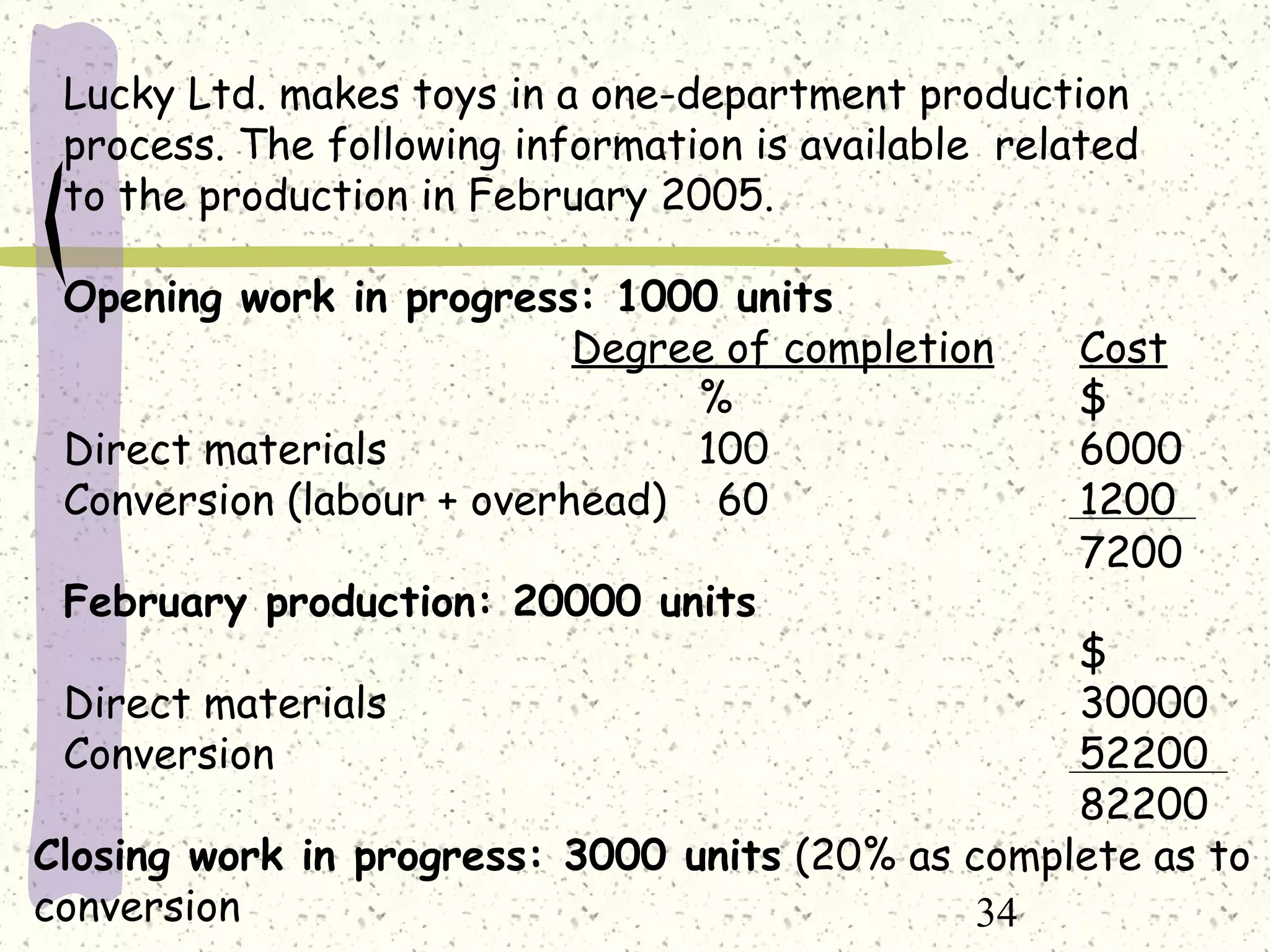

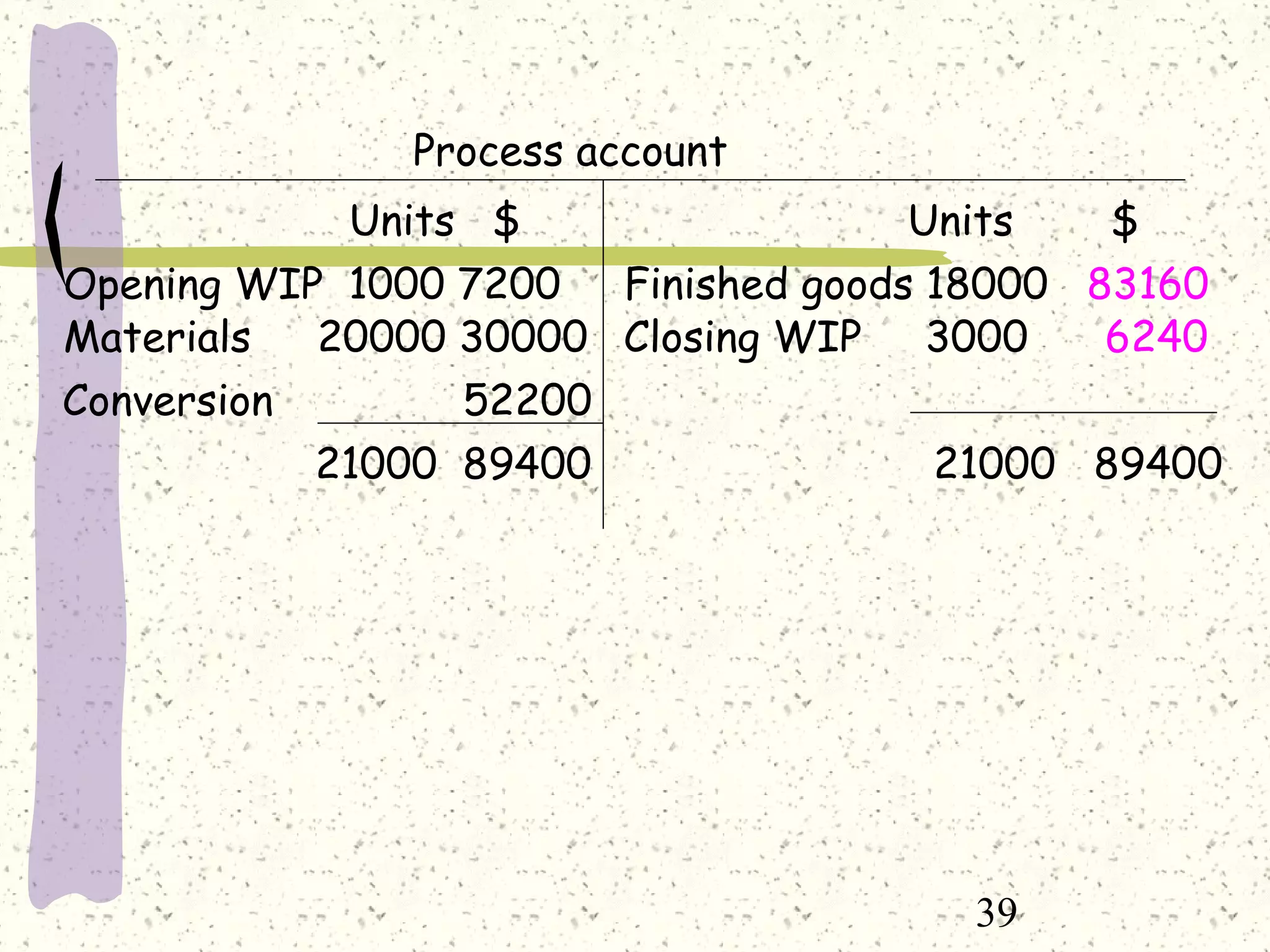

