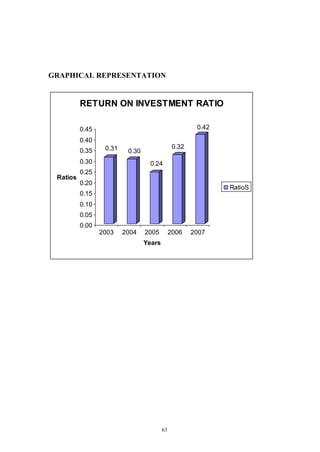

This document is a project report on ratio analysis for Genting Lanco Power Ltd from 2012. It includes an introduction to the power industry and electricity sector in India. There has been significant growth in installed power capacity since independence but demand still outstrips supply. The document discusses various power sources including hydropower, mini hydel plants, and thermal power which is now the largest source but progress has been slowed. It aims to analyze Genting Lanco's financial ratios to evaluate performance.