The document provides financial and operational highlights for Tele2 AB for Q2 2017:

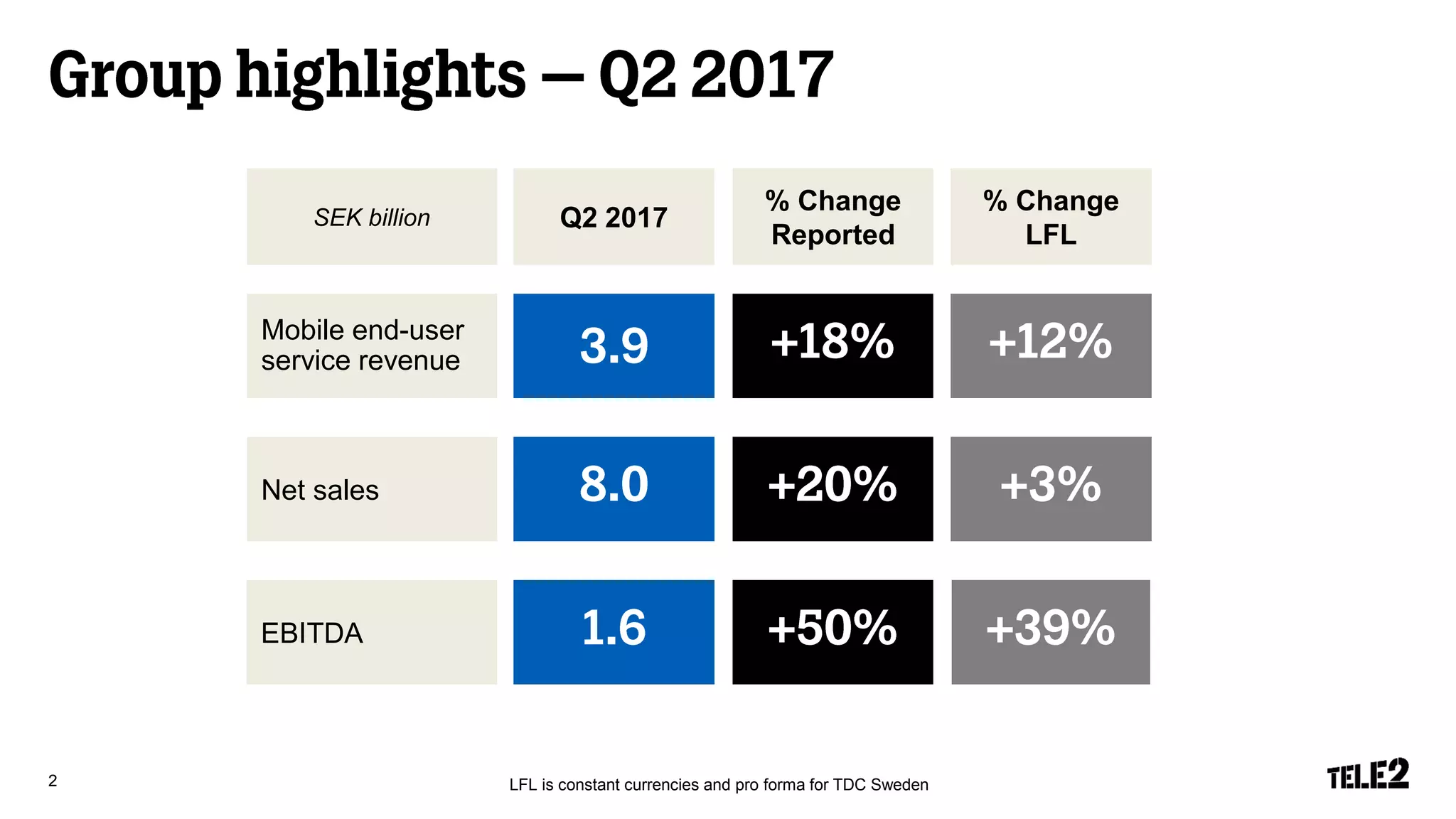