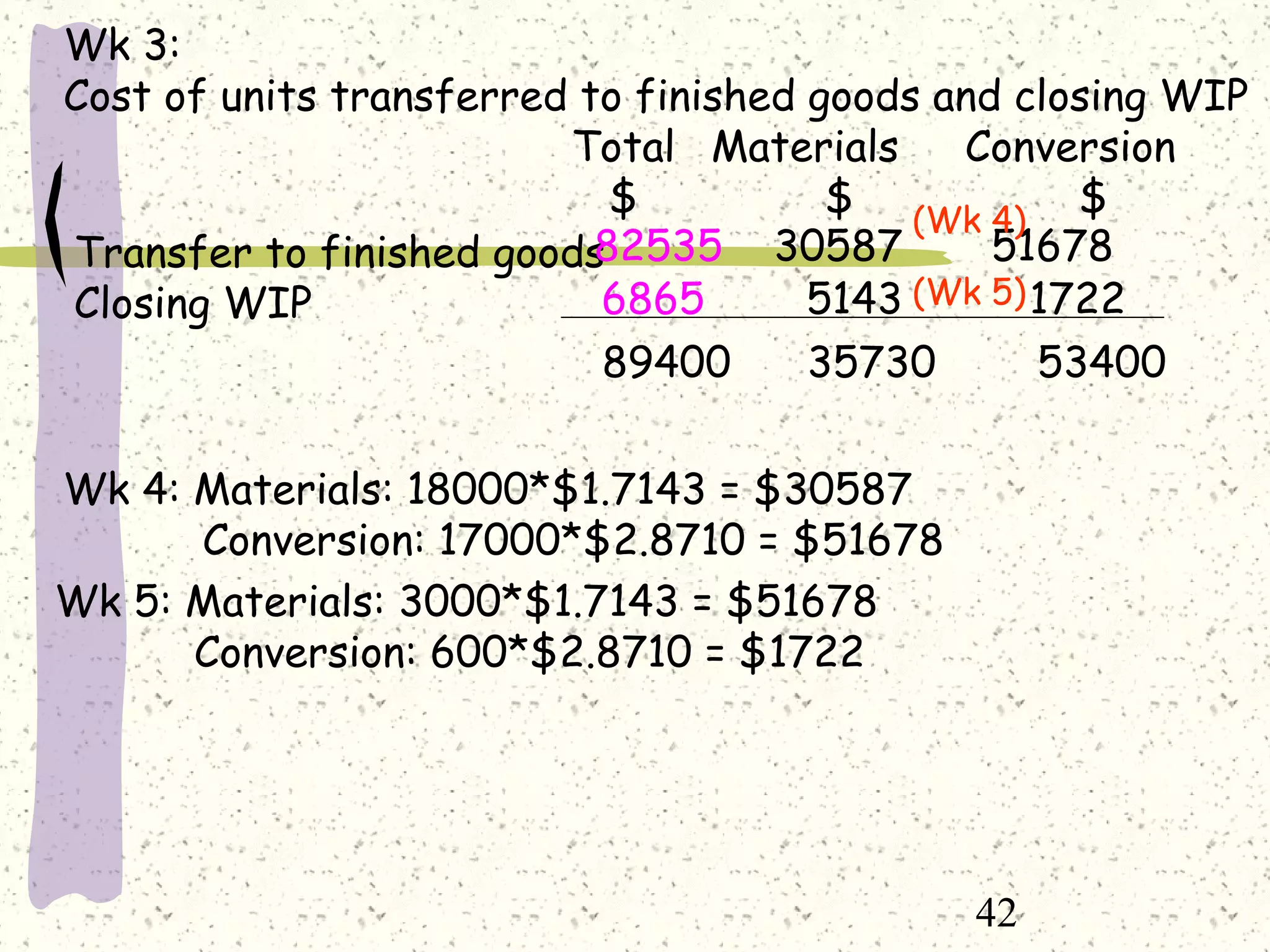

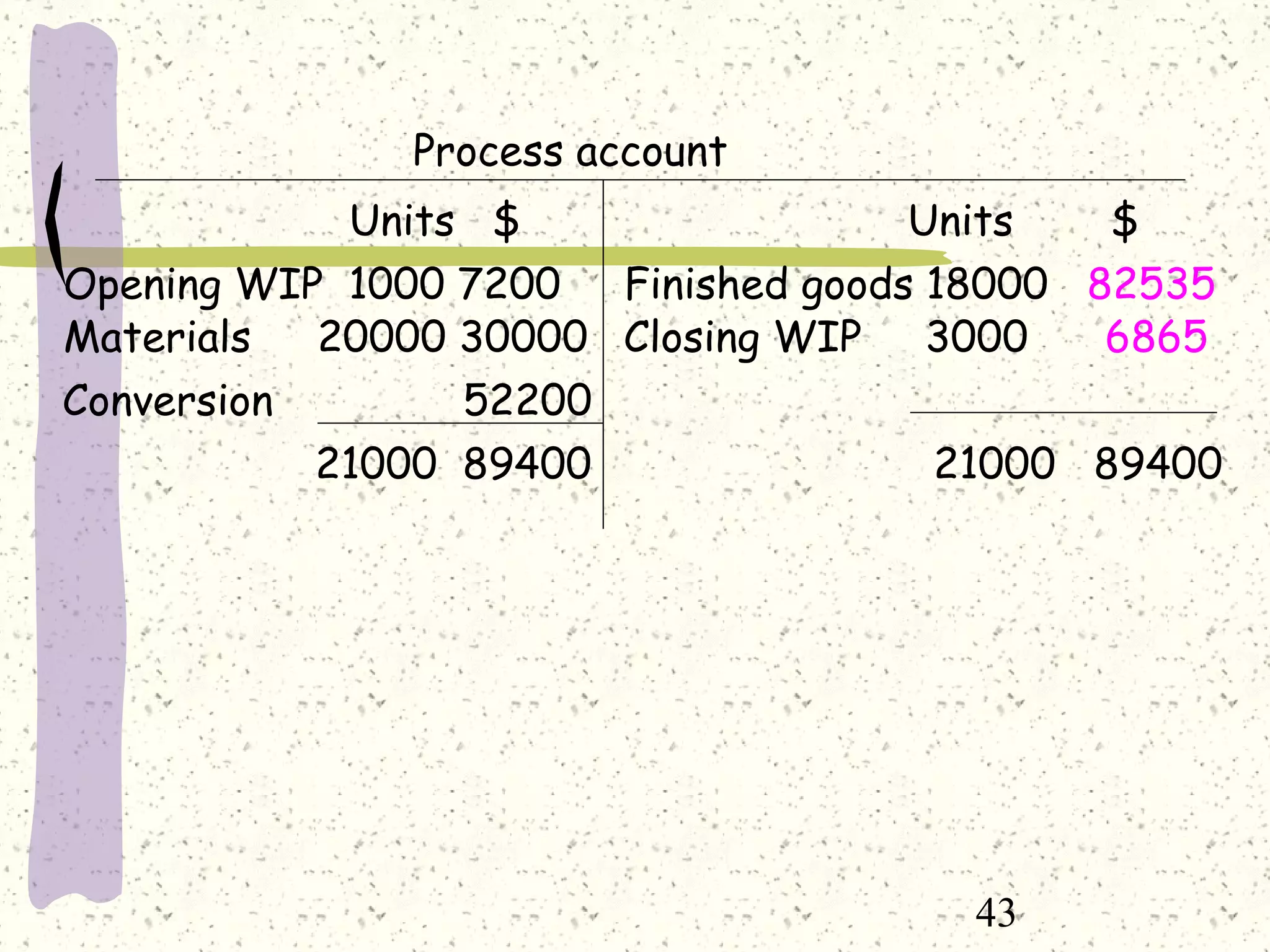

