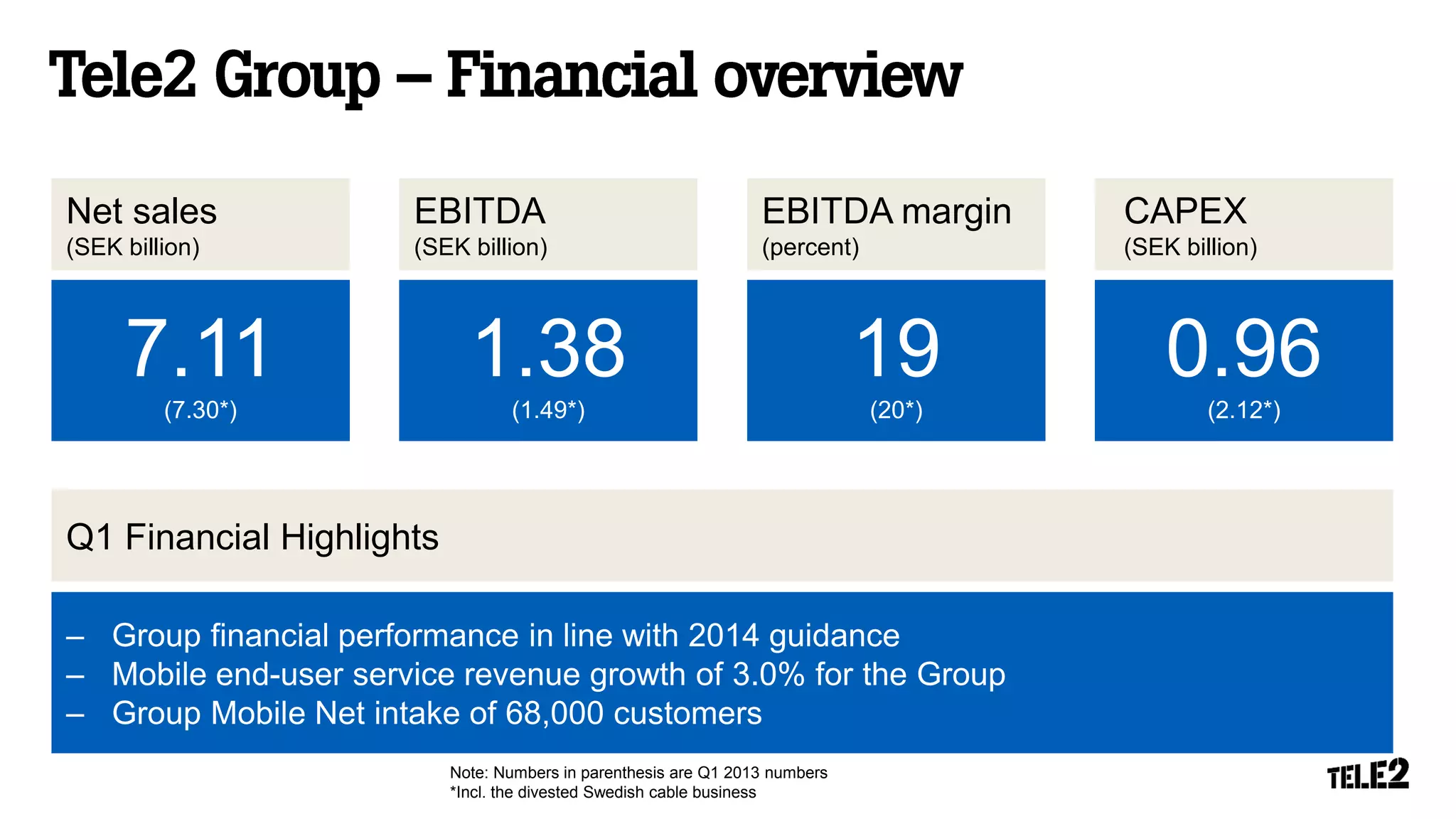

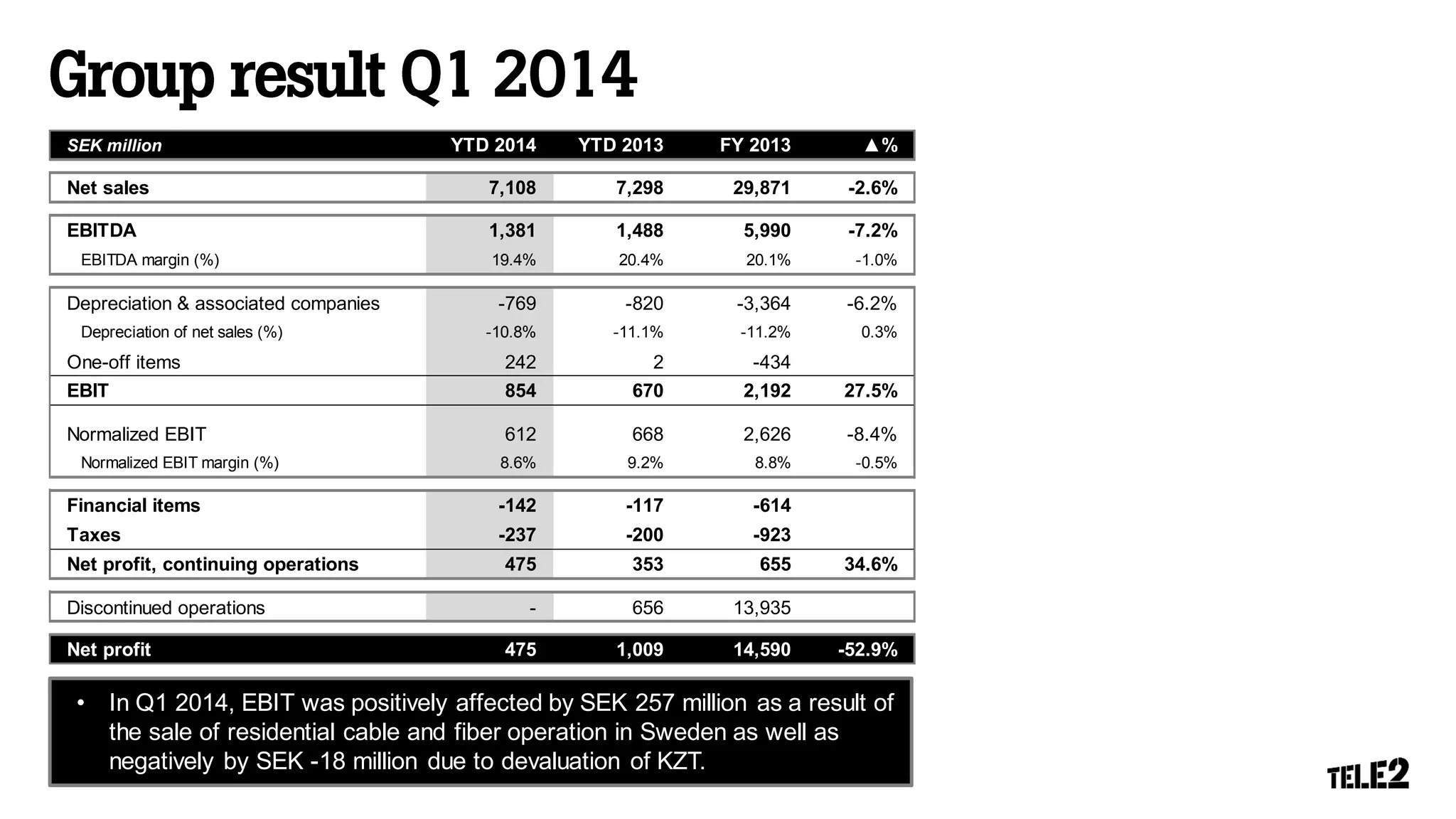

- Tele2's Q1 2014 financial performance was in line with guidance, with net sales of SEK 7.11 