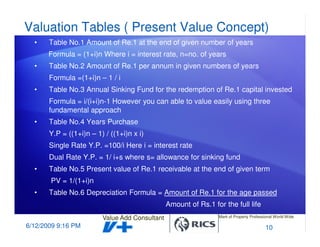

The document discusses the complexities and methodologies involved in the valuation of special township land, highlighting the role of economics, law, and various appraisal techniques. It emphasizes the importance of thorough due diligence and the need for accurate data and adjustments in comparison with similar properties. Recommendations for valuers include visiting sites, conducting neighborhood analyses, and applying appropriate capitalization and discounting rates.