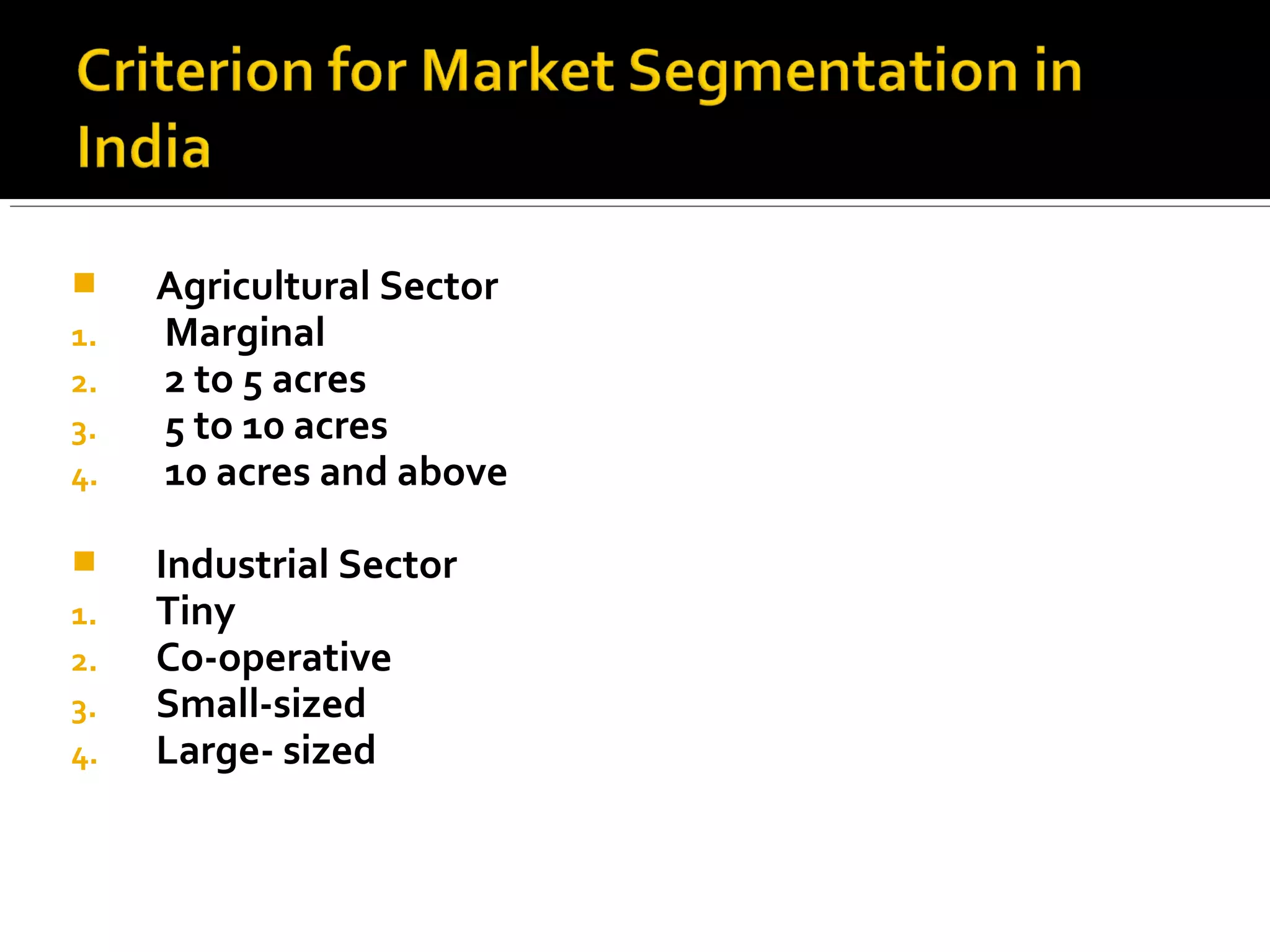

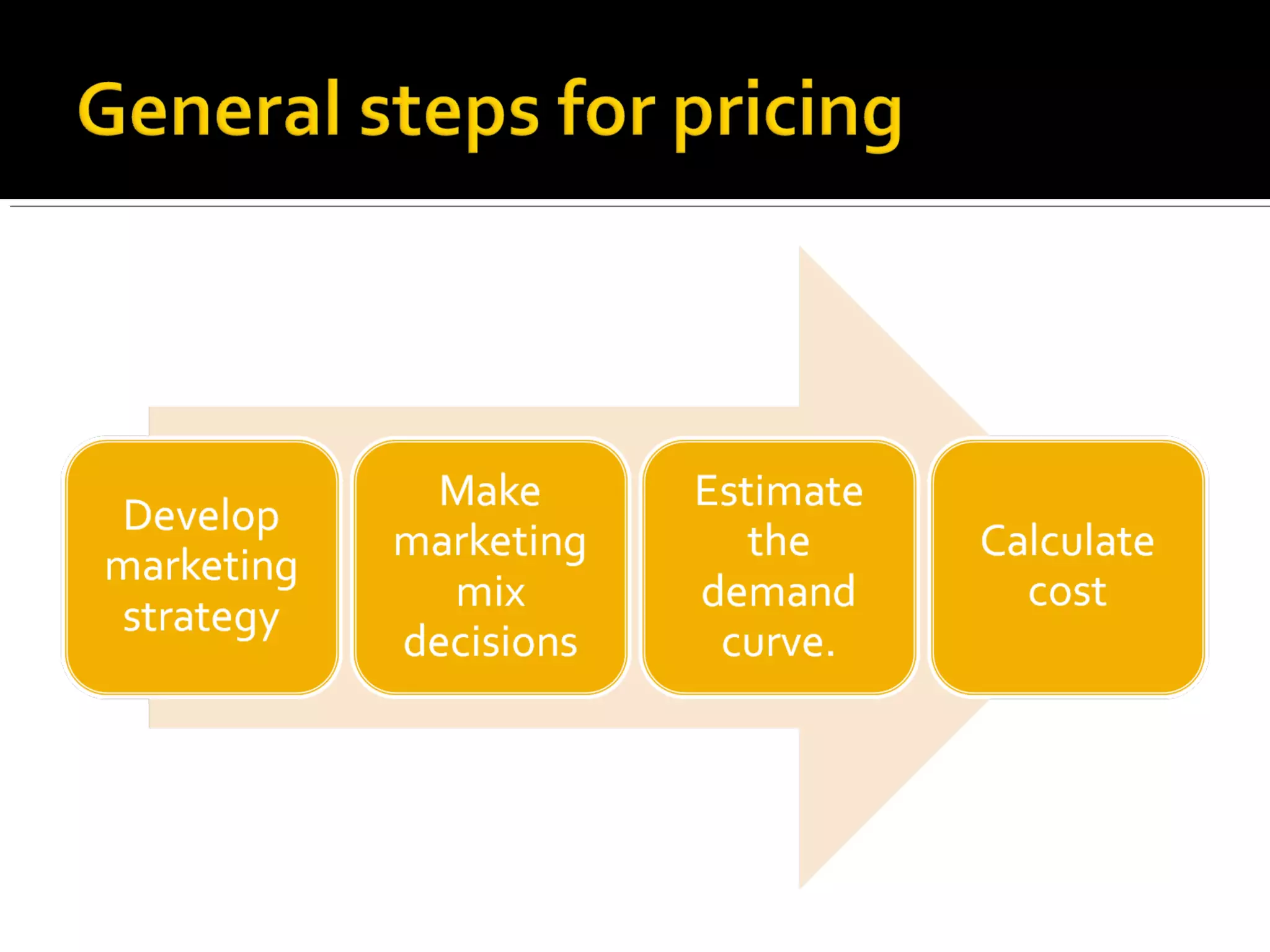

This document provides an introduction to various banking products and services. It begins with definitions of banking and the key roles banks play in providing savings opportunities and supplying liquidity through lending. It then describes the different types of banks in India including central banks, public sector banks, private sector banks, and cooperative banks. The document outlines common banking products such as deposits, loans, letters of credit, and safe deposit boxes. It also discusses important banking functions including issuing banknotes, processing payments, and intermediating credit. Finally, it briefly touches on key aspects of bank marketing like market segmentation, pricing strategies, distribution channels, and the marketing mix.