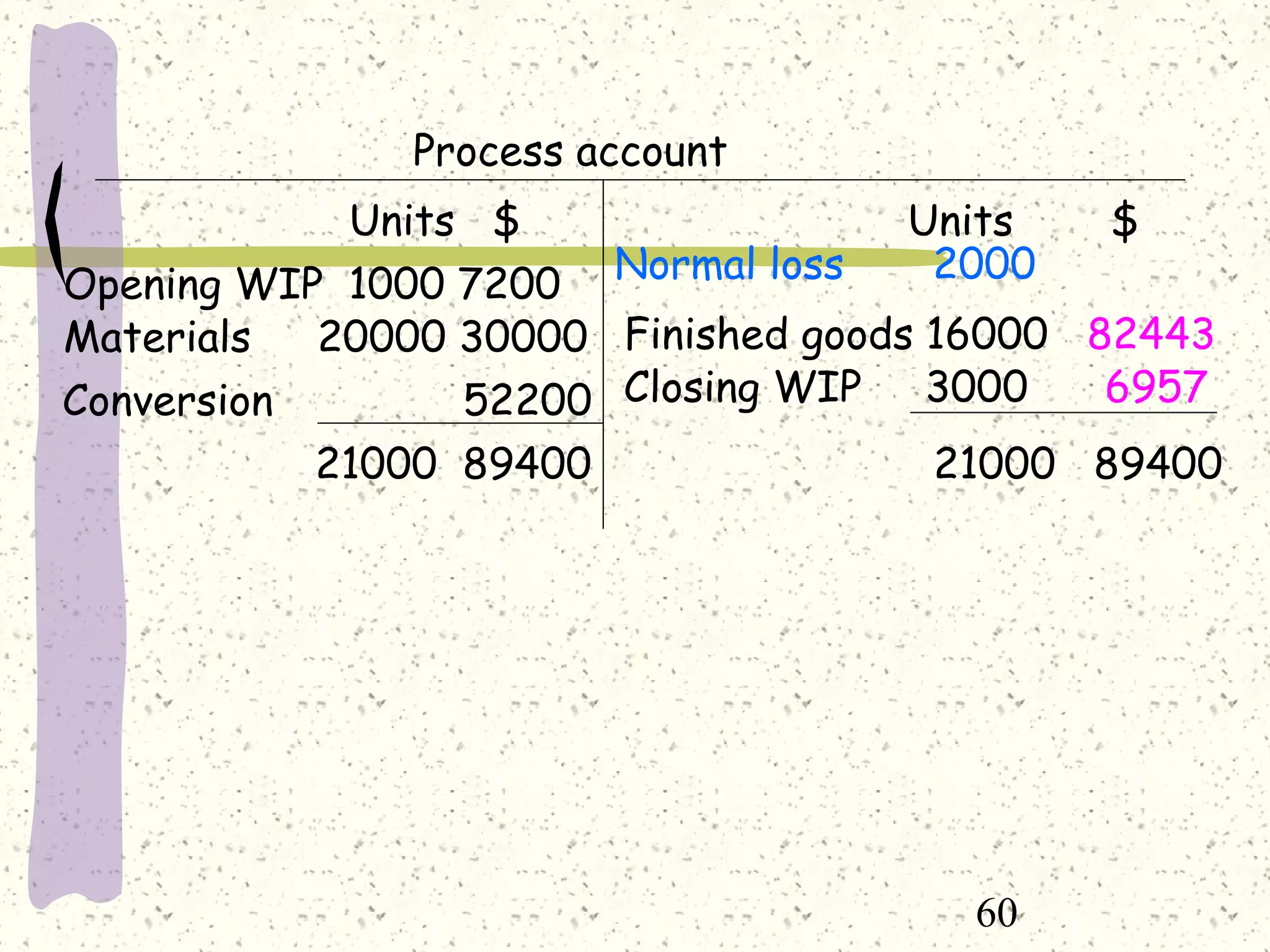

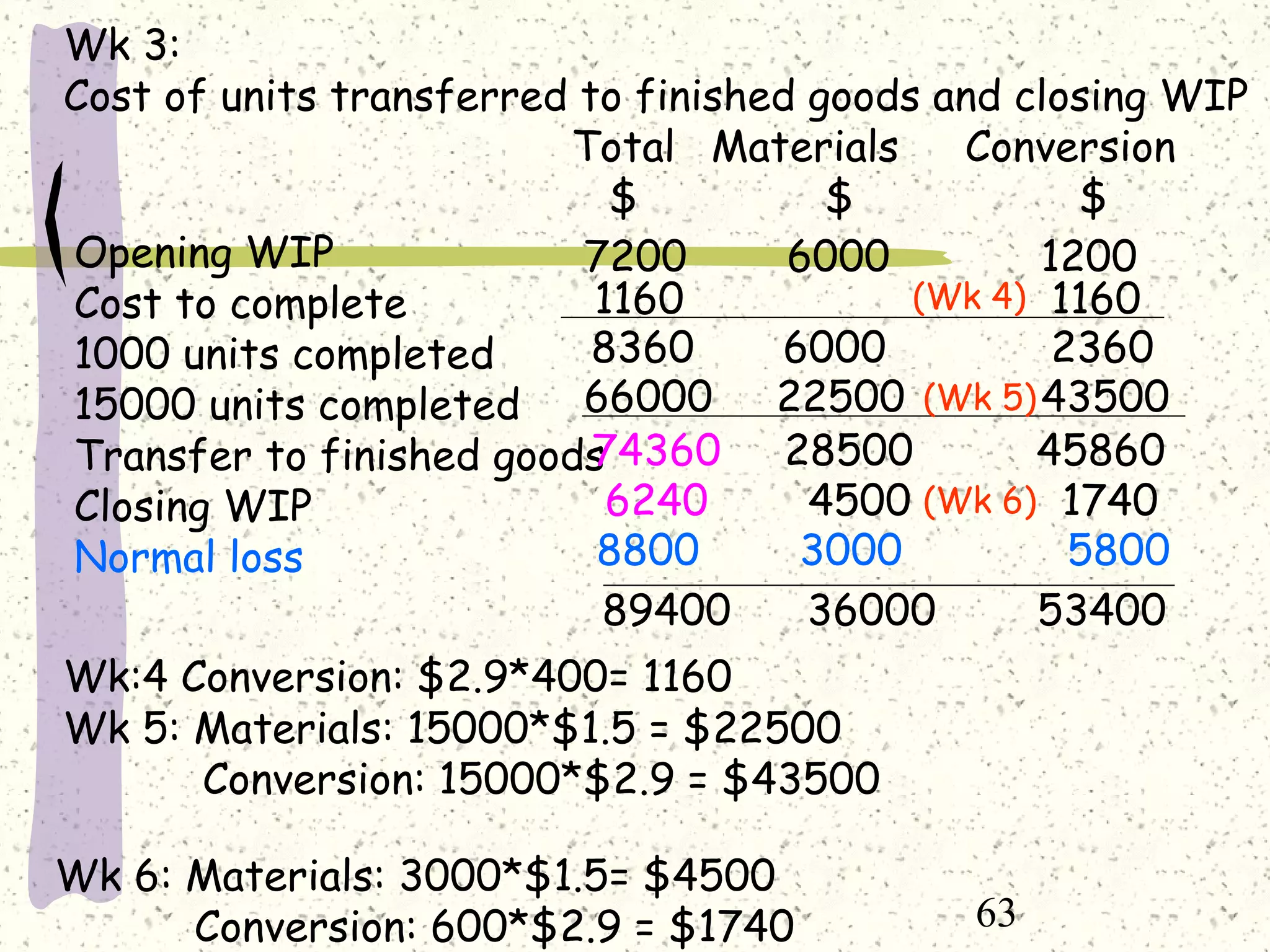

