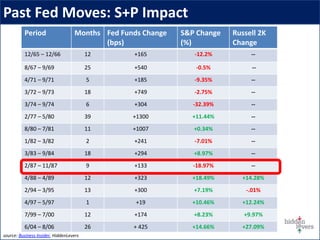

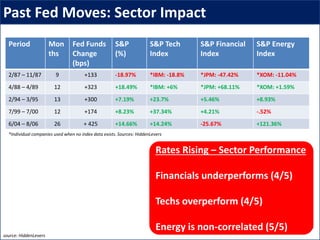

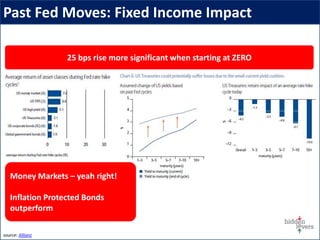

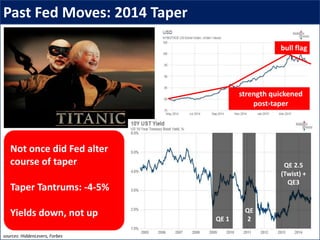

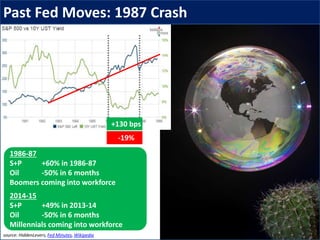

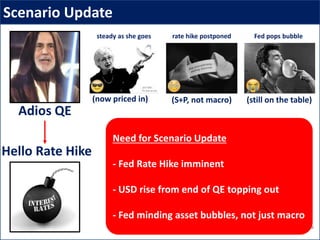

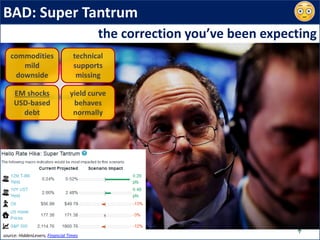

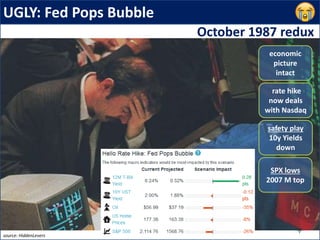

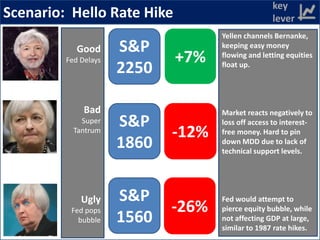

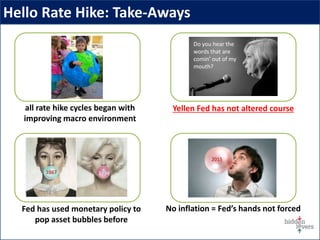

The document discusses the possibility of the US Federal Reserve raising interest rates for the first time since 2006. It begins by reviewing the effects of past rate hike cycles on financial markets, noting that historically financials underperform while technology stocks outperform. It then presents three potential scenarios for how markets may react to an upcoming rate hike: 1) The "Good" scenario of the Fed delaying hikes due to weak economic data, providing an equity boost. 2) The "Bad" scenario of a "taper tantrum"-like market correction. 3) The "Ugly" scenario of the Fed intentionally popping an asset bubble by hiking rates.