Embed presentation

Downloaded 107 times

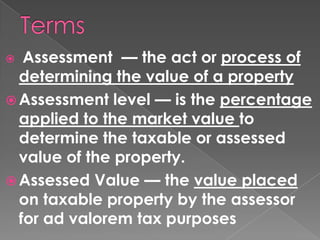

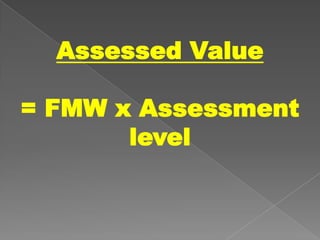

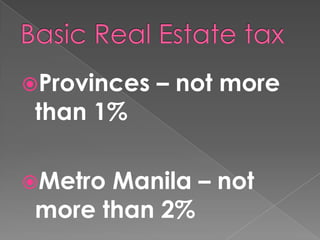

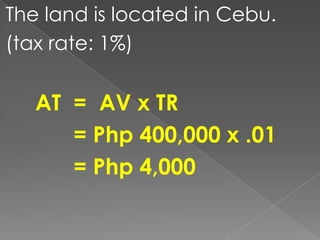

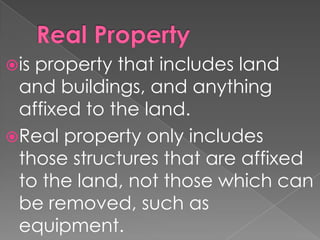

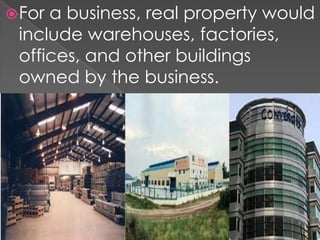

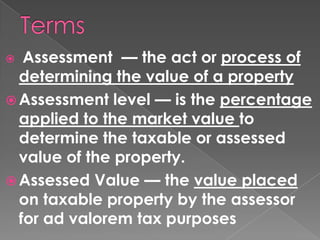

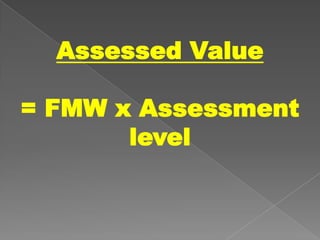

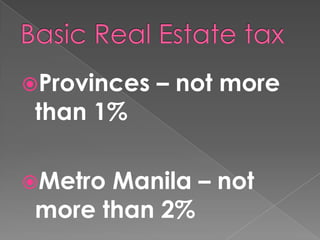

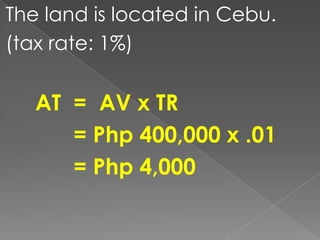

This document defines key terms related to real property and property taxes. It explains that real property includes land, buildings, and anything permanently attached to the land. It also defines assessment level as the percentage of a property's market value used to determine its assessed value for tax purposes. Finally, it provides an example of calculating the assessed value and annual property taxes for a residential property based on its market value and the local assessment level and tax rate.