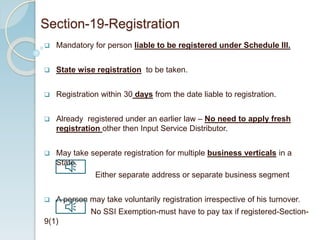

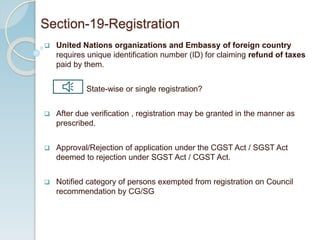

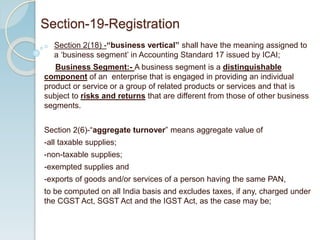

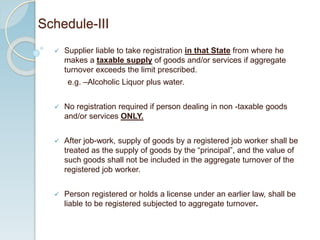

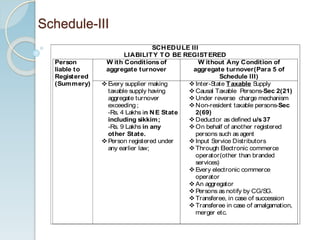

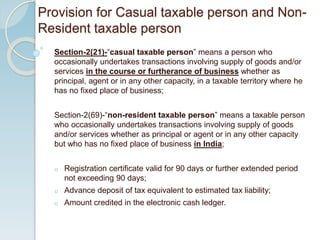

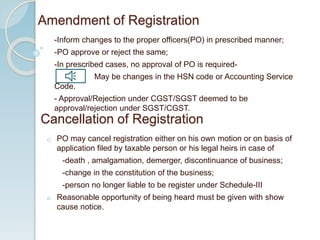

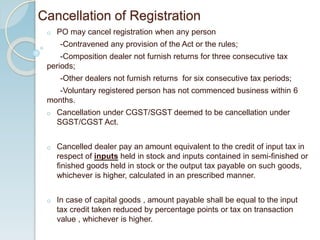

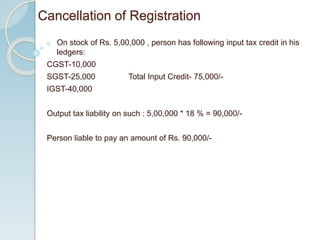

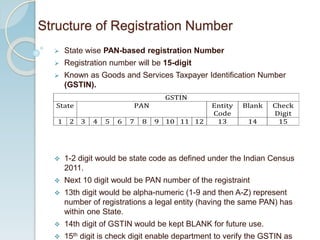

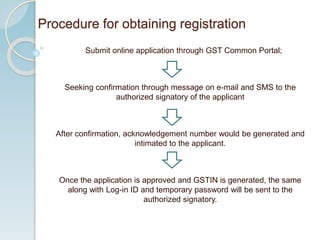

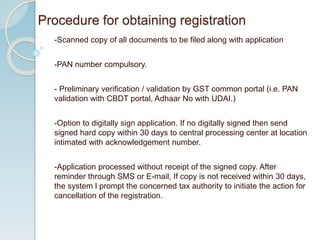

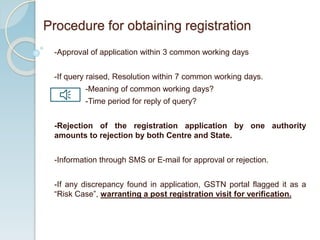

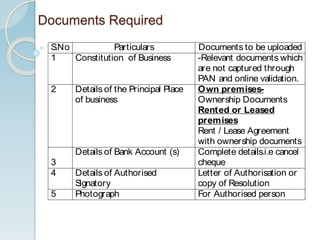

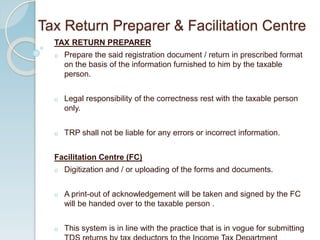

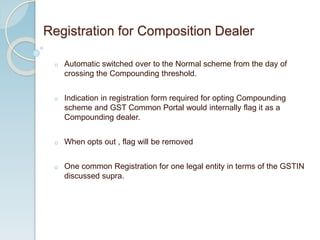

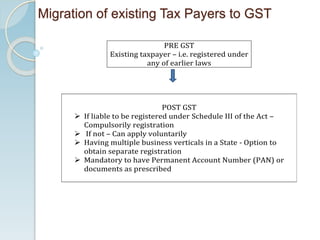

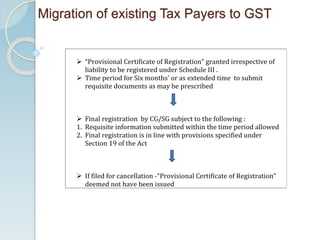

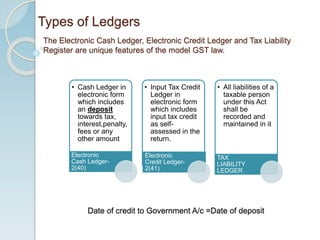

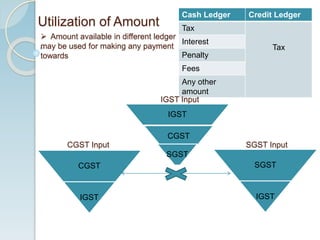

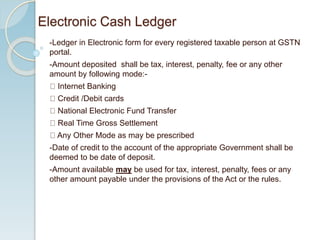

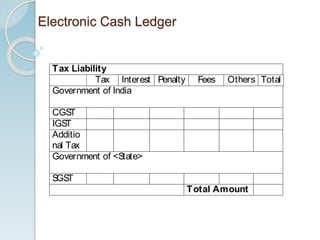

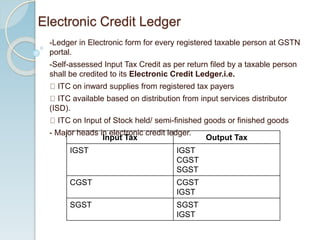

The document outlines registration and payment procedures under the Model GST Law, detailing who needs to register, the types of registrations available, and the consequences of not adhering to these regulations. It discusses aggregate turnover thresholds for mandatory registration, procedures for both casual and non-resident taxable persons, and the necessary documentation for obtaining registration. Additionally, it covers cancellation of registration, payment procedures, and the electronic ledgers in place for managing tax-related transactions.