billion and EBITDA of SEK 1.38 billion.

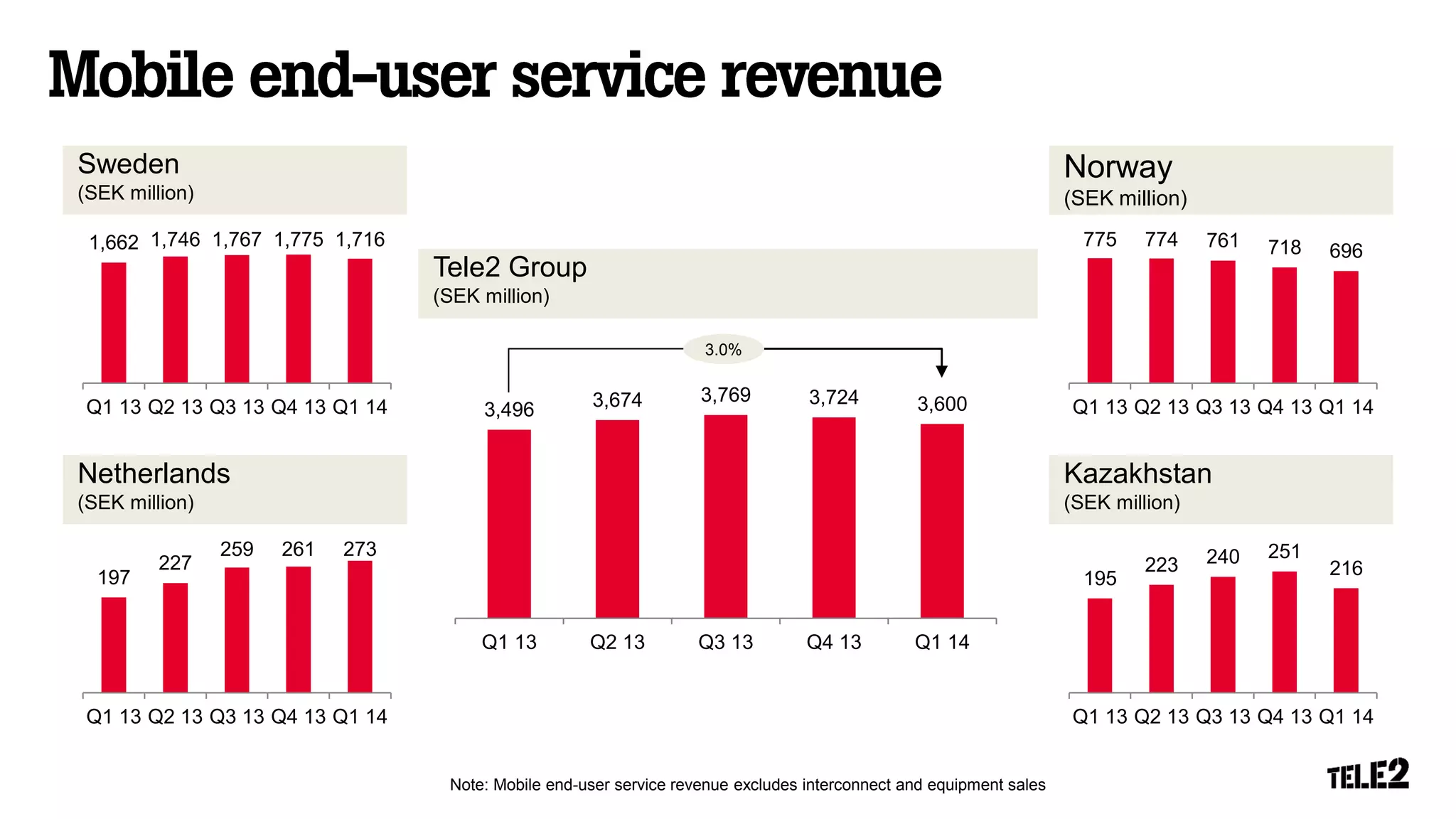

- Mobile end-user service revenue grew 3.0% for the group. Net customer intake was 68,000.

