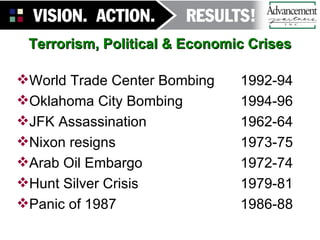

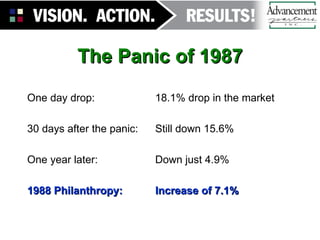

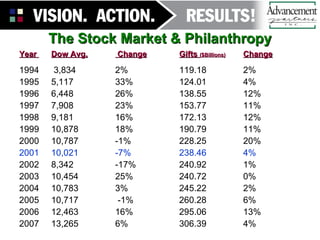

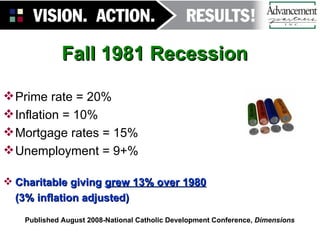

The document examines how philanthropy and the stock market relate during times of economic crisis. It analyzes 13 major events between 1939-2008 and finds that while the stock market often drops initially after a crisis, it recovers within a year. Philanthropy has increased year-over-year in all but one case, even during recessions and stock market declines. Down markets do not necessarily lead to decreased giving. The data shows philanthropy remains resilient during economic storms.