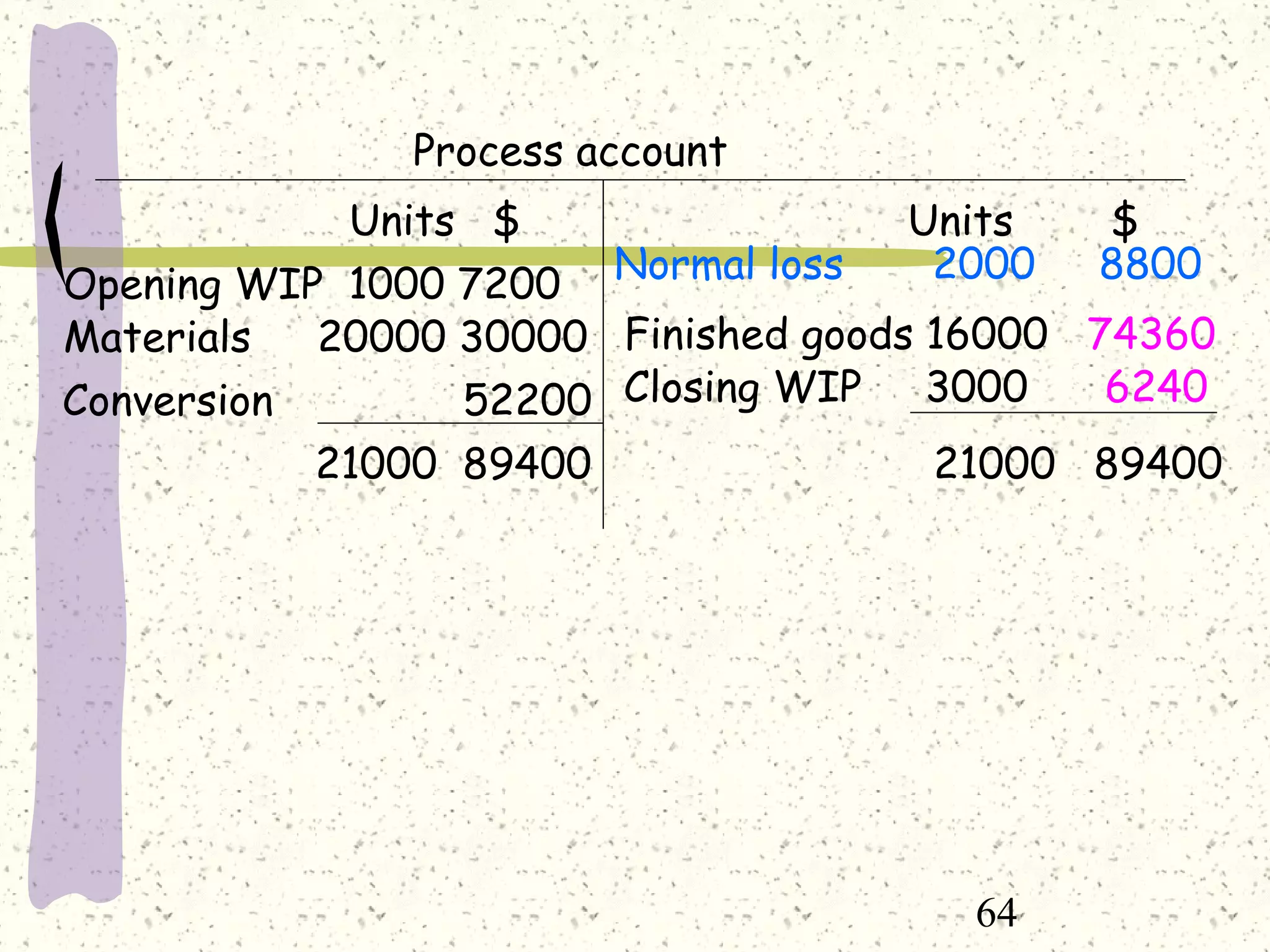

Here are the steps to prepare