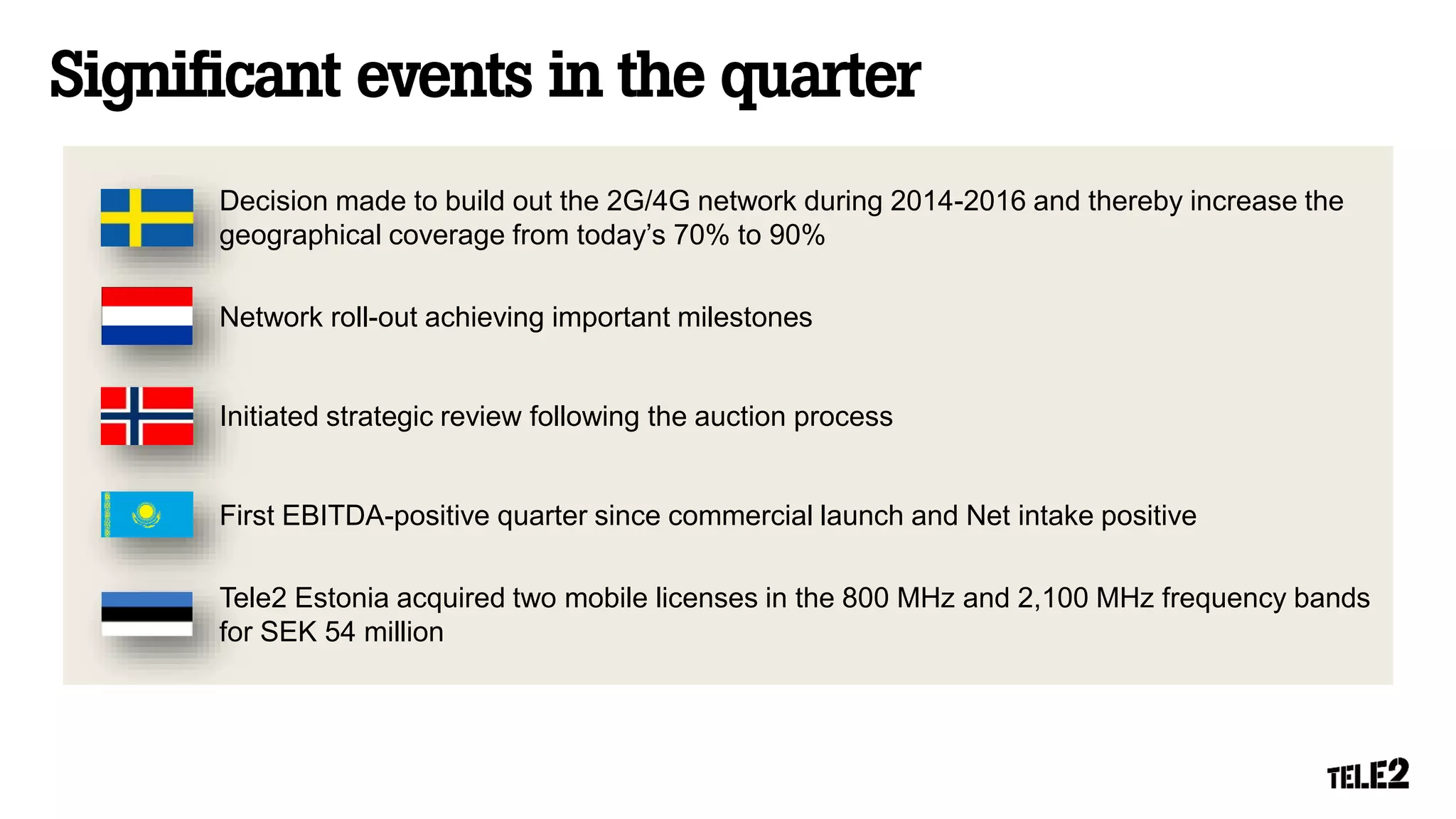

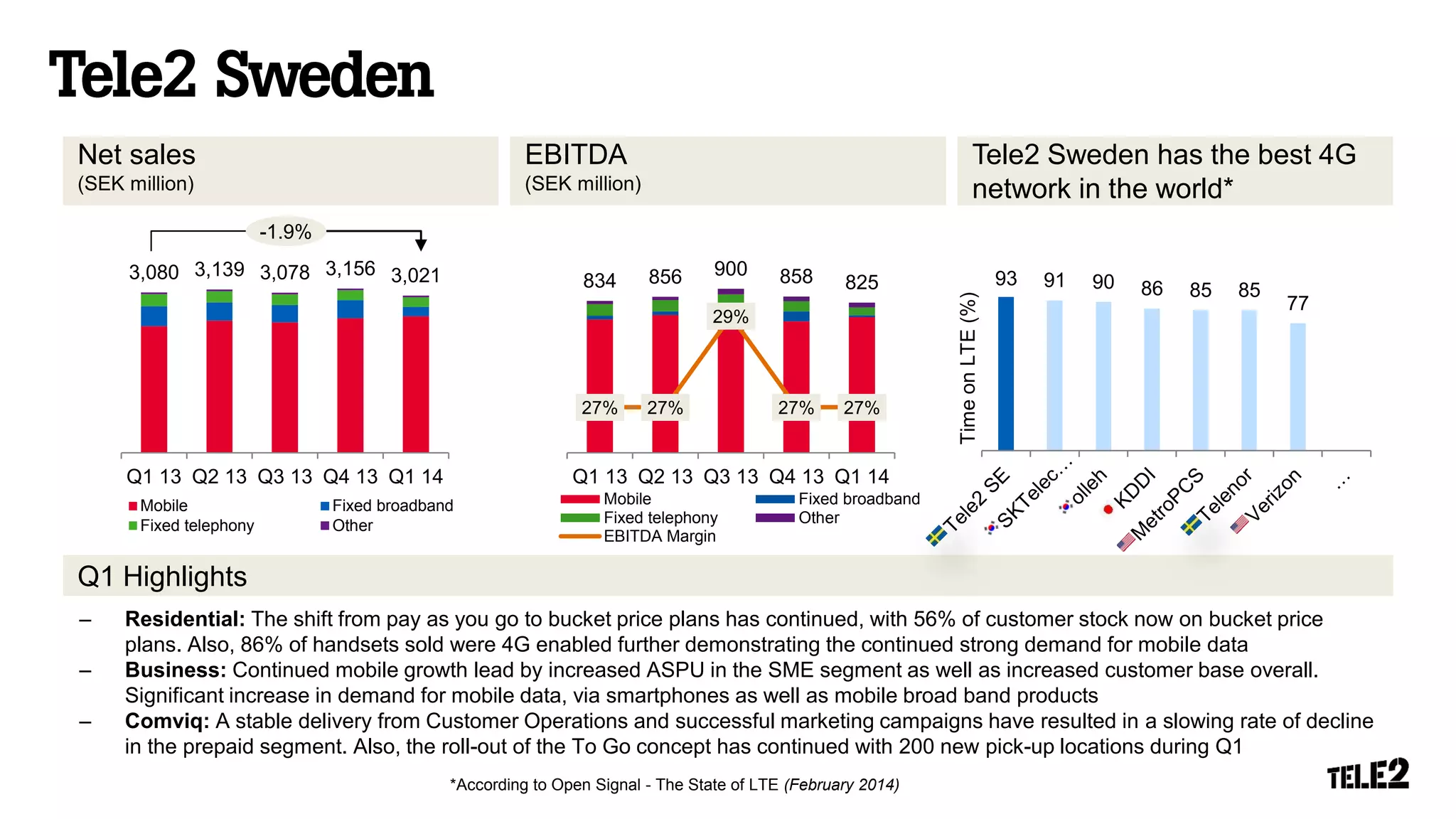

