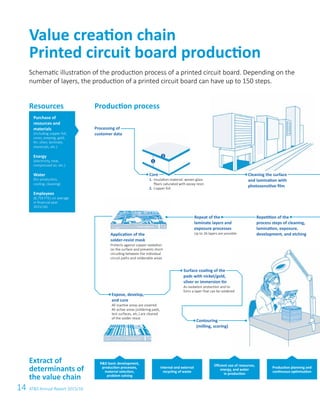

This document provides key financial figures and performance highlights for AT&S, a leading manufacturer of printed circuit boards, for the years 2012/13 through 2015/16. Some key points:

- Revenue increased 14.4% in 2015/16 to €762.9 million, with growth primarily from the Mobile Devices & Substrates segment.

- EBITDA remained flat at €167.5 million while EBIT declined 14.6% due to higher depreciation from a new production line in China.

- ROCE declined from 12.0% to 8.2% due to investments in a new plant in Chongqing, China.

- Headcount increased 12.3% to 9