the Process 1 account using FIFO method considering the losses:

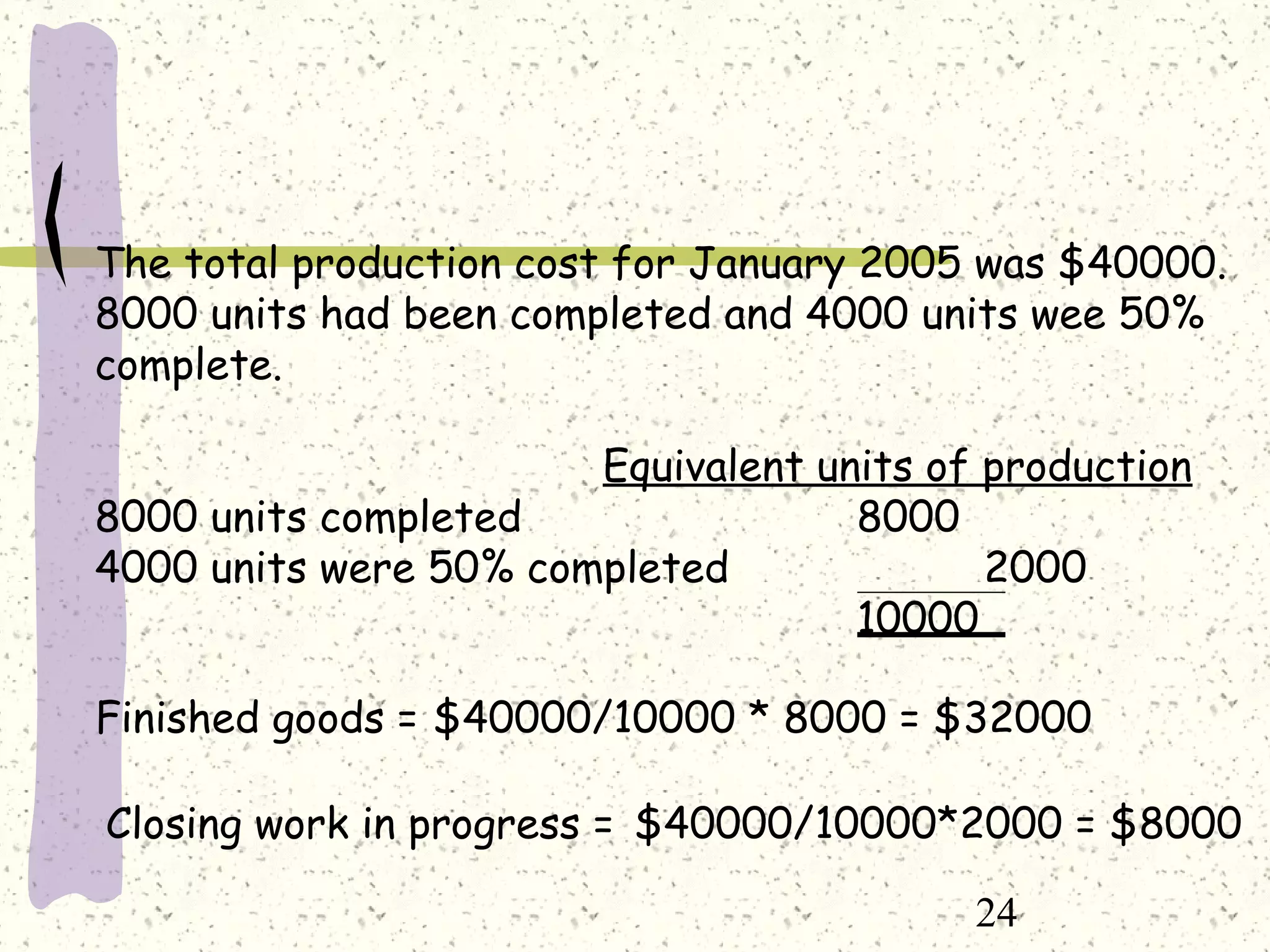

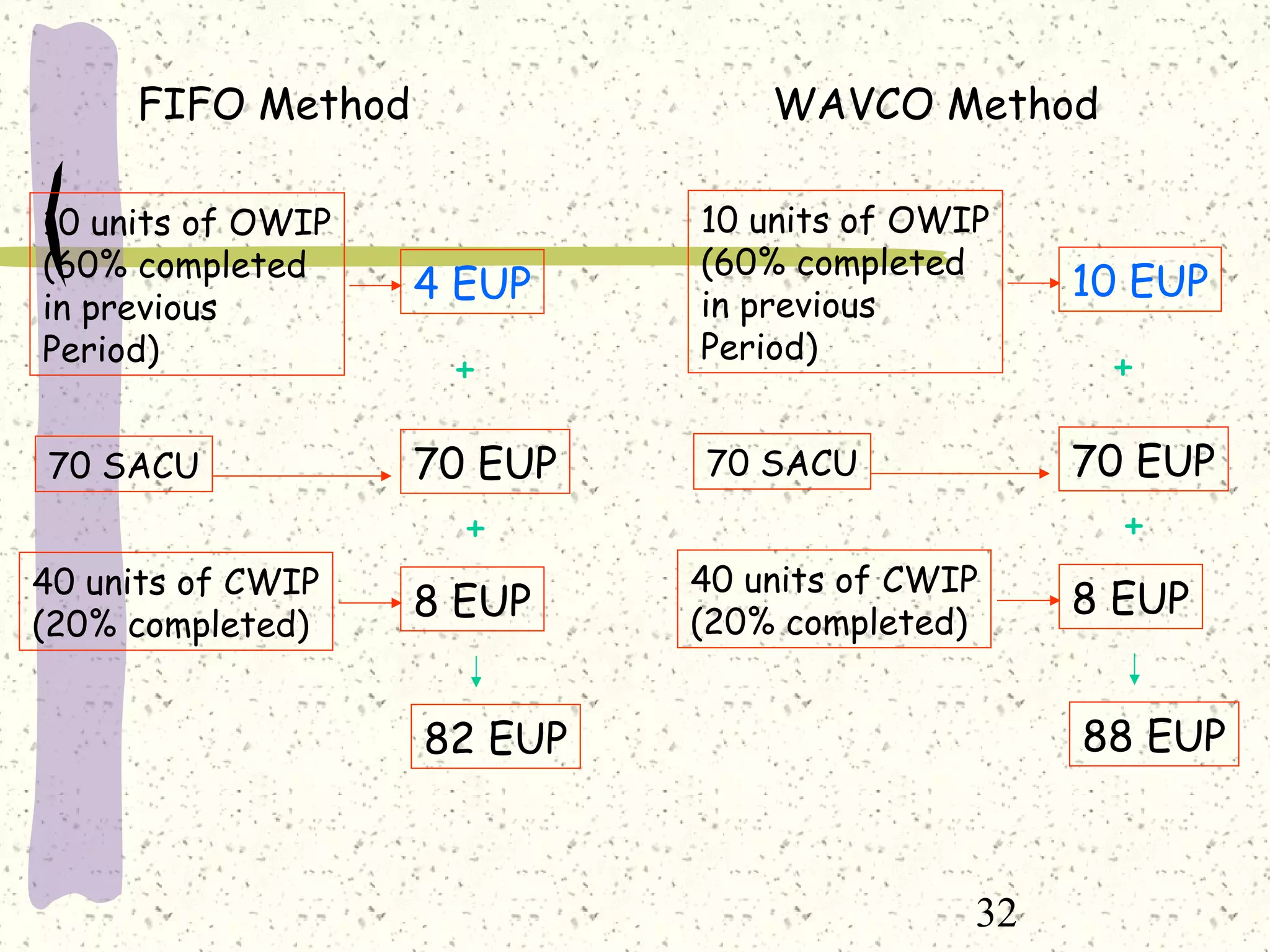