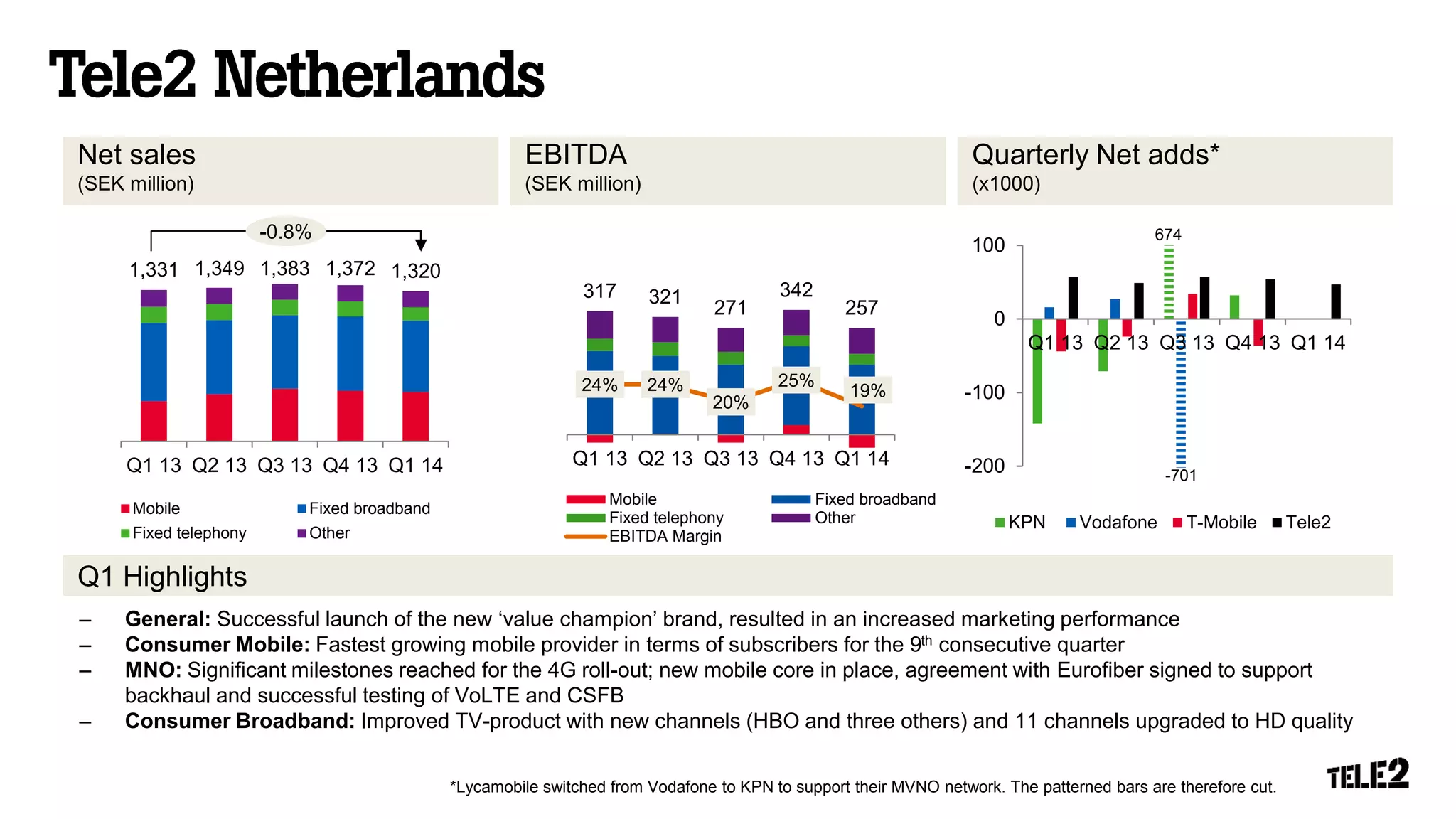

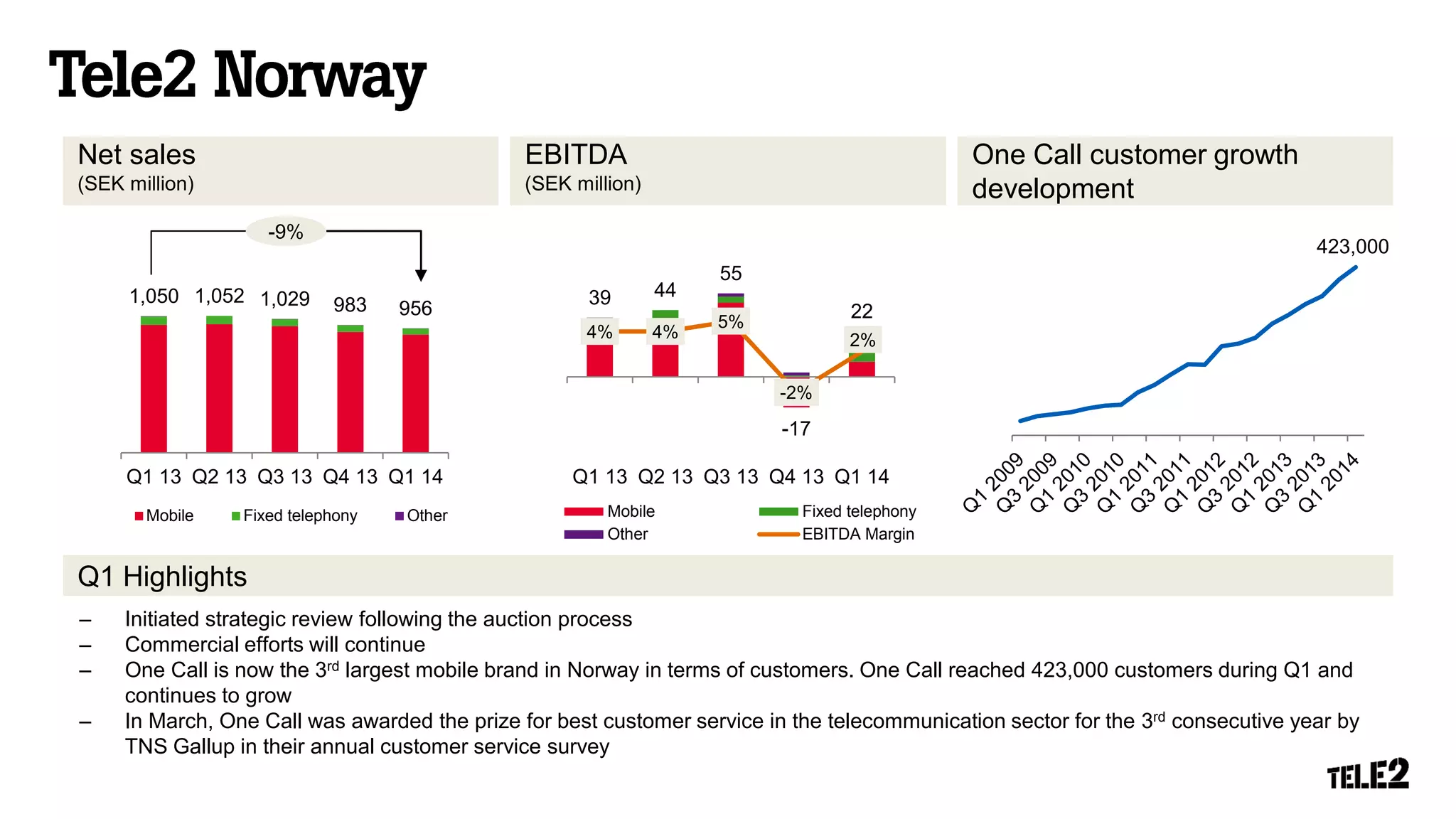

