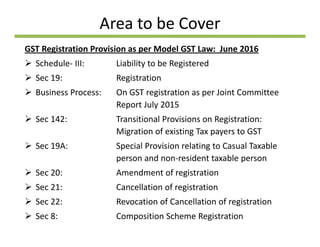

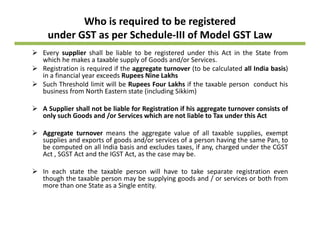

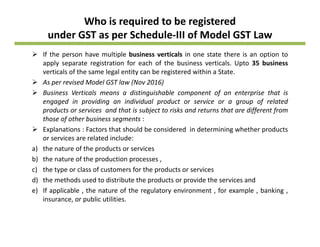

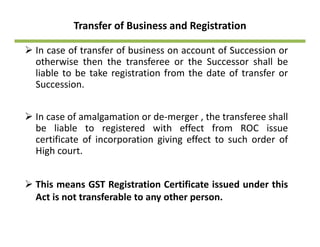

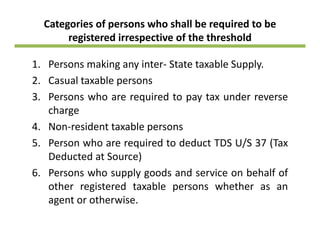

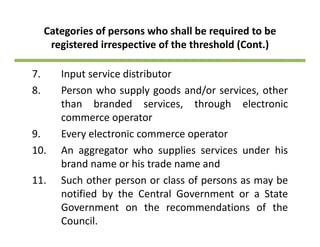

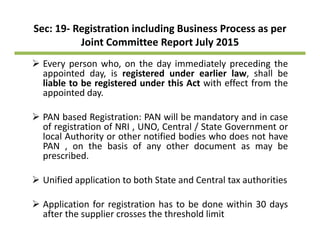

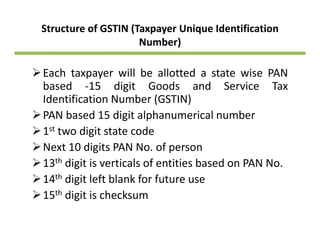

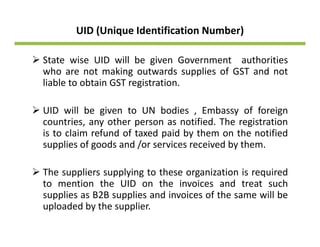

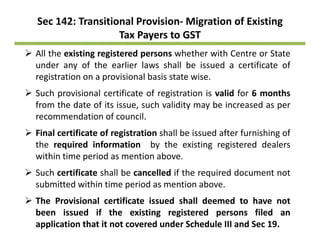

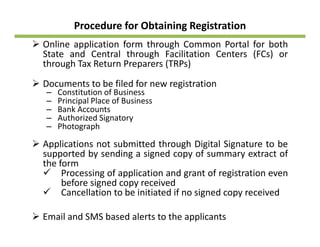

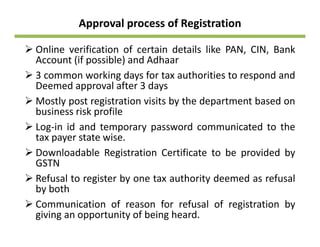

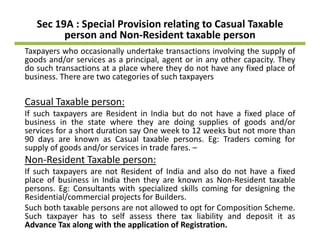

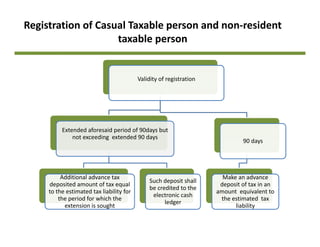

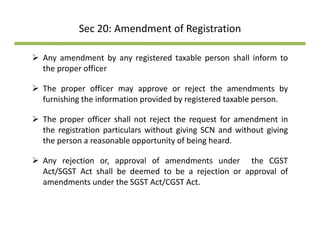

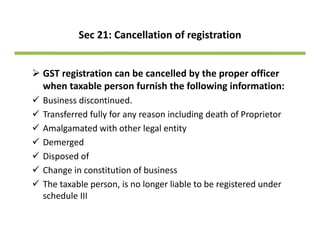

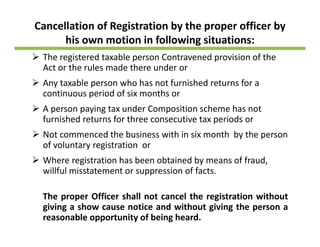

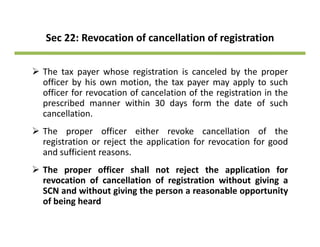

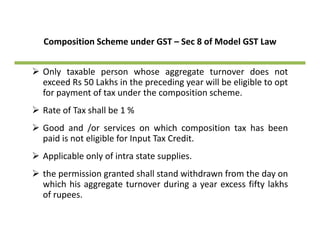

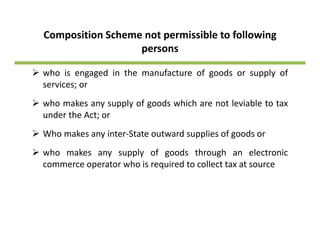

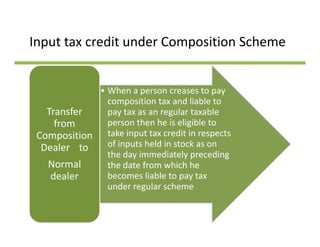

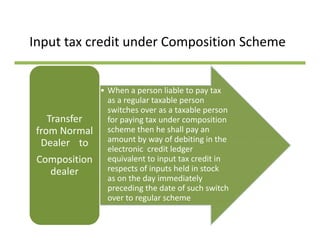

The document outlines the provisions for GST registration, covering the requirements for various types of taxpayers, including casual and non-resident taxable persons. It details the process of registration, including amendments and cancellation, as well as the structure of the Goods and Services Tax Identification Number (GSTIN). Additionally, it describes the composition scheme under GST and the eligibility criteria for registration and tax payment procedures.