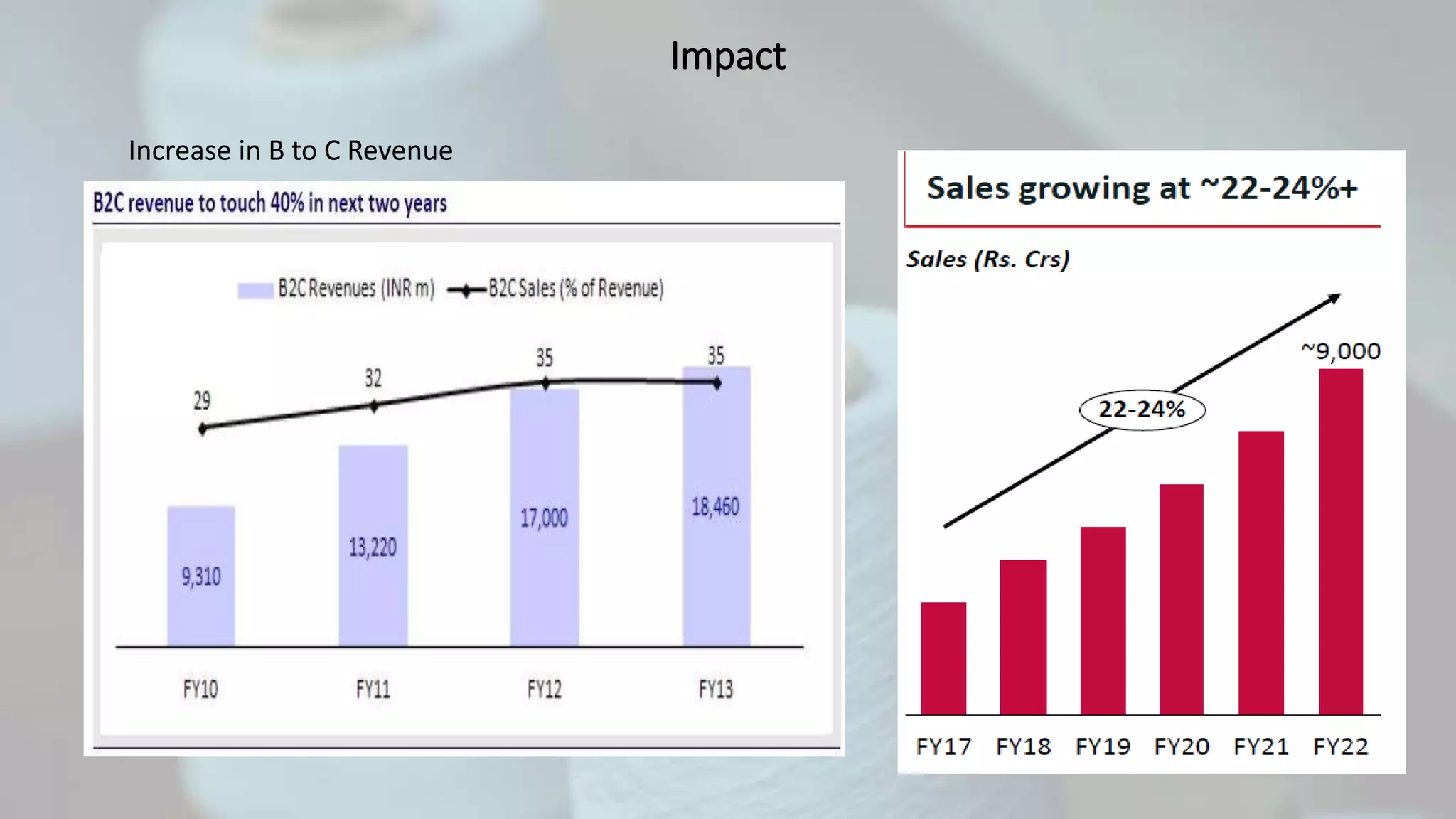

Arvind Mills was founded in 1931 and is now one of India's largest textile manufacturers and exporters. It has manufacturing plants in Gujarat, Pune, and Bangalore and employs over 30,000 people. In the late 1990s, Arvind Mills faced significant losses due to overcapacity and shifting fashion trends. To address this, the company diversified its product portfolio, expanded its retail business, and monetized surplus land. These strategic changes have led to strong financial performance, with the retail business growing at 25% annually and the share of consumer-facing sales increasing to 40% of revenues.