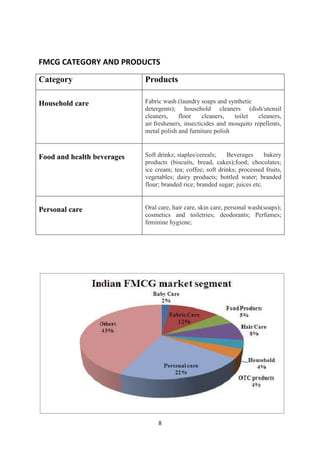

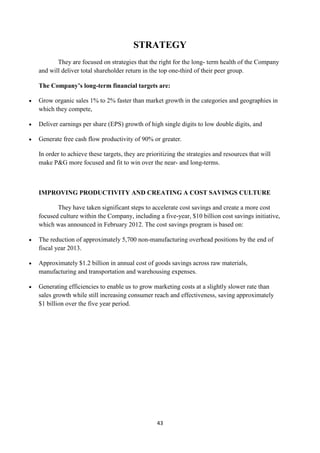

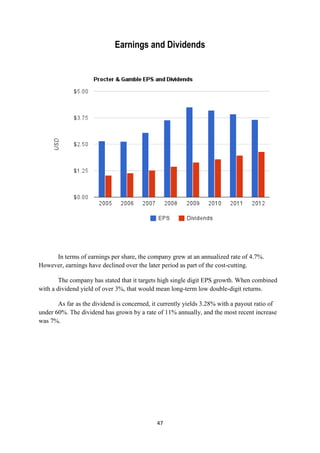

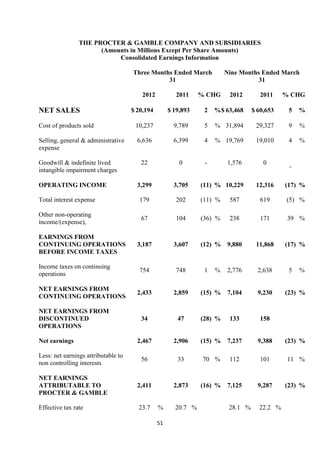

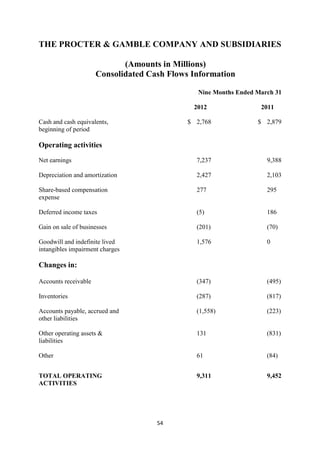

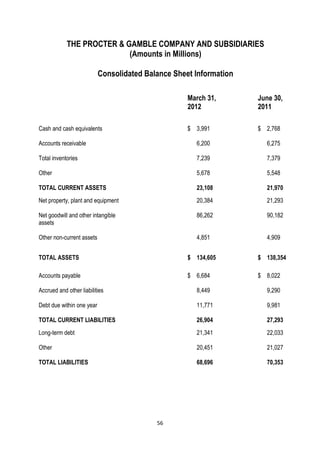

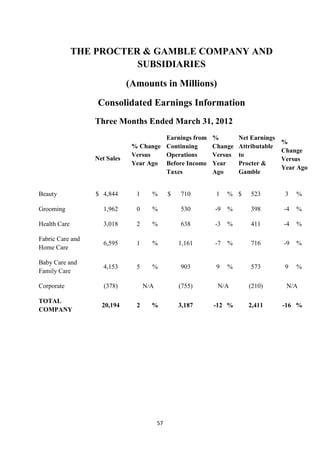

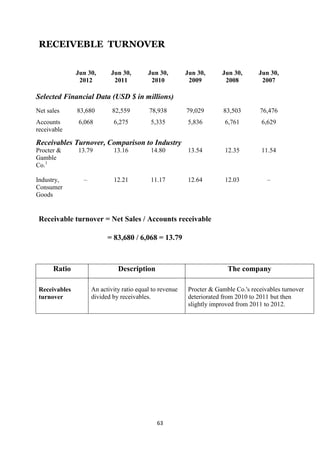

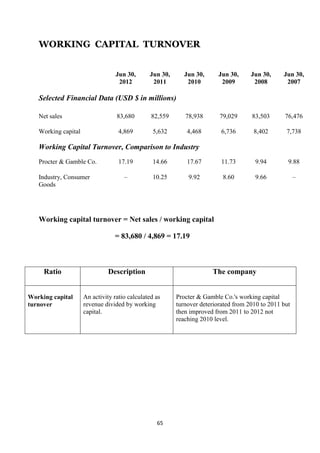

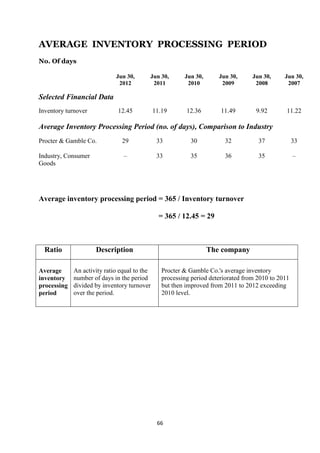

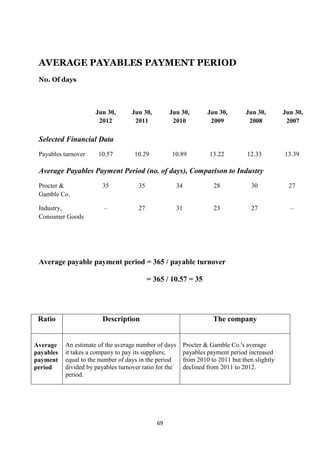