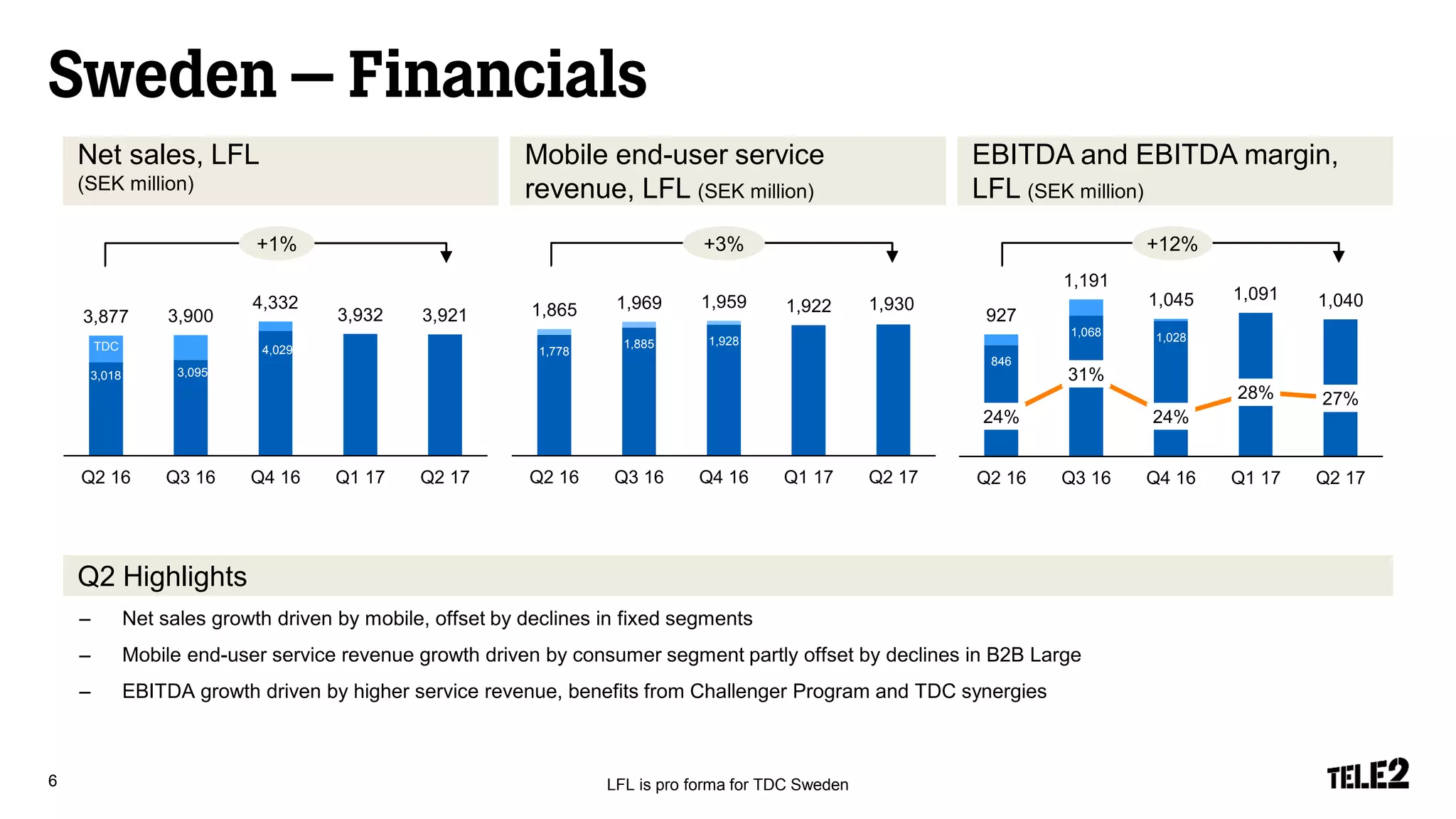

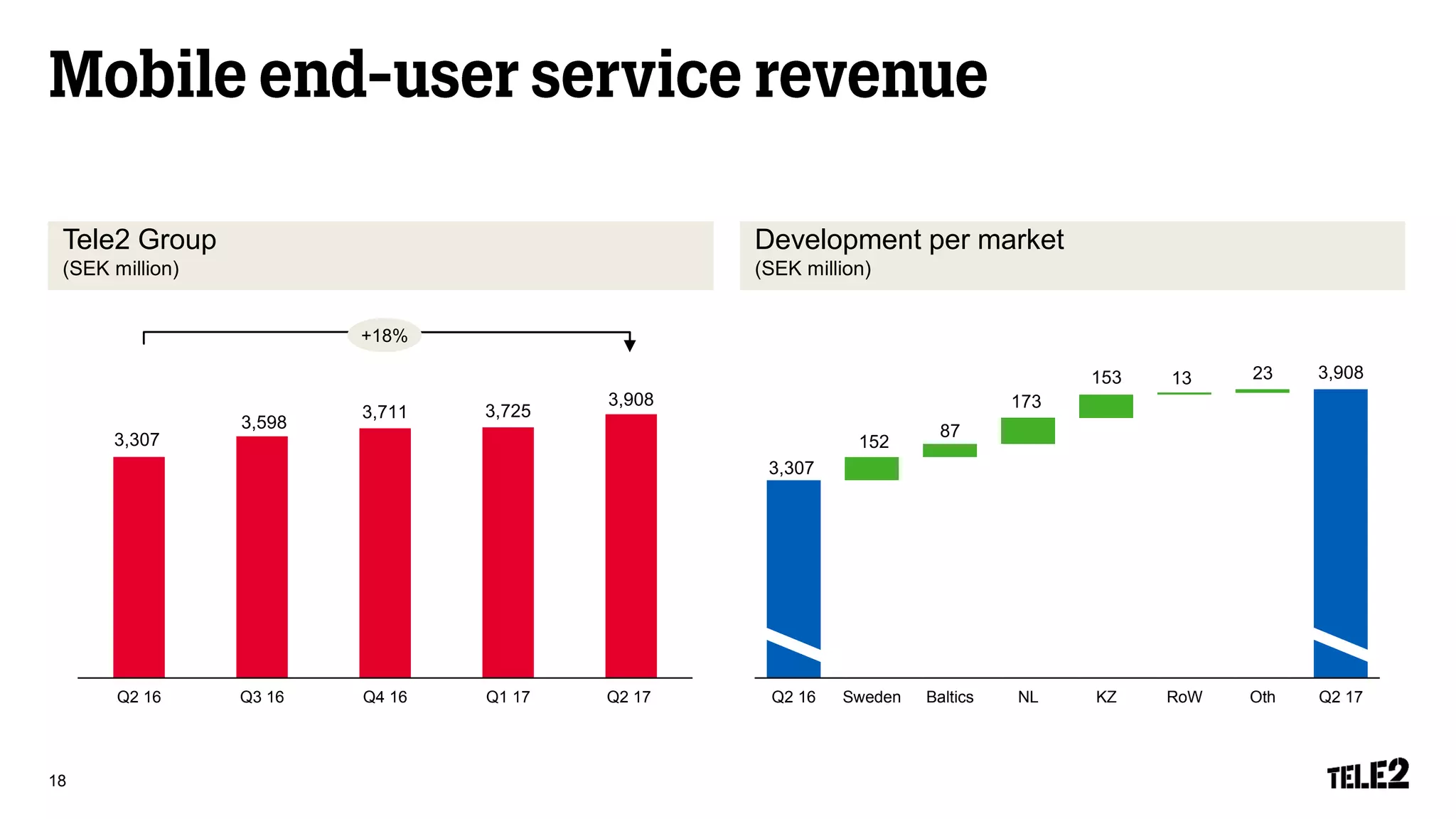

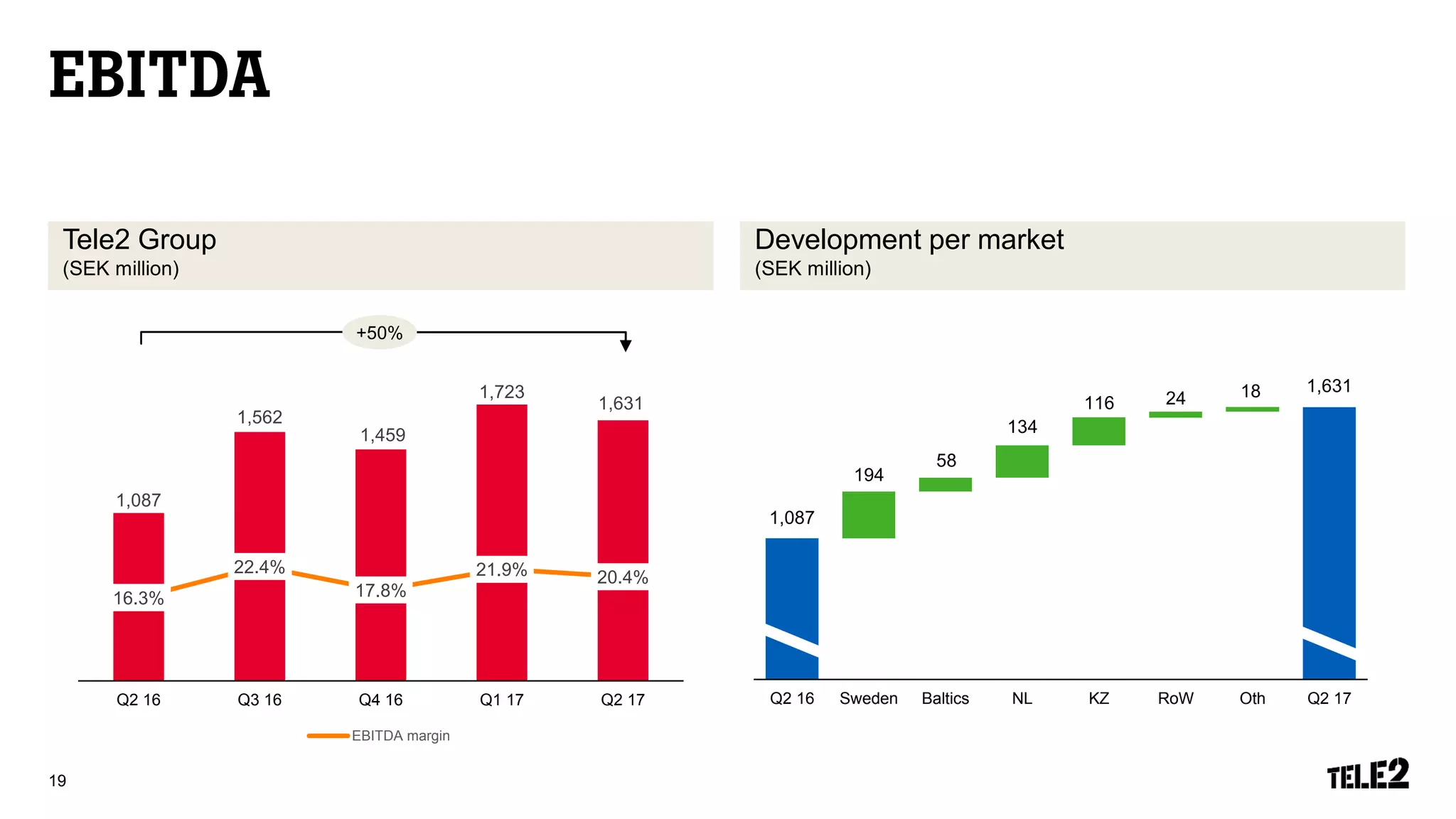

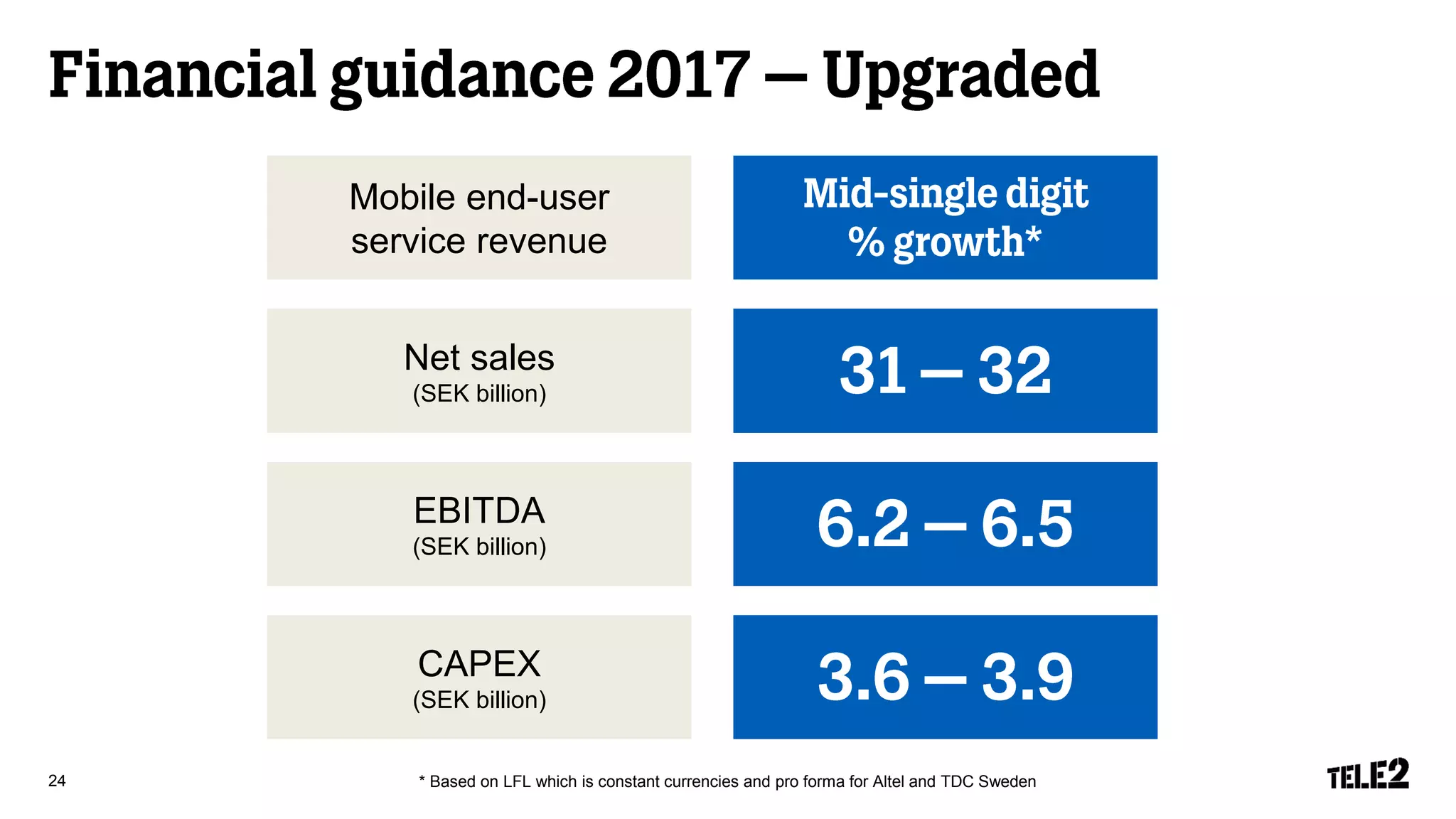

