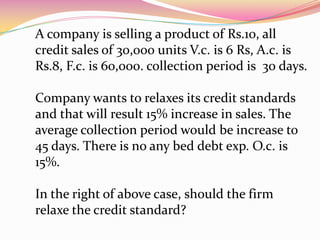

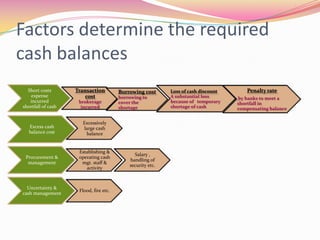

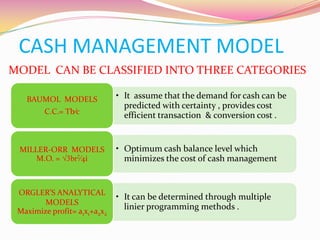

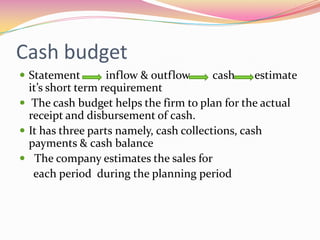

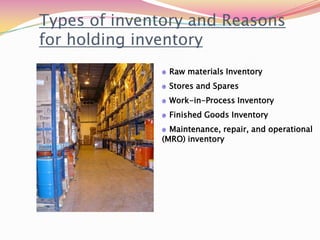

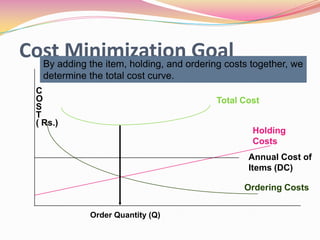

This document provides an overview of receivable management, cash management, and inventory management. It discusses key aspects of managing debtors, including establishing credit policies, analyzing customer creditworthiness, and controlling receivables. It also outlines important factors in cash management like meeting payment schedules and minimizing cash balances. Additionally, the document defines inventory, describes inventory costs and reasons for holding inventory, and lists techniques for inventory control like the economic order quantity model.