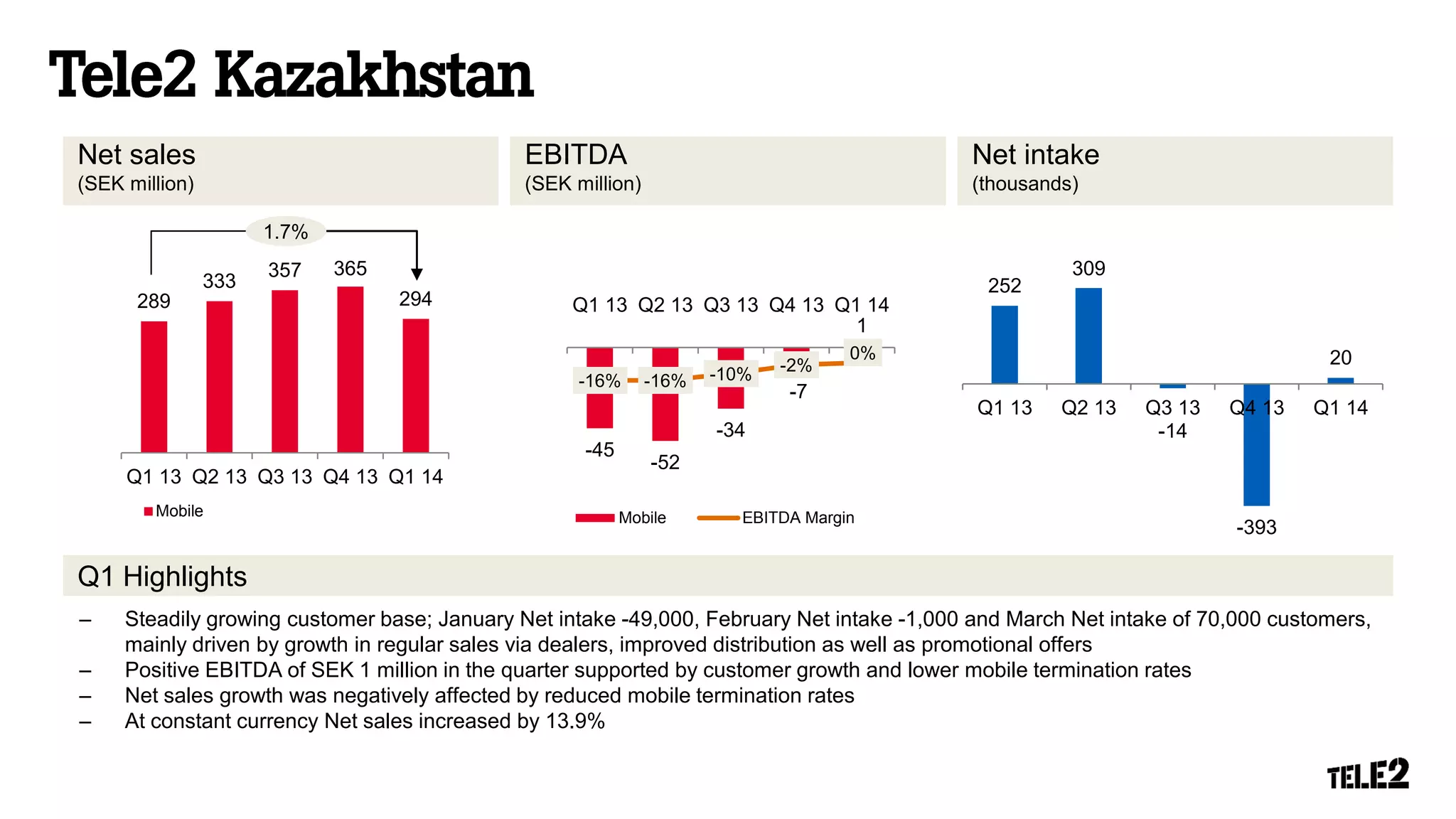

- Key highlights included positive EBITDA in Kazakhstan, growth in Sweden and the Netherlands, and ongoing strategic reviews in Norway and Germany.