- Net sales grew 18% driven by increases in mobile end-user service revenue and EBITDA increased 50% due to higher service revenue and integration synergies.

- Mobile end-user service revenue growth was driven by increases in the consumer segment, higher ASPU, and a larger share of customers opting for bundles over 3GB of data.

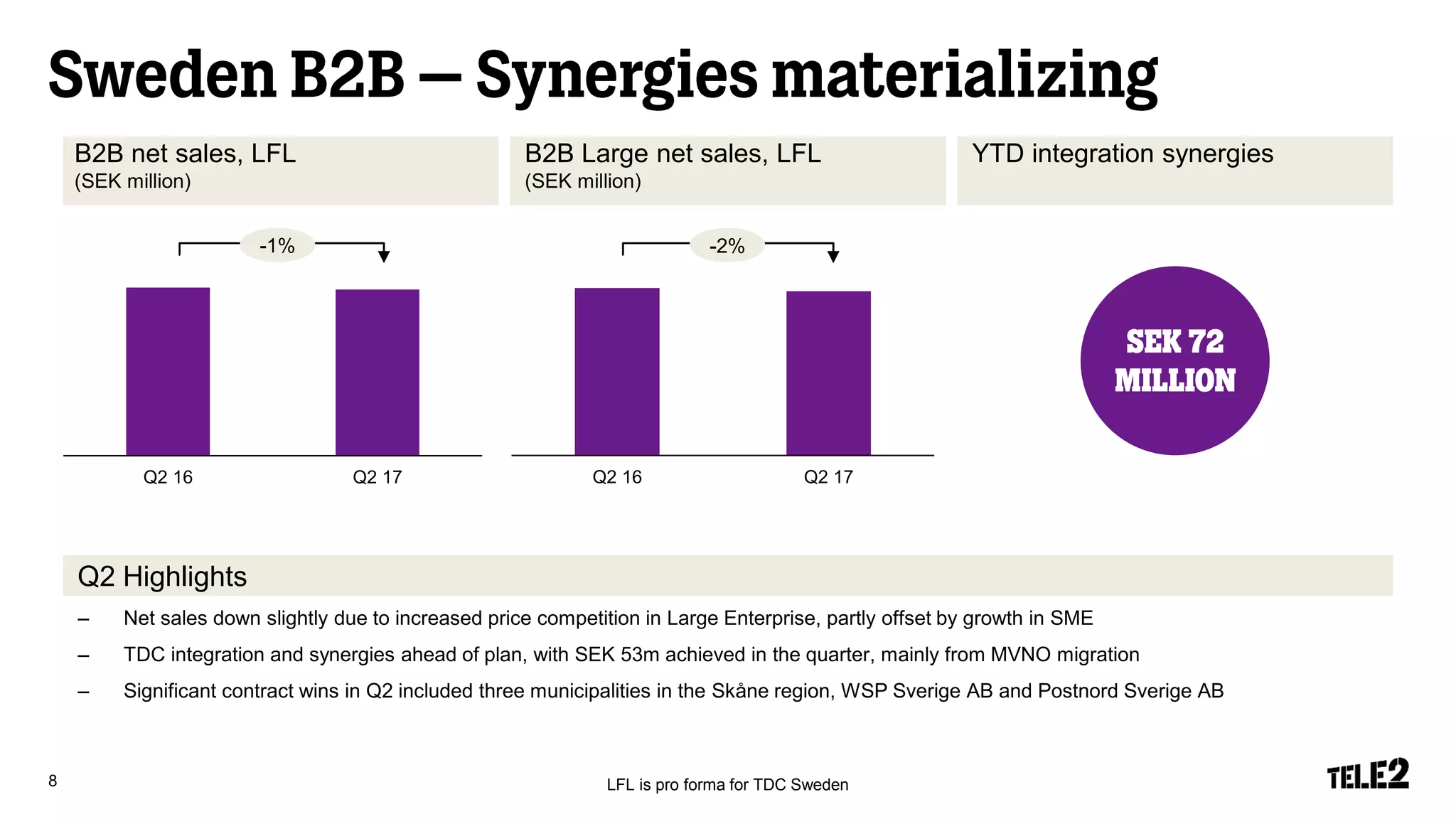

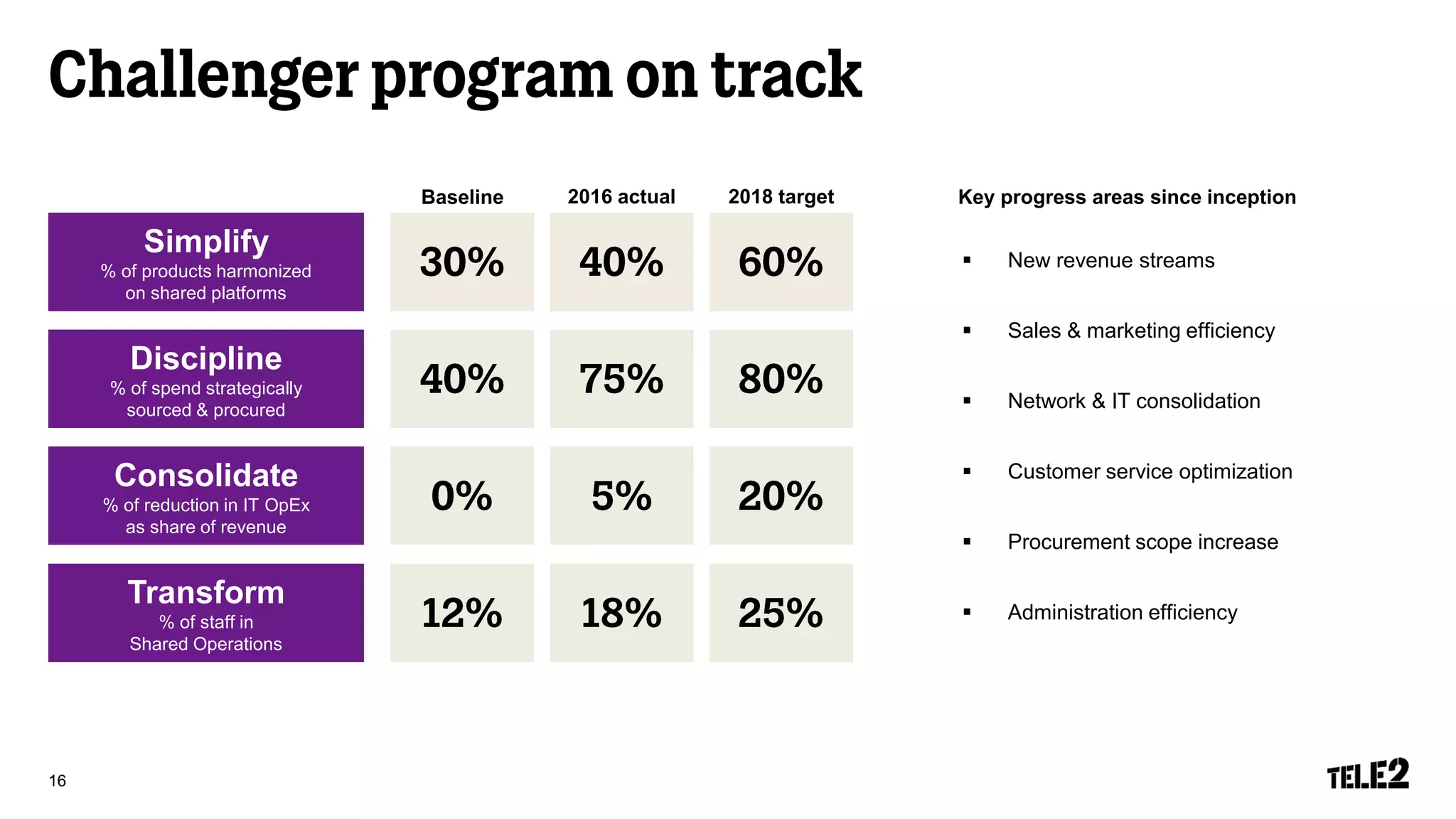

- Integration synergies from the TDC acquisition were ahead of plan, achieving SEK 53 million in the quarter mainly from migrating MVNO customers.

