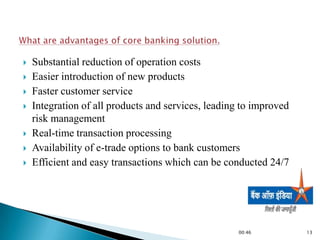

The Bank of India, founded in 1906 and nationalized in 1969, operates 3752 branches across India and offers a wide range of financial products including loans, insurance, deposit schemes, and digital banking services. It has implemented a core banking system to enhance operational efficiency and improve customer service through real-time transaction processing. The bank actively markets its offerings and emphasizes the importance of complaints management within the banking sector.