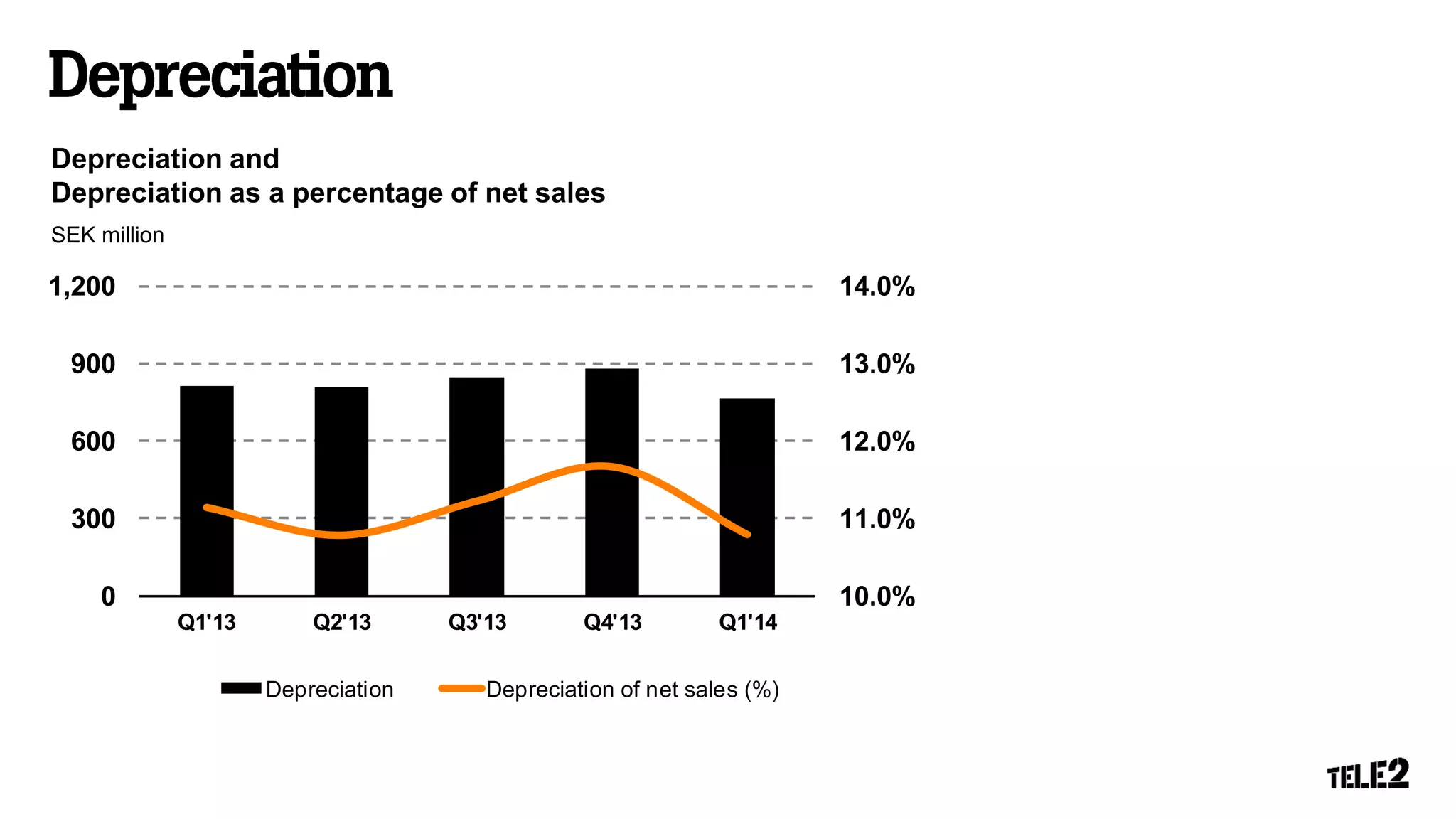

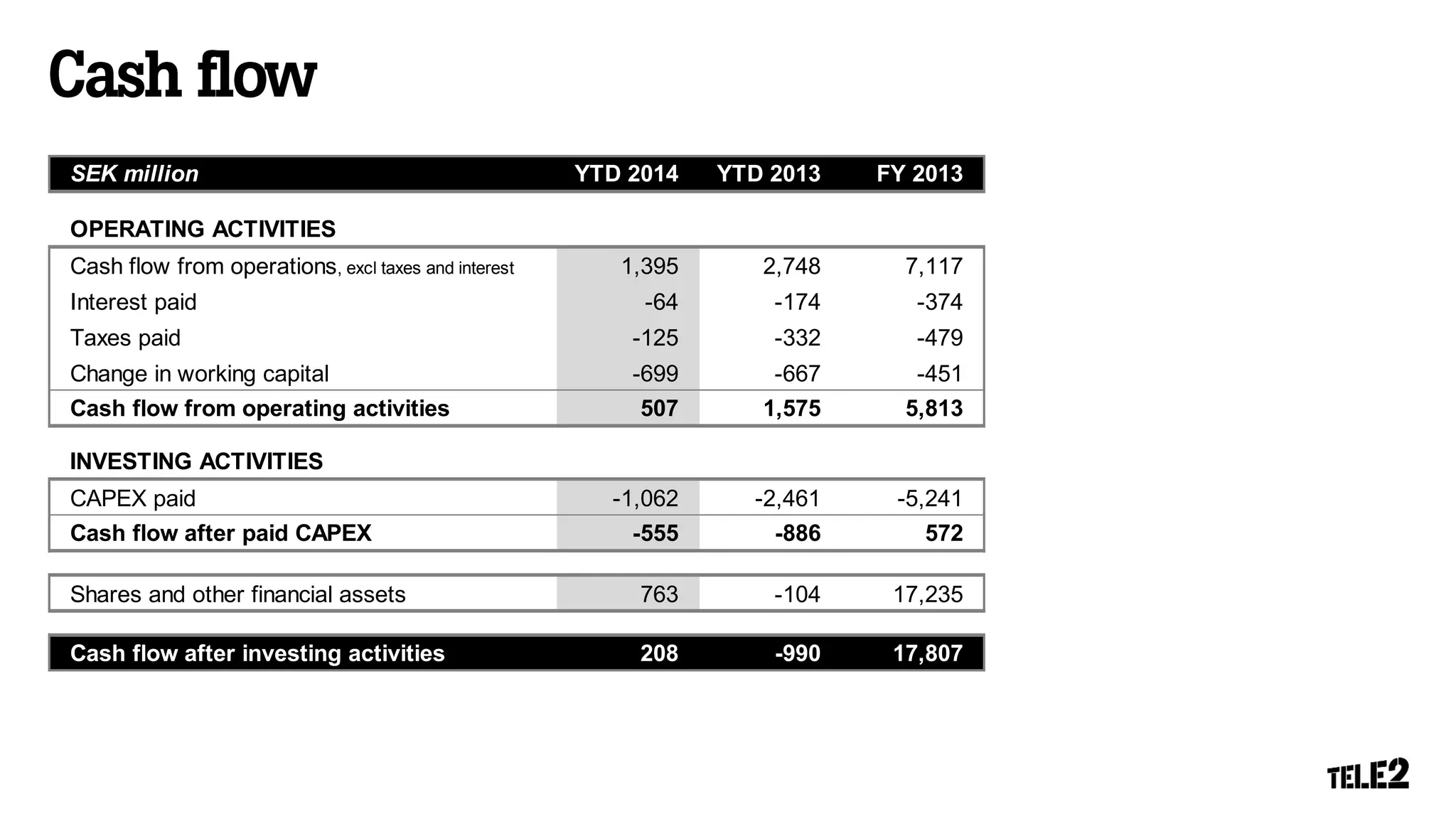

