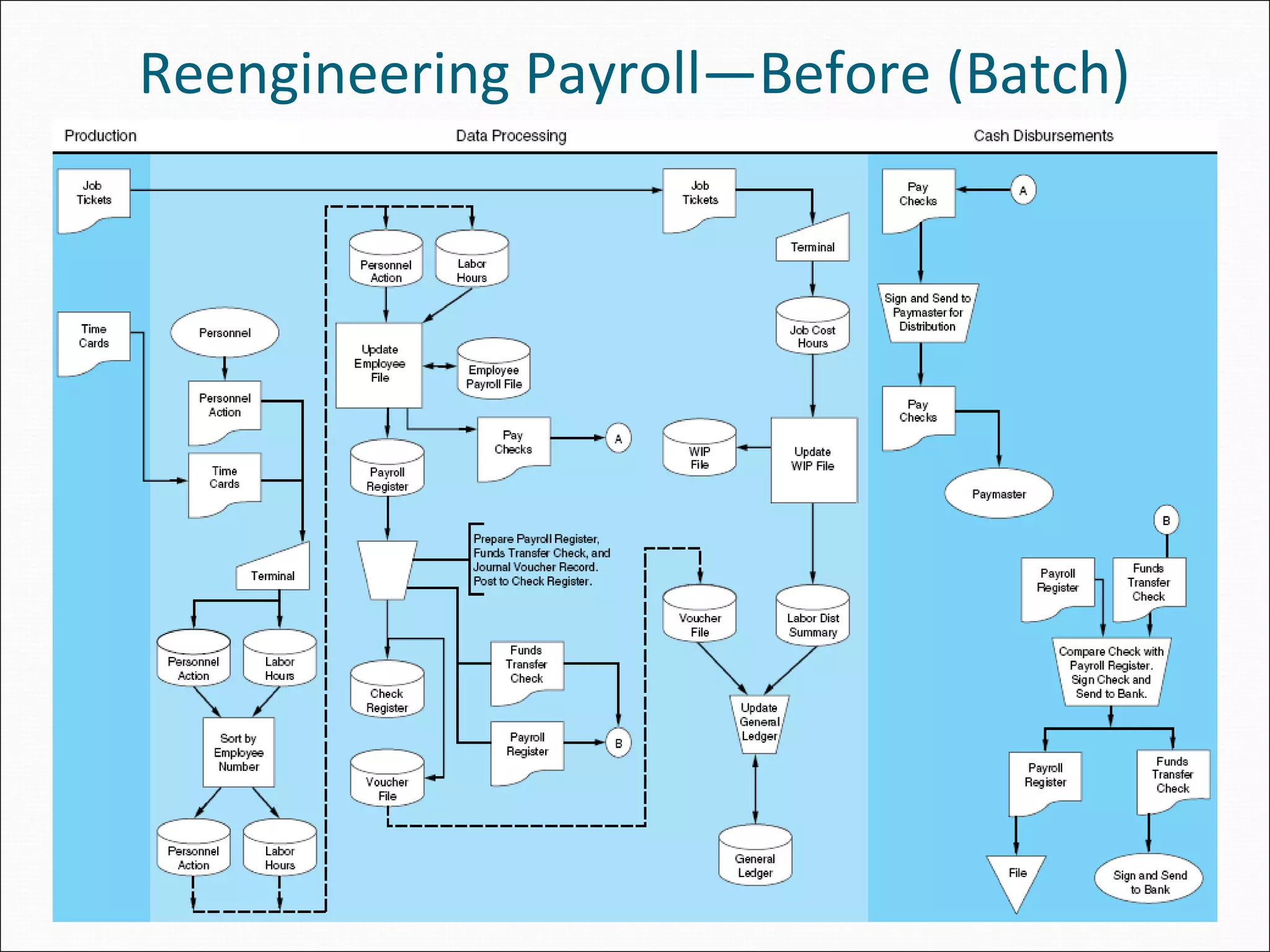

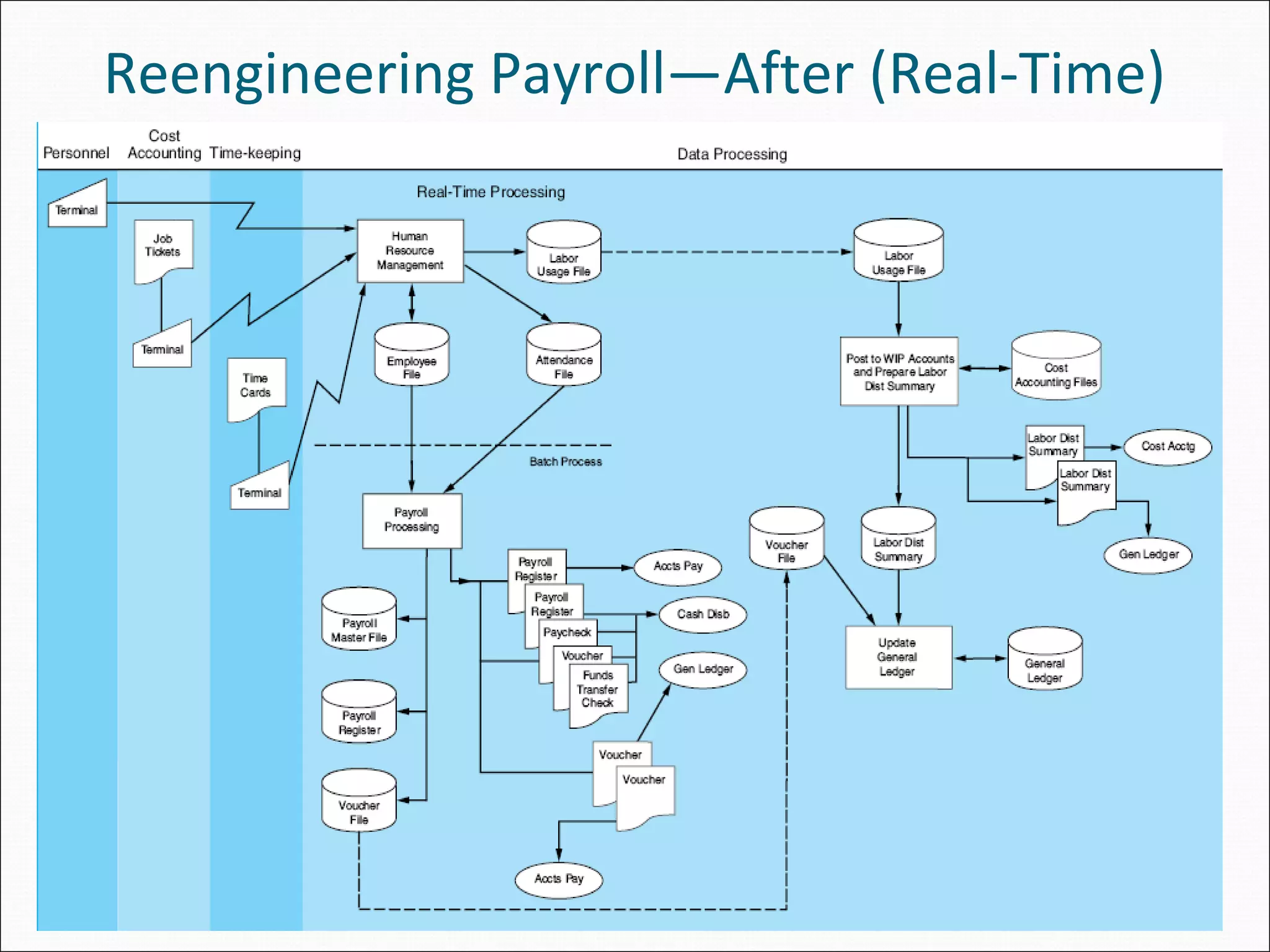

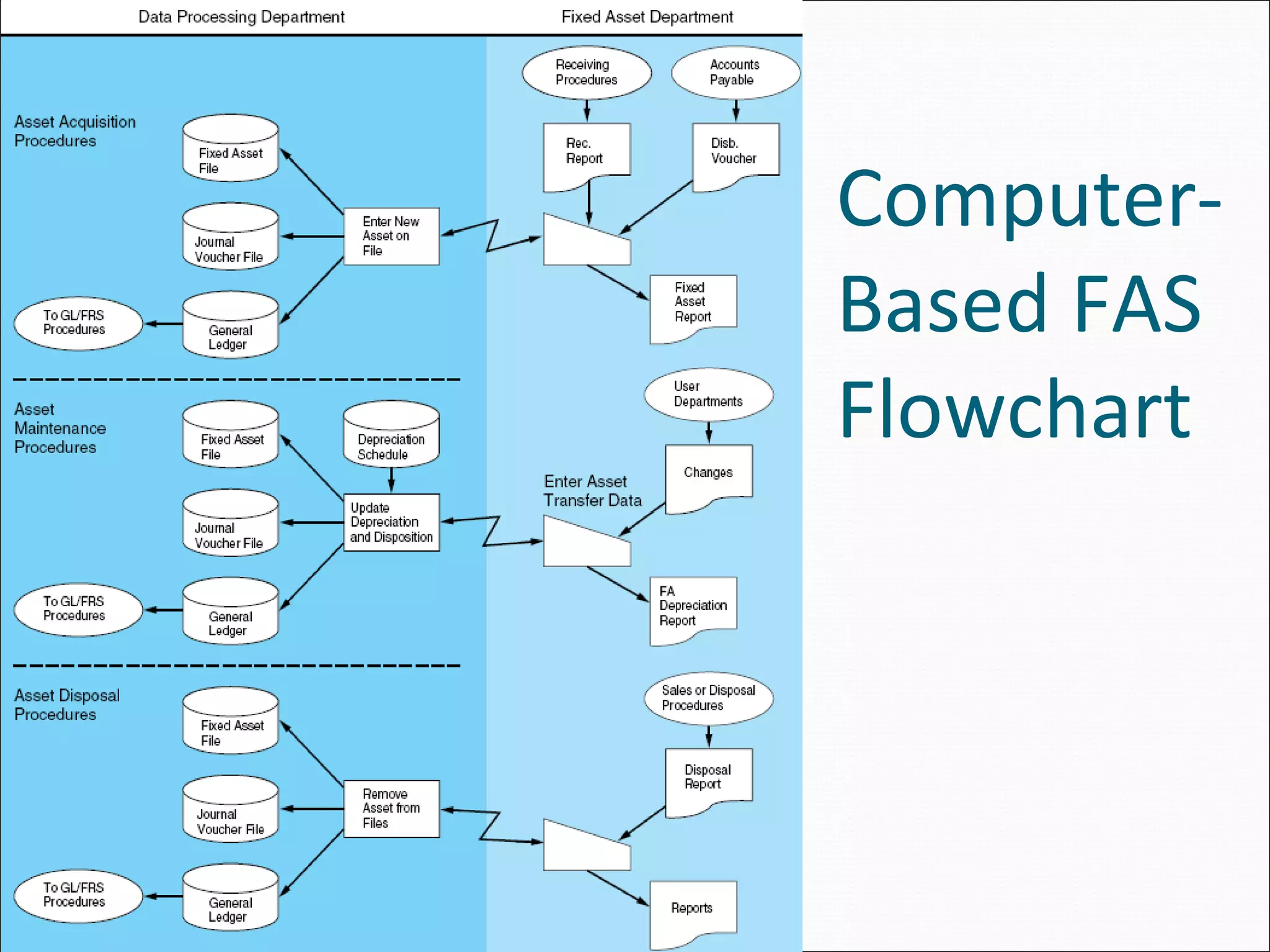

This document outlines objectives and procedures for manual and computerized payroll and fixed asset accounting systems. For payroll, it describes processing steps from timekeeping and payroll preparation to general ledger posting. Key controls are transaction authorization, segregation of duties, and independent verification. For fixed assets, it outlines the asset lifecycle from acquisition to disposal and depreciation calculation. Computerized systems automate many tasks but still require authorization and verification controls.