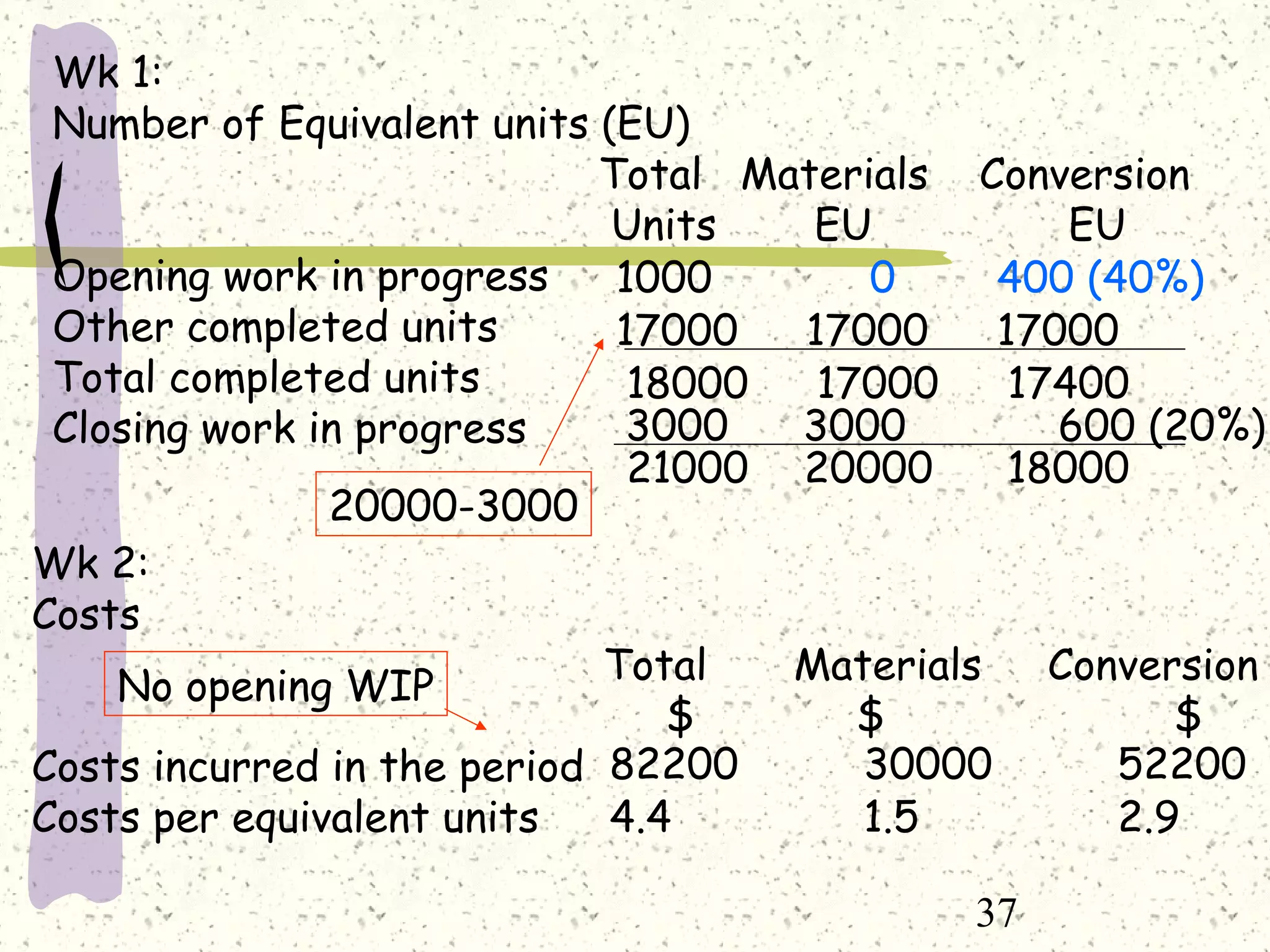

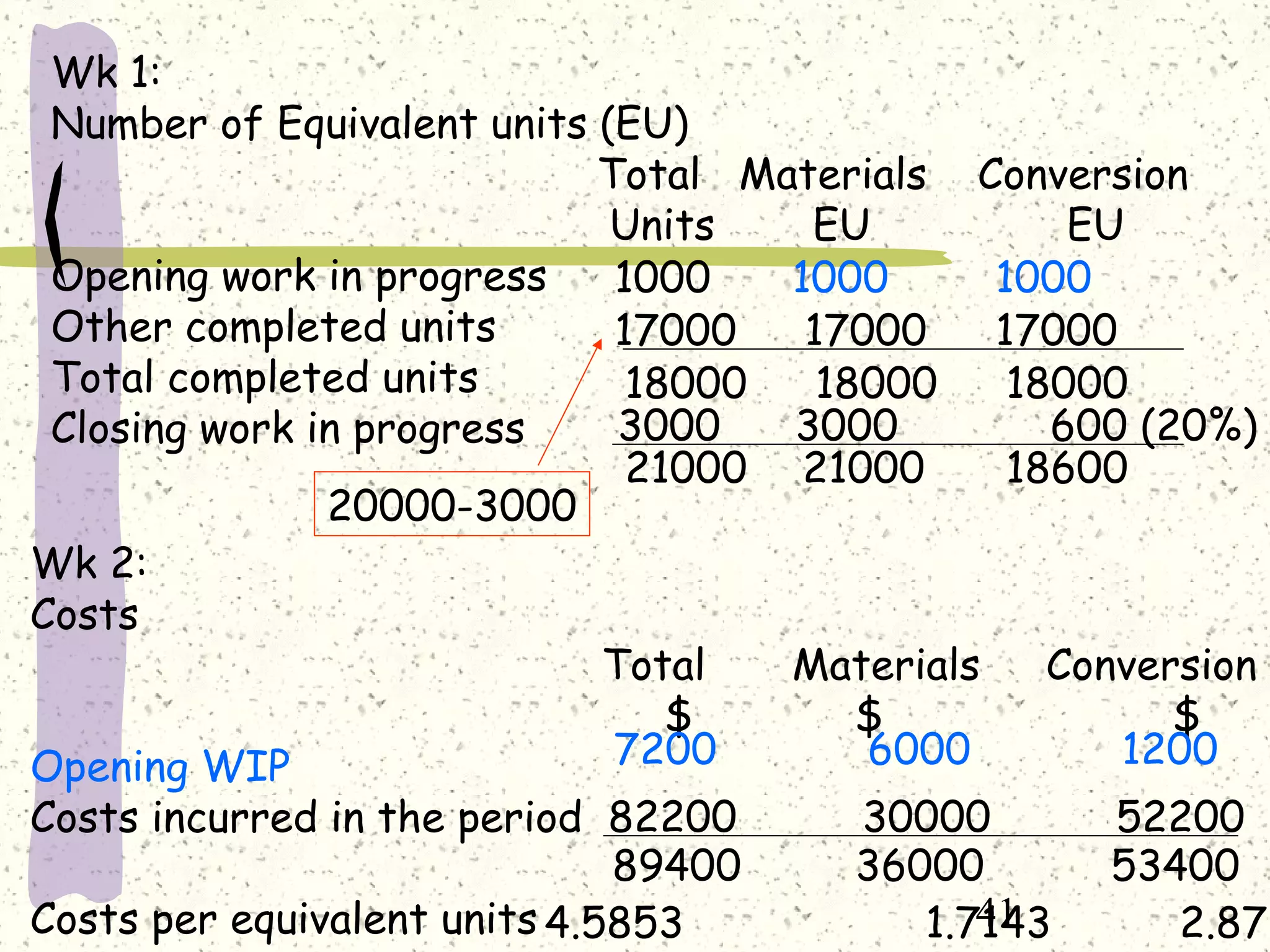