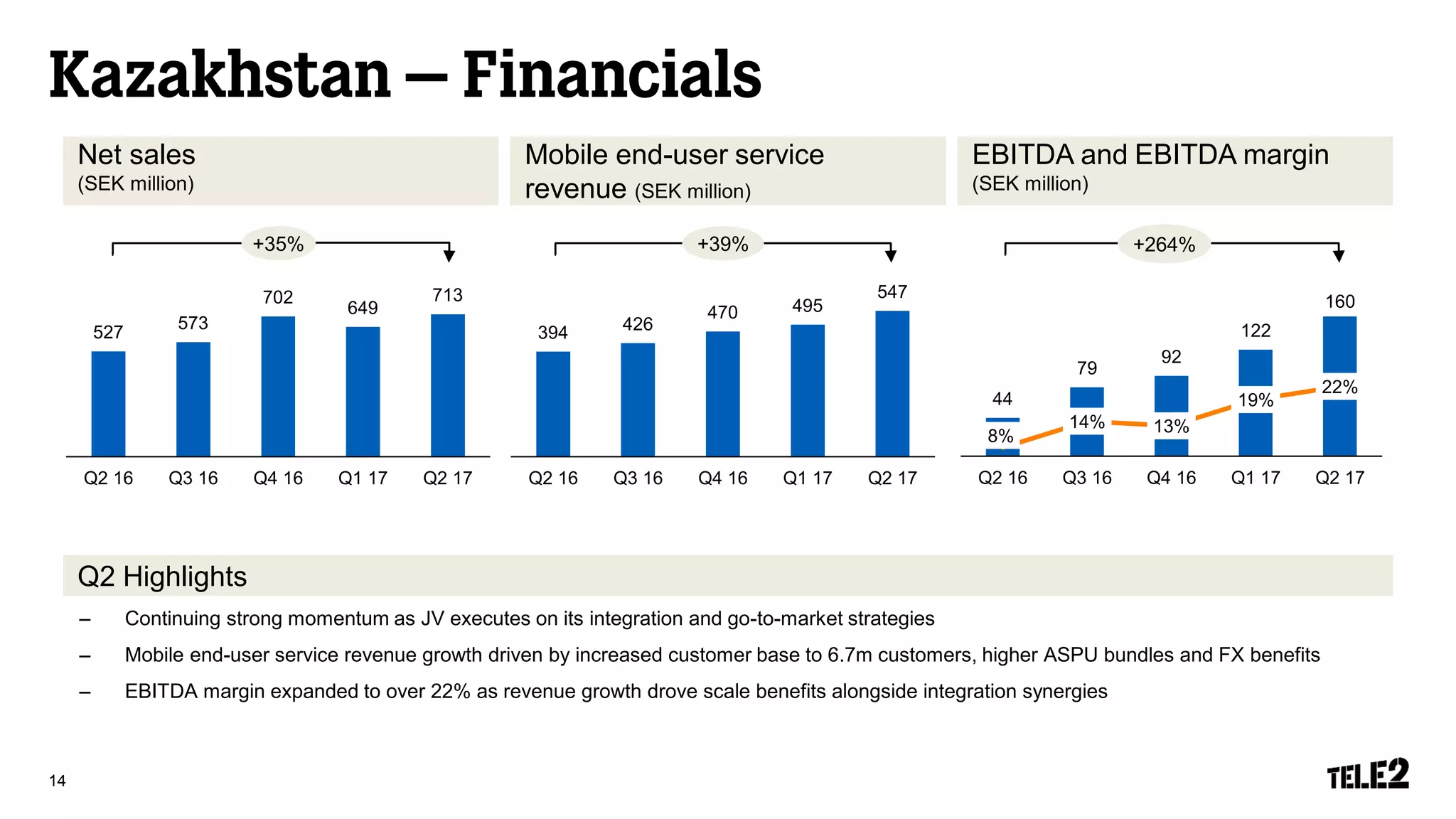

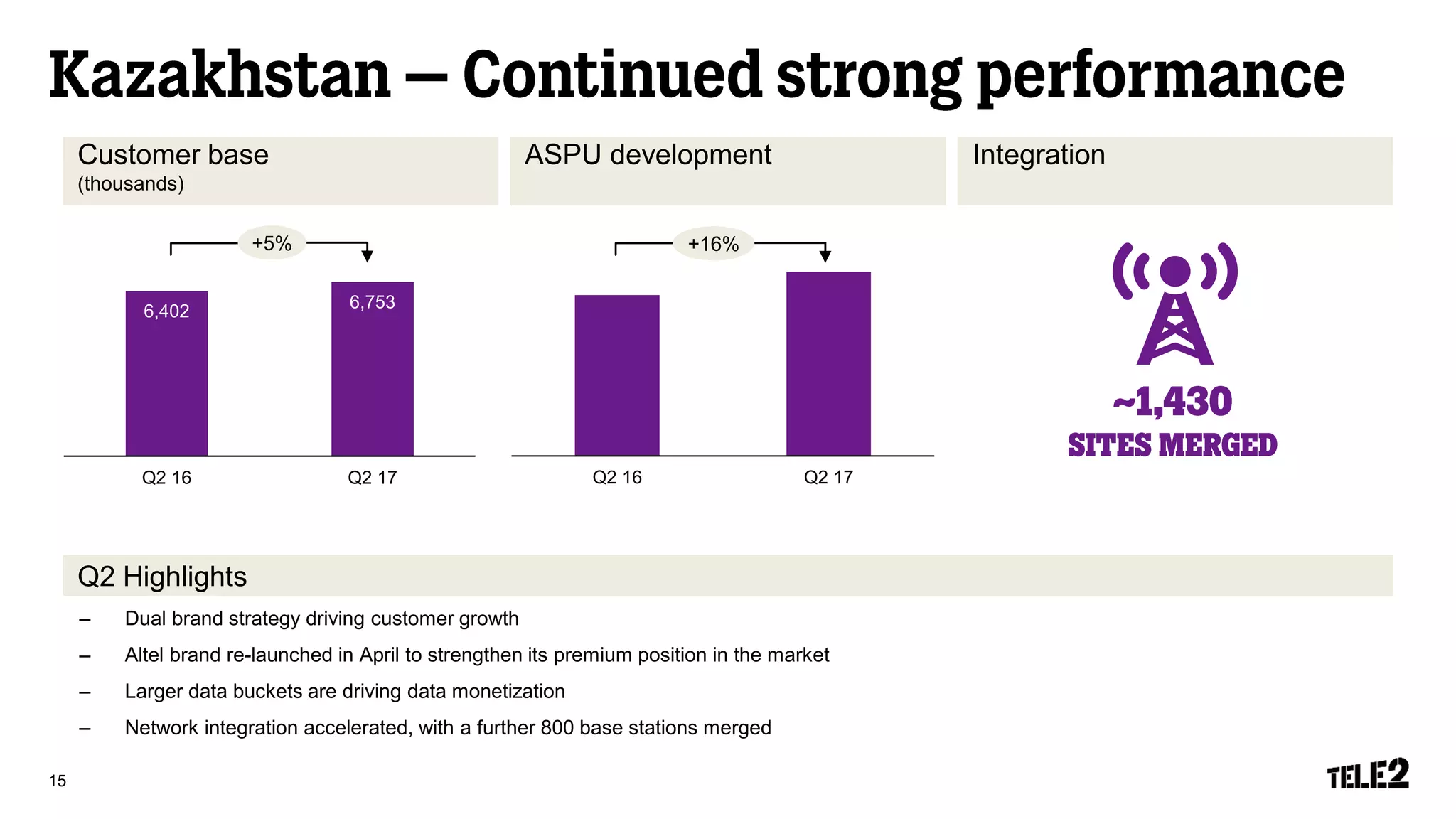

- The Kazakhstan joint venture continued its strong momentum, growing net sales 35% and EBITDA 39% through