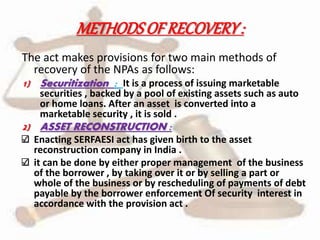

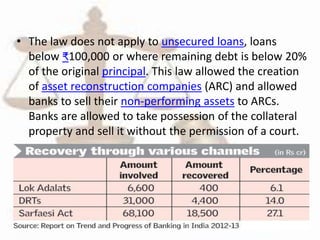

The document discusses the Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act of 2002 in India. It provides a history of debt recovery laws in India prior to SARFAESI. SARFAESI allows banks and financial institutions to auction residential or commercial properties to recover loans in case of default. It enables banks to reduce non-performing assets by taking possession of secured assets without court intervention. The act established asset reconstruction companies and empowers banks to seize assets and sell them off in order to strengthen banks' ability to recover non-performing assets faster.