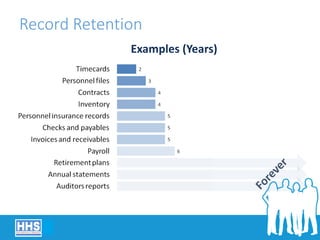

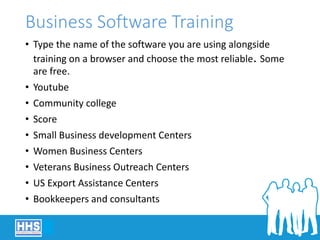

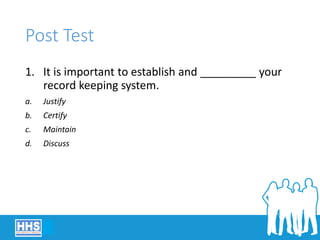

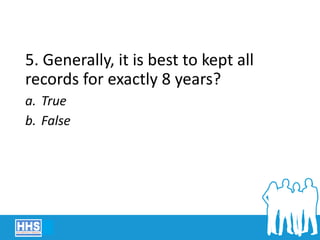

The document discusses the importance of record keeping for small businesses. It covers the basics of establishing an effective record keeping system, including which records to keep for tracking business deals, planning, legal compliance, and tax preparation. It also discusses best practices for organizing records, tools that can be used, software options, and the importance of training for any software selected. Record keeping is presented as an essential practice for all small business owners to properly manage their business operations and meet legal requirements.