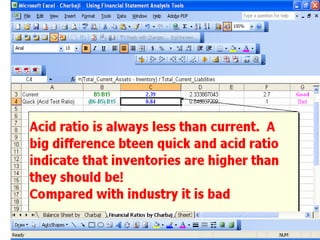

The document discusses how to analyze a business using financial ratios. It explains that ratios show the relationship between two numbers and can be used to compare a company's performance over time and to other companies in the same industry. The document then outlines 12 steps for conducting a basic financial analysis of a company, including acquiring financial statements, calculating common size ratios and other key financial ratios related to liquidity, debt, profitability, efficiency and stock value. These ratios can provide insights into a company's strengths and weaknesses.