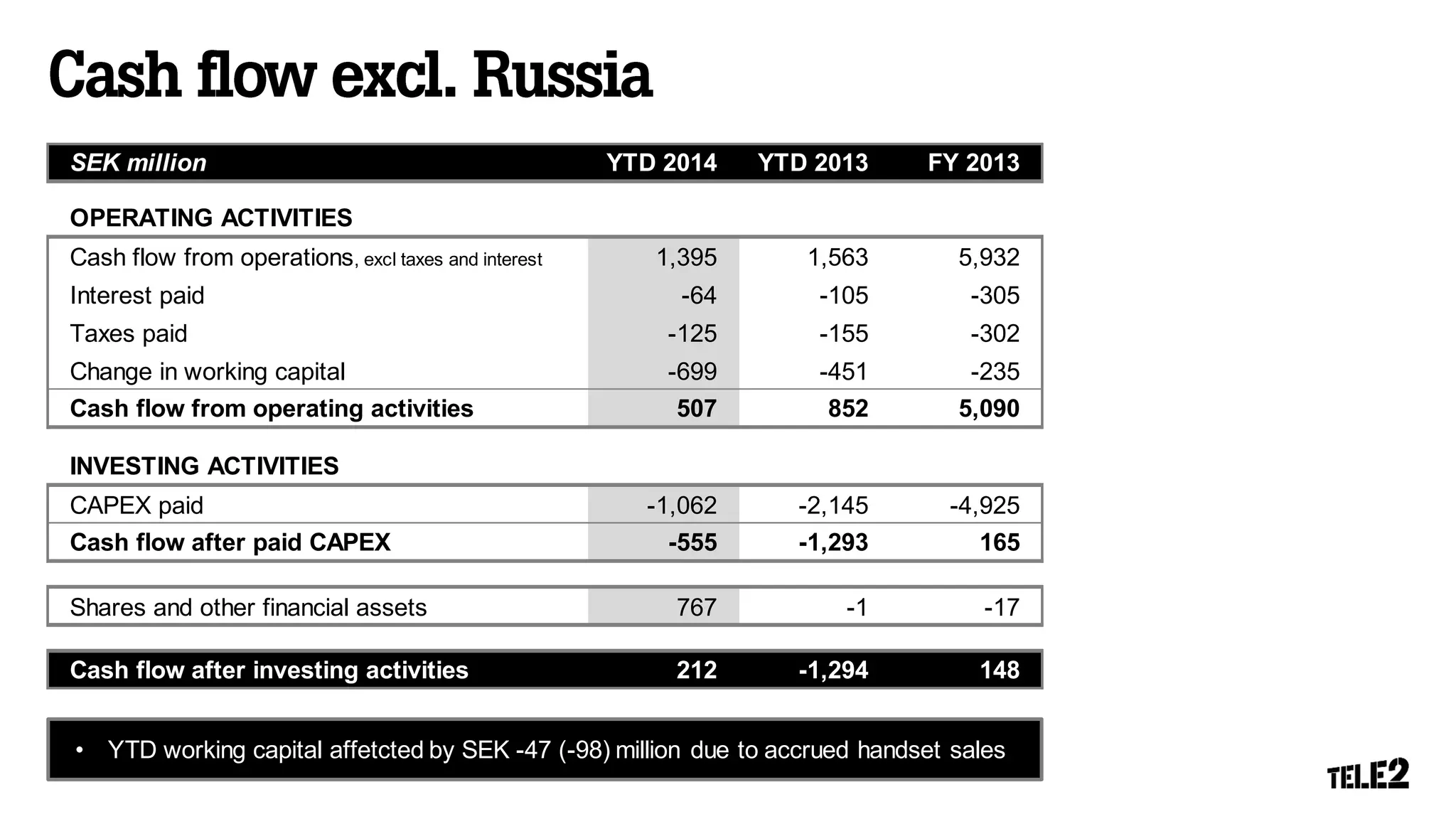

- CAPEX was SEK 0.96 billion as Tele2 continued investing in network rollouts.