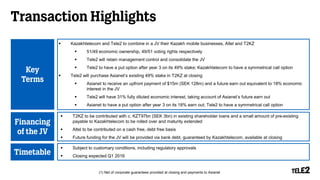

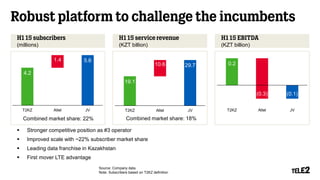

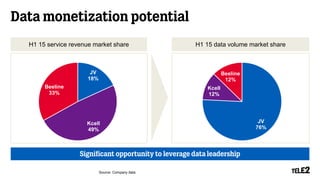

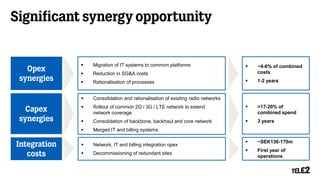

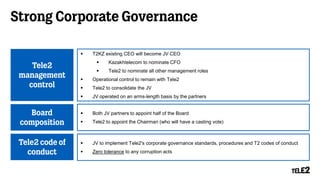

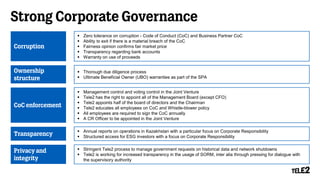

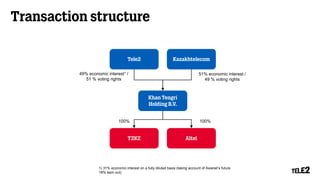

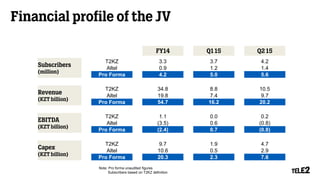

Tele2 is announcing a joint venture with Kazakhtelecom to combine their mobile businesses in Kazakhstan, Altel and T2KZ. Tele2 will have a 31% economic interest in the joint venture. The transaction is expected to close in Q1 2016. The joint venture will have improved scale and a stronger competitive position as the #3 operator. Significant cost synergies and data monetization opportunities are expected. Strong corporate governance procedures will be put in place, with Tele2 maintaining management control.