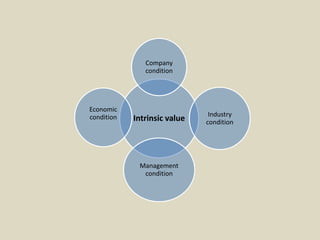

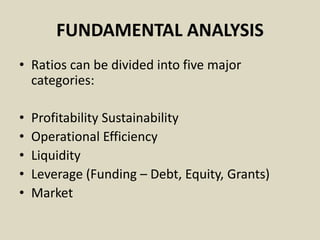

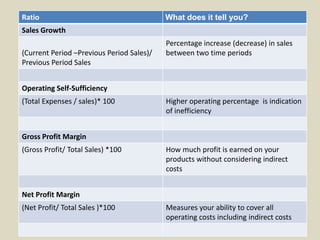

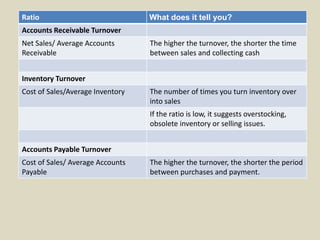

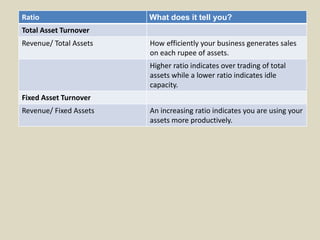

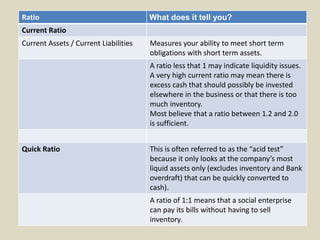

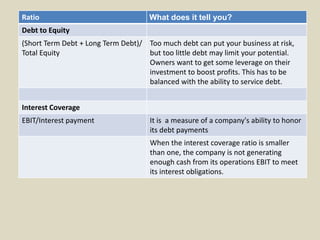

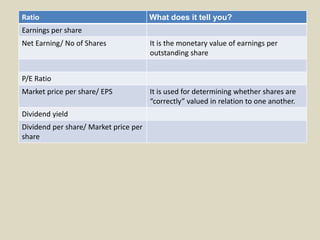

Fundamental analysis evaluates a security's underlying value by examining related economic, financial and other qualitative and quantitative factors. It includes examining a company's financial statements and health, its management and competitive advantages, and its competitors and markets. Technical analysis, on the other hand, studies past stock price movements and patterns to predict future movements. Key fundamental ratios help analyze a company's profitability, operational efficiency, liquidity, leverage, and market performance. These ratios provide insights into a company's financial health and ability to operate and grow successfully.