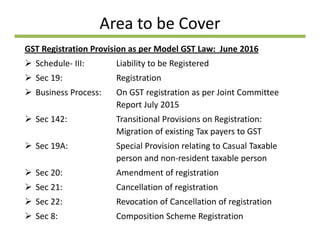

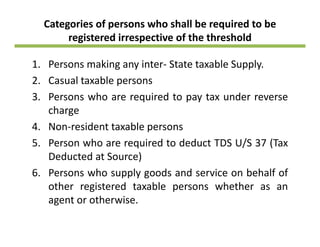

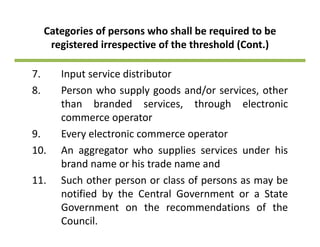

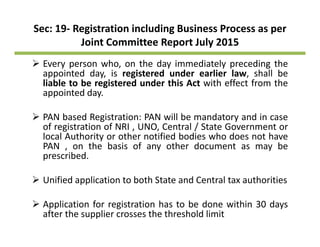

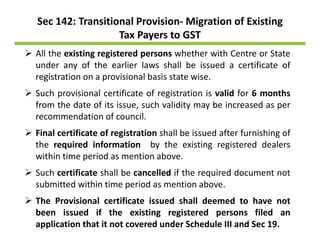

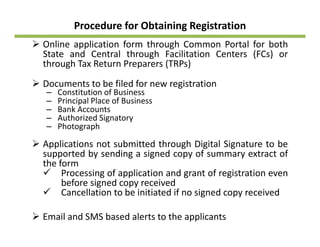

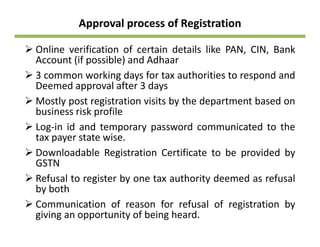

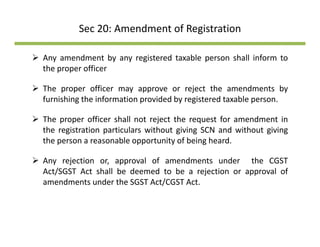

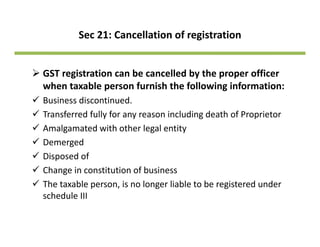

1. The document discusses provisions related to GST registration including who is required to register, the registration process, amendments, cancellation, and revocation of registration. It also covers transitional provisions for existing taxpayers and registration requirements for casual/non-resident taxpayers and composition scheme.

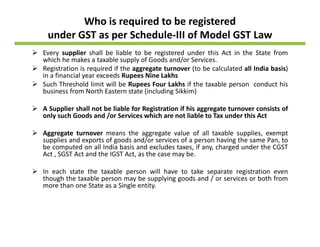

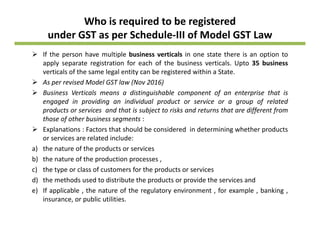

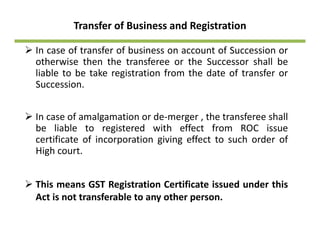

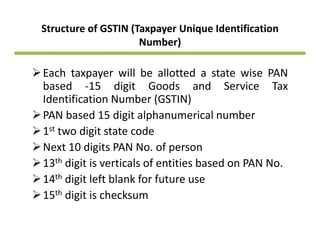

2. Key points include that registration is required if aggregate turnover exceeds Rs. 9 lakhs (Rs. 4 lakhs for North East states), the structure of the 15-digit GSTIN number, online application process and approval within 3 days, and that registration is not transferable between persons.

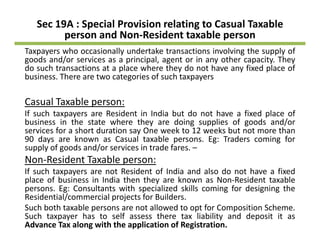

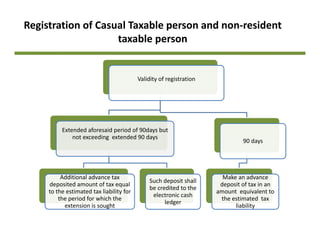

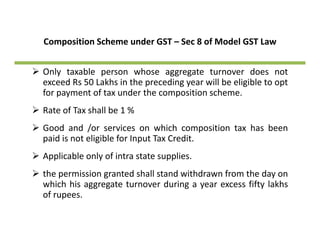

3. Special provisions are discussed for casual/non-resident taxpayers requiring advance tax deposit and maximum 90 day registration validity, and