Embed presentation

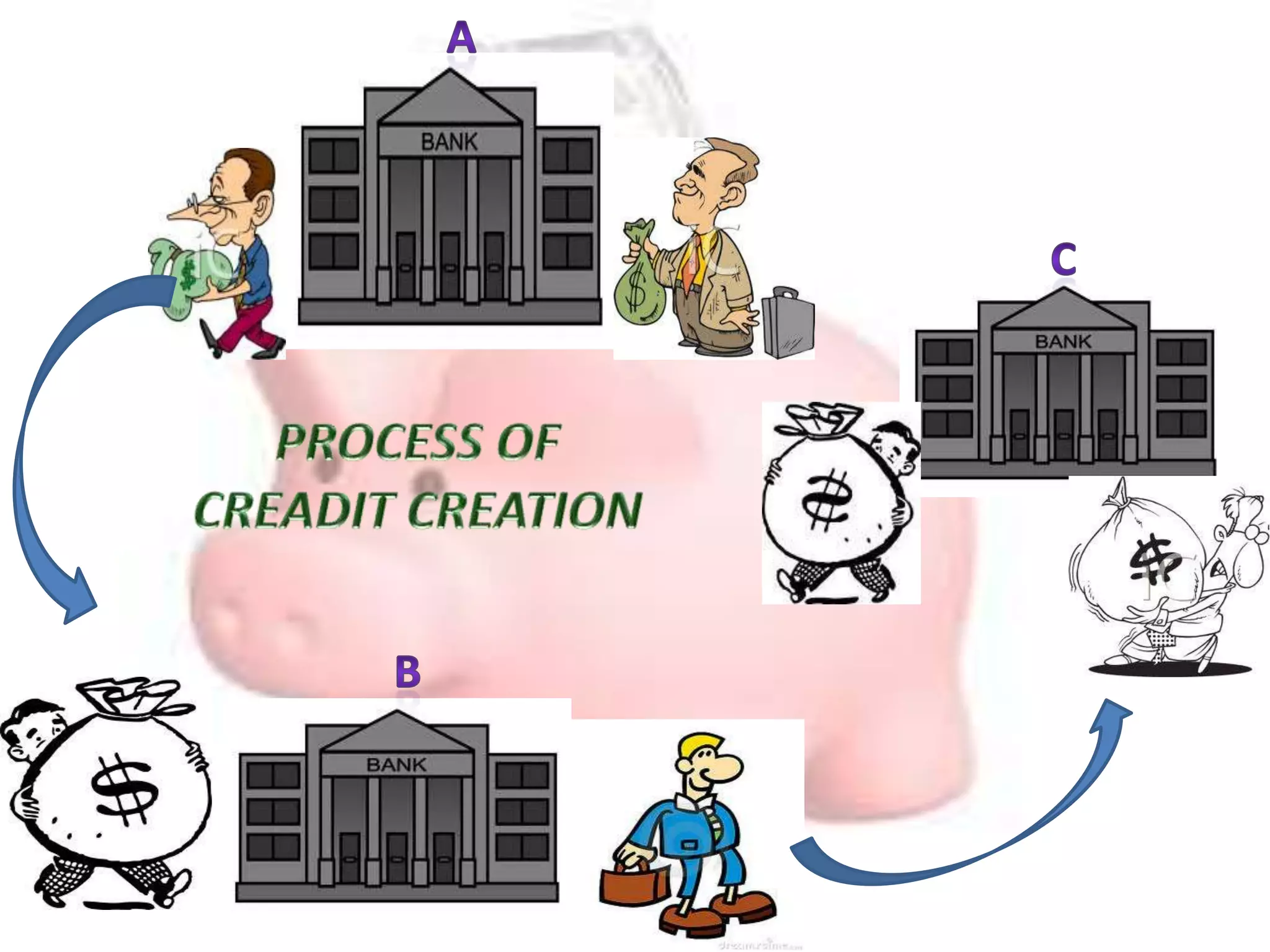

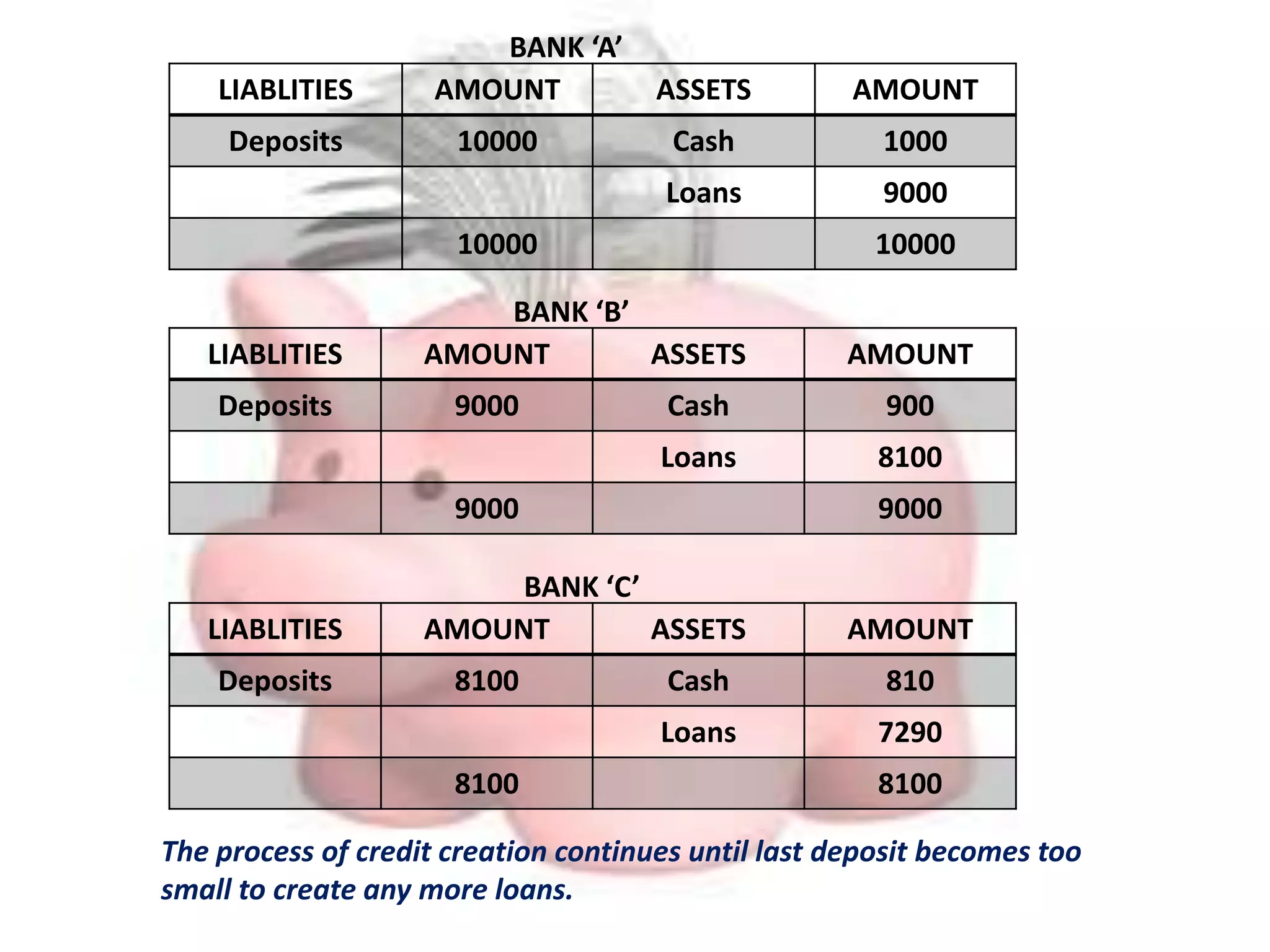

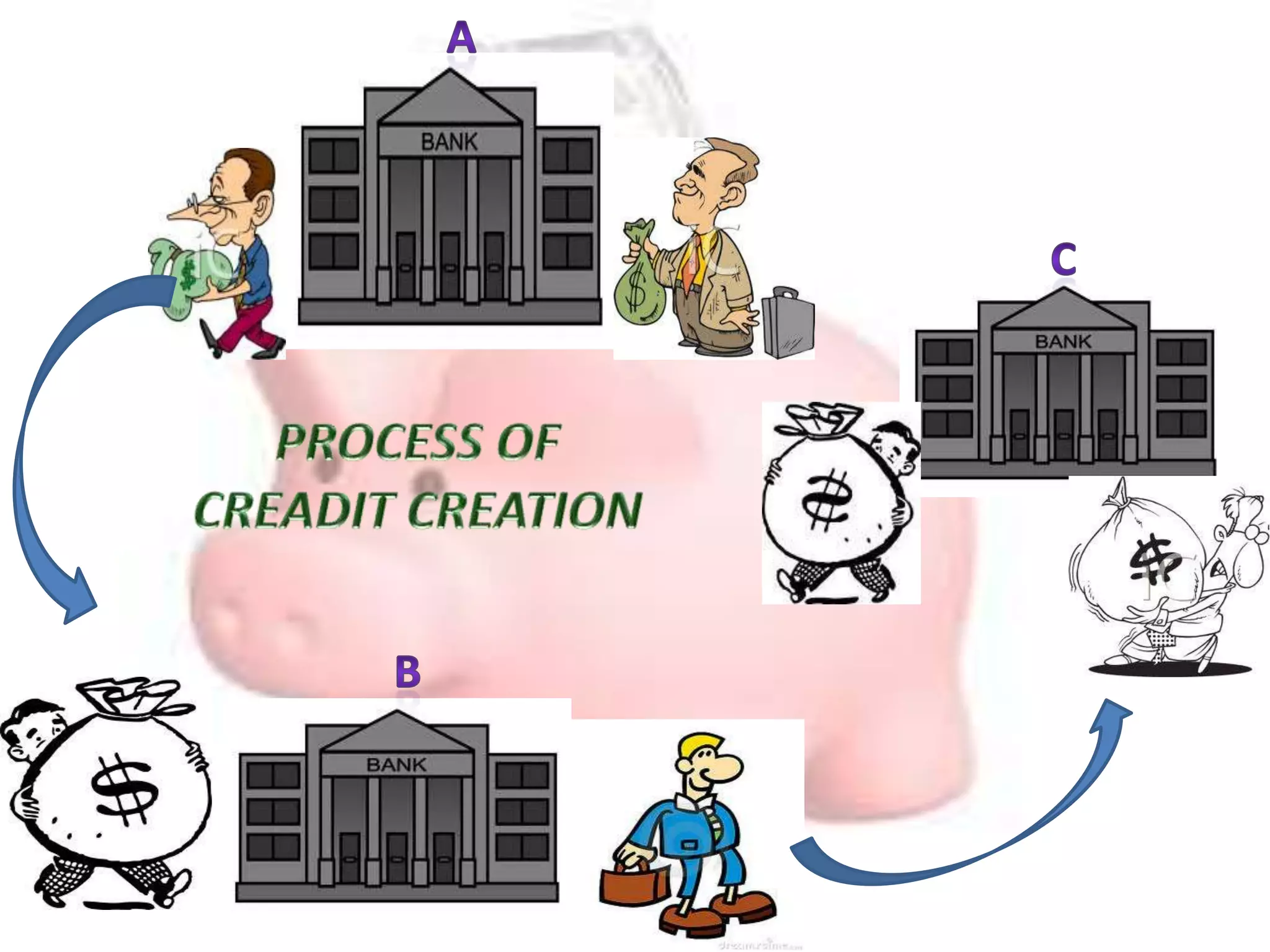

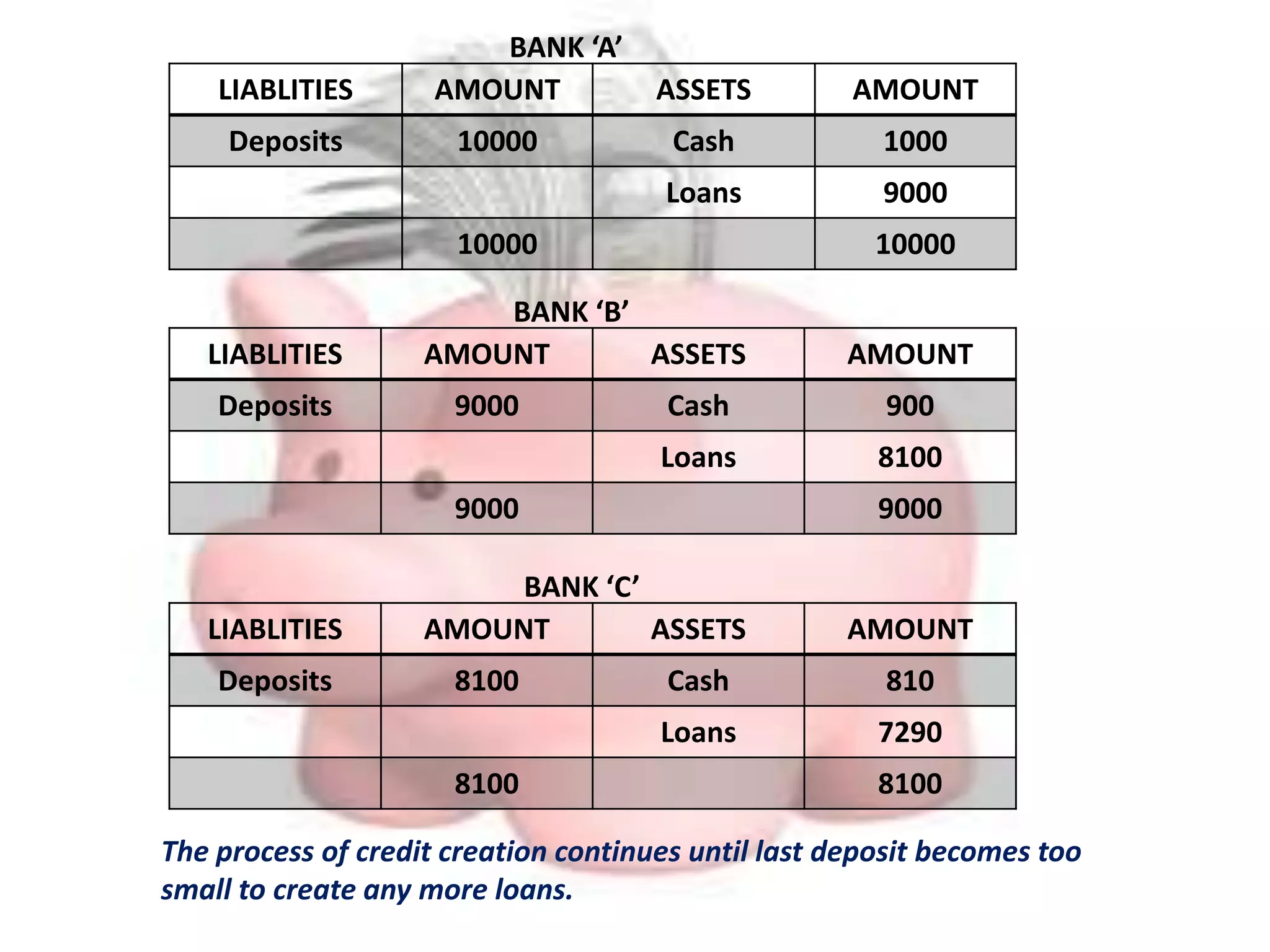

Commercial banks engage in credit creation by accepting primary deposits from customers and using some of those deposits to issue loans and advances, thereby creating derivative deposits. This process of using deposits to issue loans that themselves generate further deposits allows banks to multiply the money supply through the fractional reserve system. As shown through examples of Banks A, B, and C, each new loan issued creates a new deposit, with the amount of deposits and loans growing until reserves become too small to support additional lending.