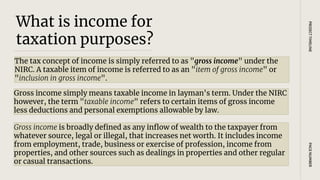

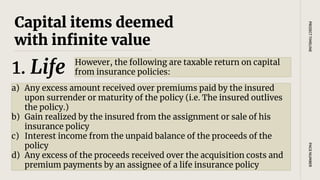

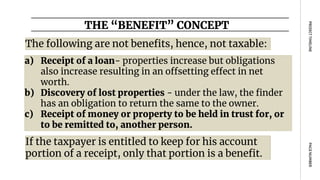

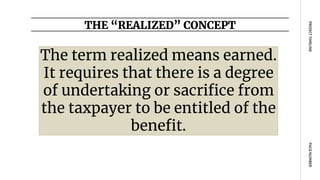

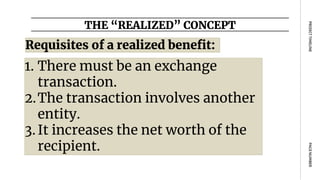

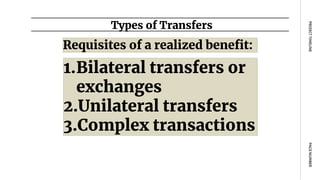

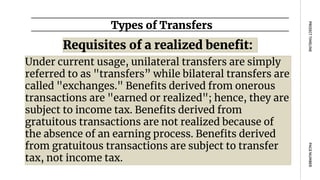

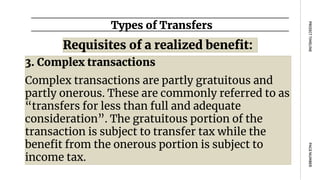

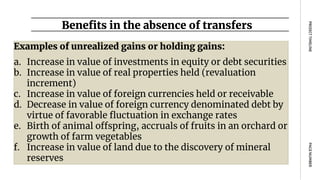

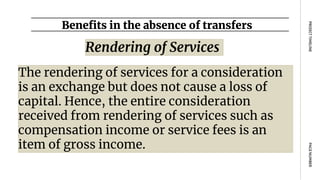

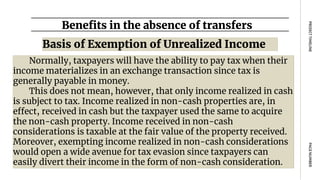

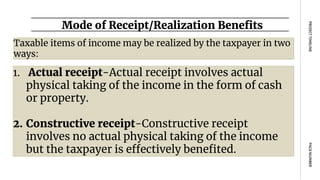

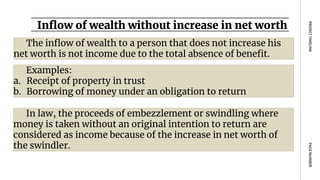

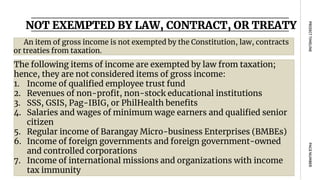

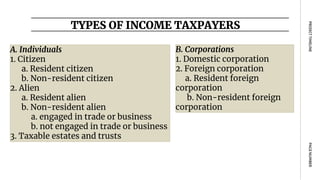

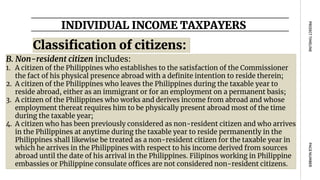

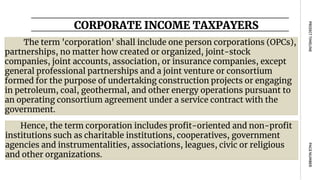

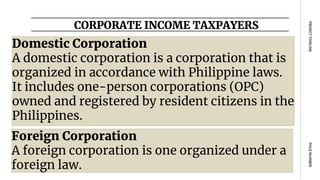

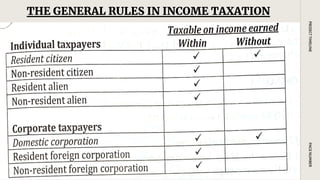

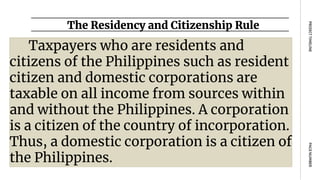

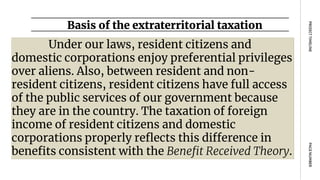

The document discusses the key concepts related to determining gross income for taxation purposes under Philippine law. It defines gross income broadly as any inflow of wealth from any source that increases a taxpayer's net worth. To be considered gross income, an item must be a return on capital, realized through a transaction with another entity, and not exempted by law. Certain recoveries of lost profits and compensation for services are included as taxable returns on capital. Unrealized gains such as increases in property value are not considered gross income unless realized through a transaction. The document also outlines different types of individual and corporate taxpayers.