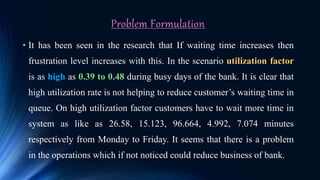

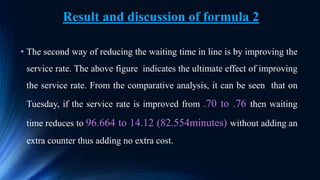

This document discusses applying queuing theory to improve service efficiency at a bank. It analyzes customer arrival and service rates to model the bank's queues. The model, M/M/C, is used to calculate key metrics like expected wait times. Adding an extra server on busy days can significantly reduce wait times, as can improving the service rate. Properly applying queuing theory through data analysis and modeling can help banks optimize their service levels and increase customer satisfaction.

![Formula 1 [Adding another server to the system during

busy days (Increase server)]

PROPOSED MODEL: (M/M/C): (GD/∞/∞) model:

• The probability of no customer in the bank,

P0=

1

𝑛=0

𝑠−1

𝜆

𝜇

𝑛

𝑛!

+

𝜆

𝜇

𝑠

𝑠!

∗

1

1−

𝜆

𝑠𝜇

• The probability of n customers in the bank,

𝝀

𝝁

𝒏!

𝒑0 if 0≤ 𝒏 ≤ 𝒔

Pn=

𝝀

𝝁

𝒔!𝒔 𝒏−𝒔 𝒑0 if n≥ 𝒔](https://image.slidesharecdn.com/queuemodelofbank-180110102002/85/Queueing-model-of-bank-7-320.jpg)

![Case study of a local bank

[Service time per day is 10:00 to 1:00 and 3:00-4:00.total 240

minutes.]

Bank data of customer count for one

month

Week No. Monday Tuesday Wednesday Thursday Friday

Week 1 140 114 132 146 156

Week 2 120 123 199 145 150

Week 3 199 171 159 120 130

Week 4 150 180 149 107 110

Total 609 588 639 518 546

Average 152.25 147 159.75 129.5 136.5](https://image.slidesharecdn.com/queuemodelofbank-180110102002/85/Queueing-model-of-bank-9-320.jpg)

![Psychological View [Frustration]](https://image.slidesharecdn.com/queuemodelofbank-180110102002/85/Queueing-model-of-bank-14-320.jpg)