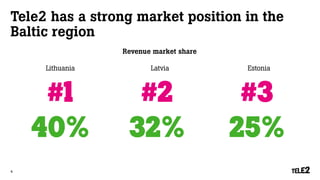

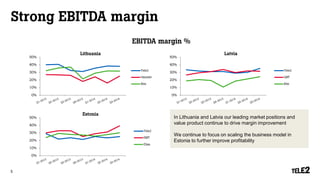

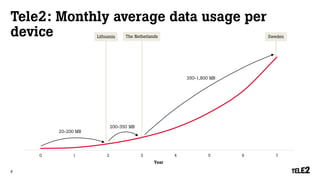

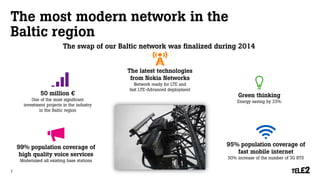

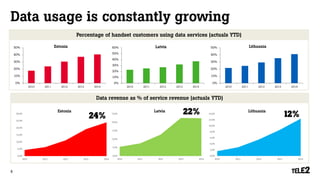

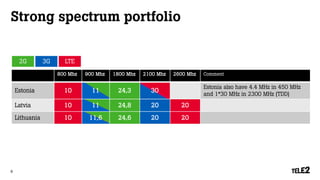

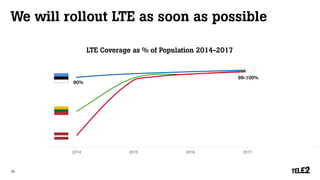

This document discusses Tele2's position in the Baltic telecommunications market. It notes that Tele2 has strong market positions in Latvia and Lithuania as the number 2 and number 1 provider respectively, and is working to improve profitability in Estonia where it is number 3. It also describes Tele2's investments in upgrading its network infrastructure in the Baltic region to modernize base stations and increase coverage. This will allow Tele2 to rollout LTE services and capitalize on increasing customer data usage.