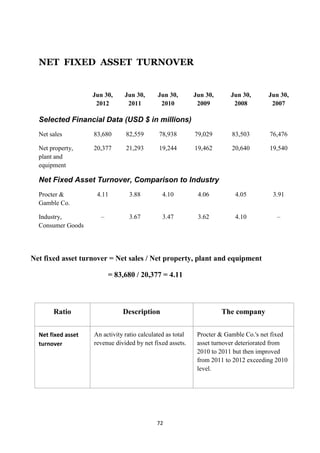

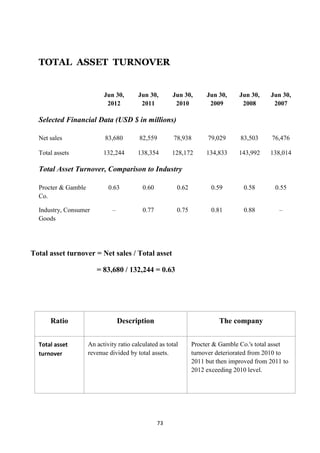

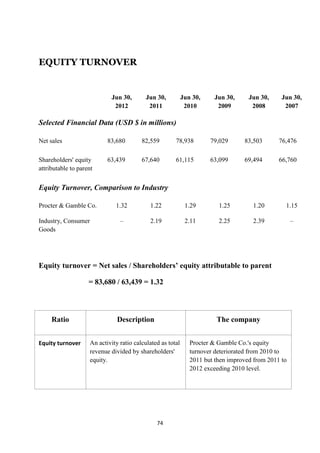

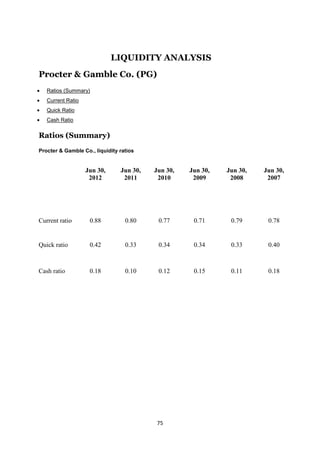

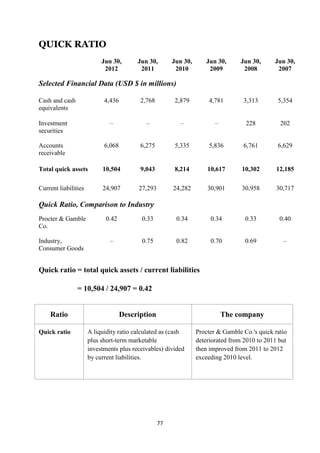

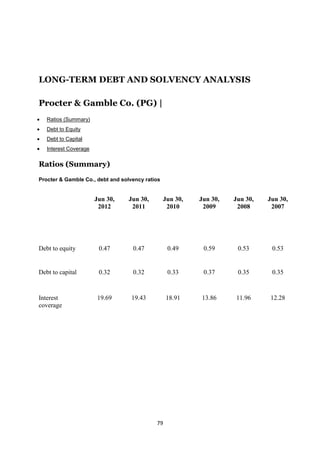

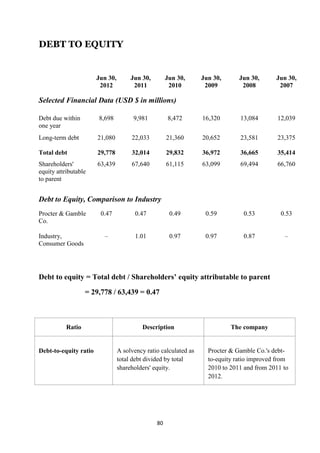

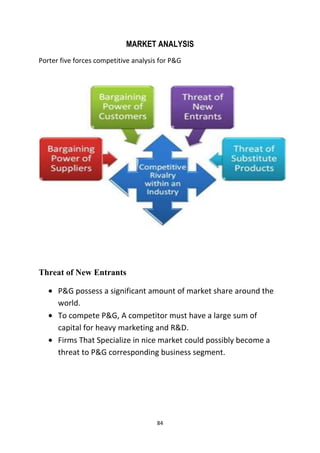

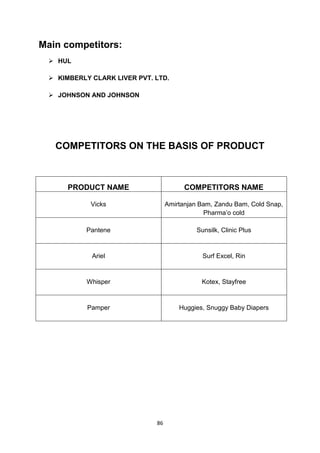

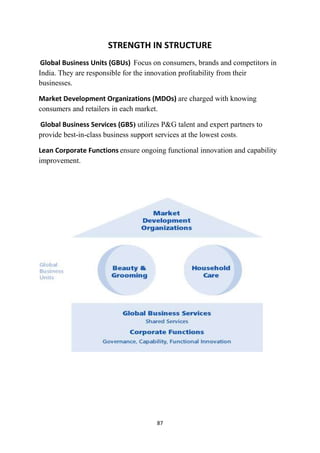

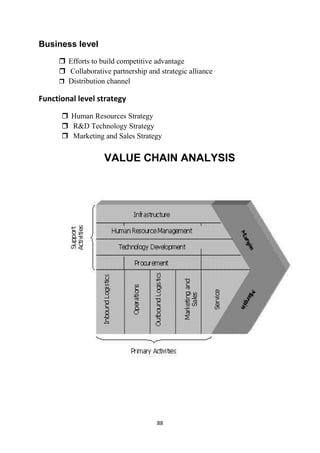

This document discusses a dissertation submitted by five students to Seethalakshmi Ramaswami College in partial fulfillment of the requirements for the award of the degree of Master of Commerce in Corporate Finance. The dissertation focuses on analyzing the growth and expansion of Fast Moving Consumer Goods (FMCG) sector in India with special reference to Procter & Gamble. It includes chapters on the company profile of P&G, an analysis of P&G on various parameters, sustainability practices of P&G, and recommendations.