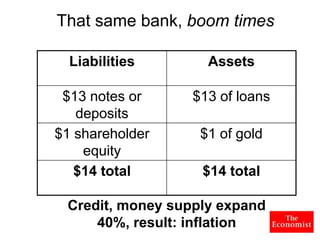

This document provides a primer on monetary policy, the role of central banks like the Federal Reserve, and quantitative easing (QE). It explains that central banks were created to address problems with the gold standard like bank panics. The Fed aims to act as a lender of last resort and conduct monetary policy. QE involves the Fed buying bonds to lower long-term interest rates when short-term rates hit zero. While QE increases the money supply, it does not necessarily cause inflation if the money is not lent and spent. QE seems to be helping reduce unemployment, though it has risks like encouraging risk-taking that require oversight.