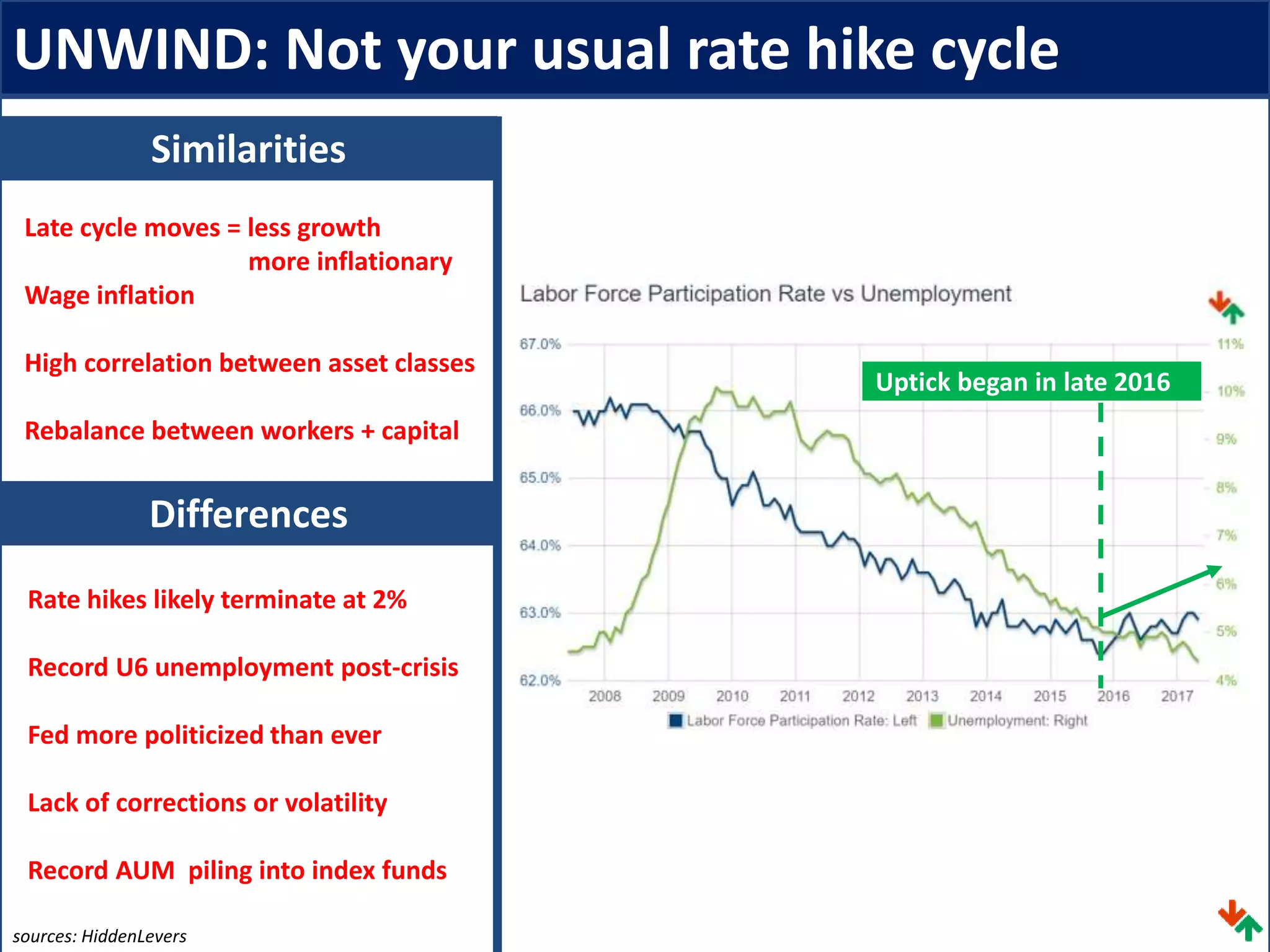

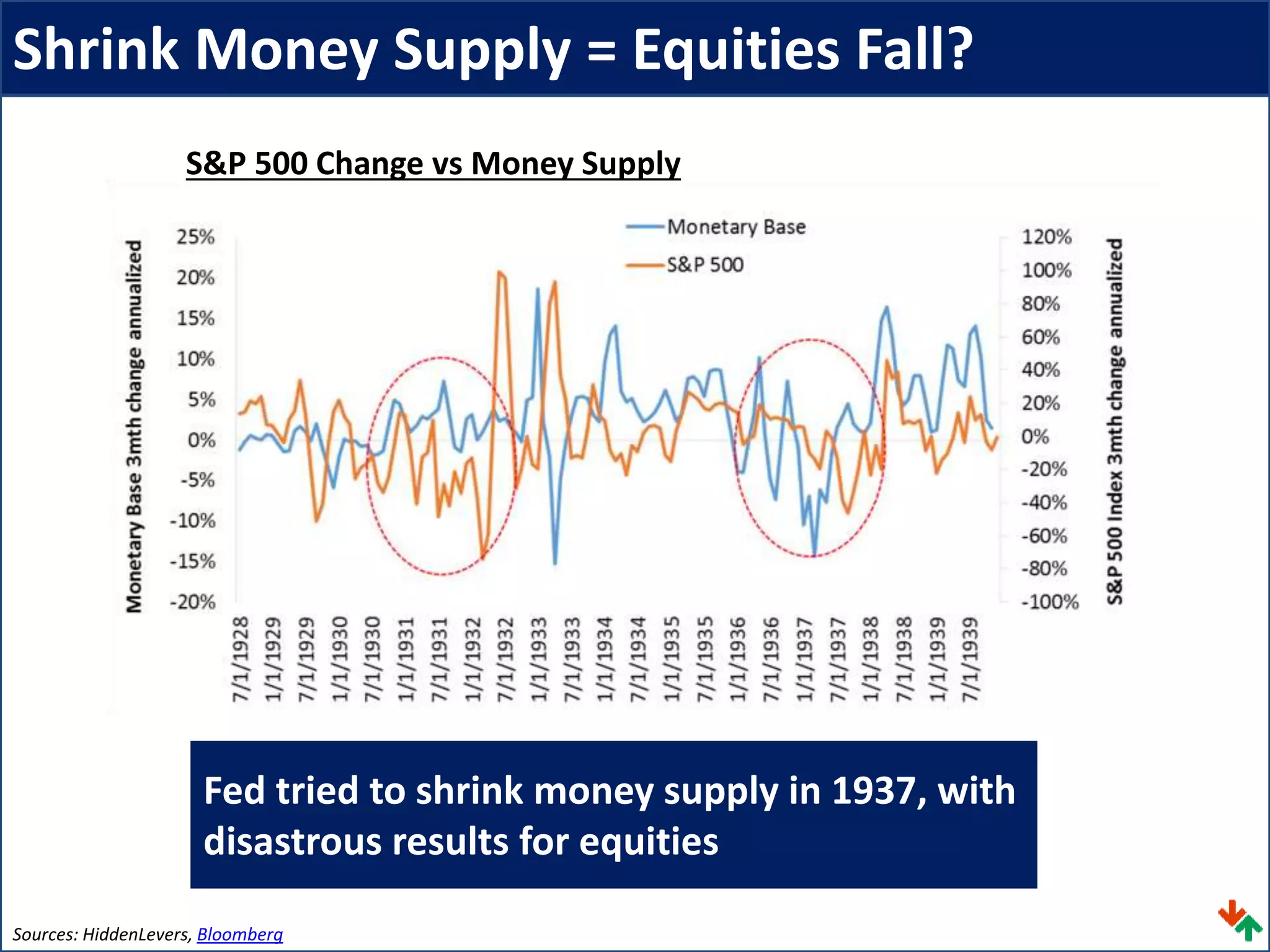

The document discusses the Federal Reserve unwinding its balance sheet and the potential impact. It provides three potential scenarios for Fed unwinding:

1) Good scenario: The 10-year Treasury rises to 2.5%, the S&P 500 increases 12%, and inflation rises to 3.2% as the economy runs hot.

2) Neutral scenario: The 10-year Treasury rises to 2%, the S&P 500 falls 8%, and inflation increases slightly to 2.1% in a slow and steady unwinding.

3) Bad scenario: The 10-year Treasury rises to 2.5%, the S&P 500 declines 35% as unwinding pierces an equity bubble, and inflation increases