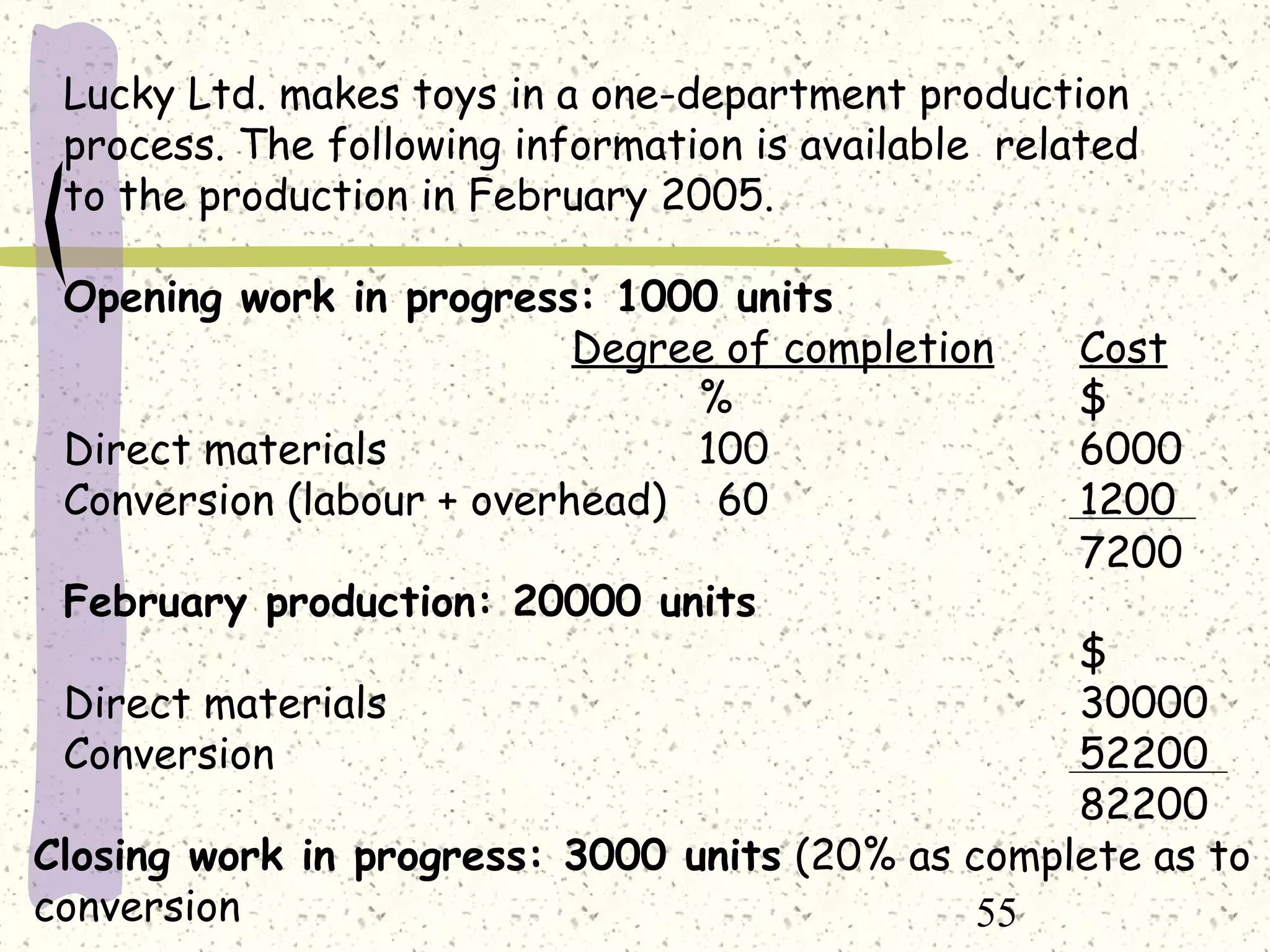

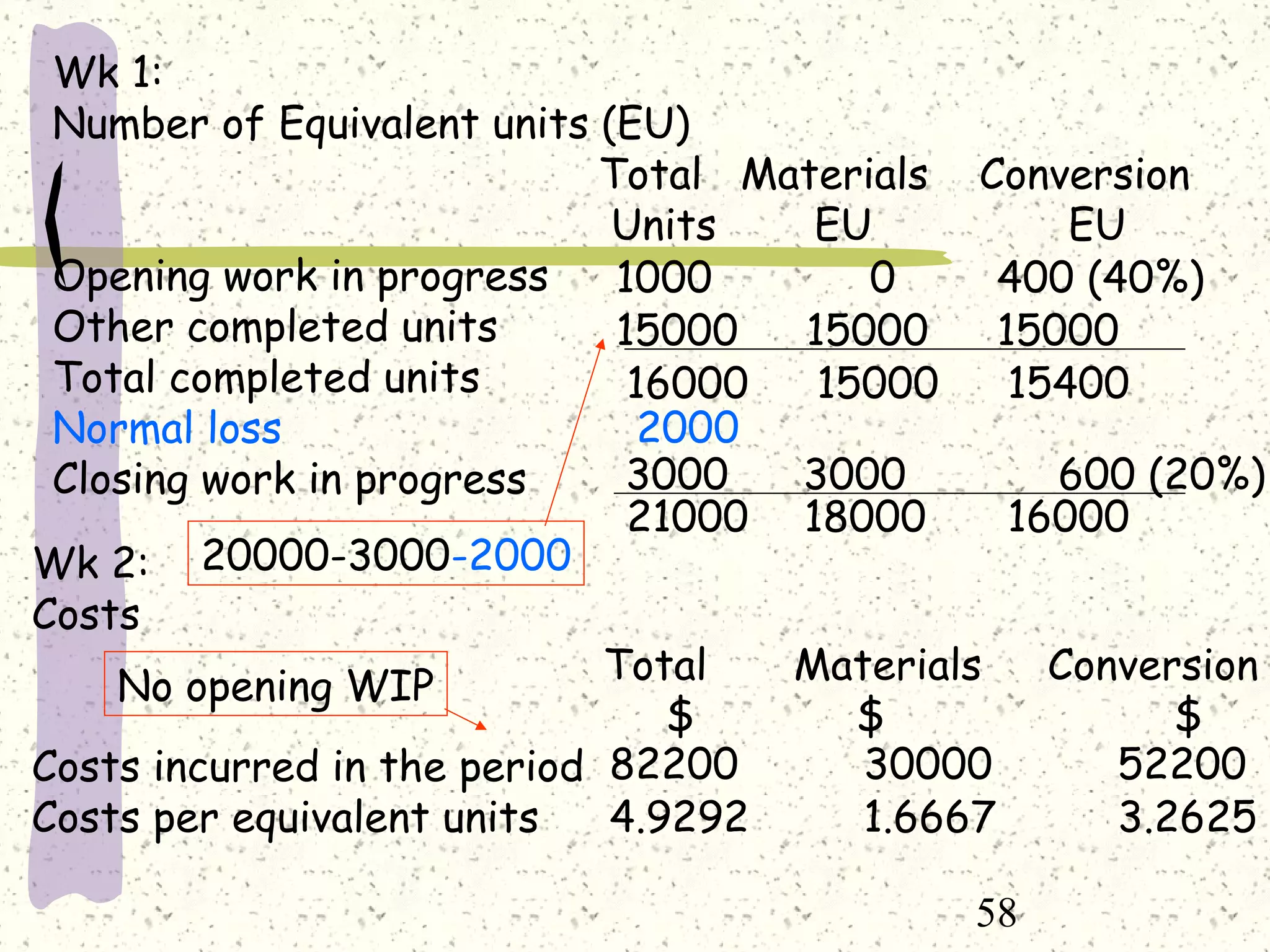

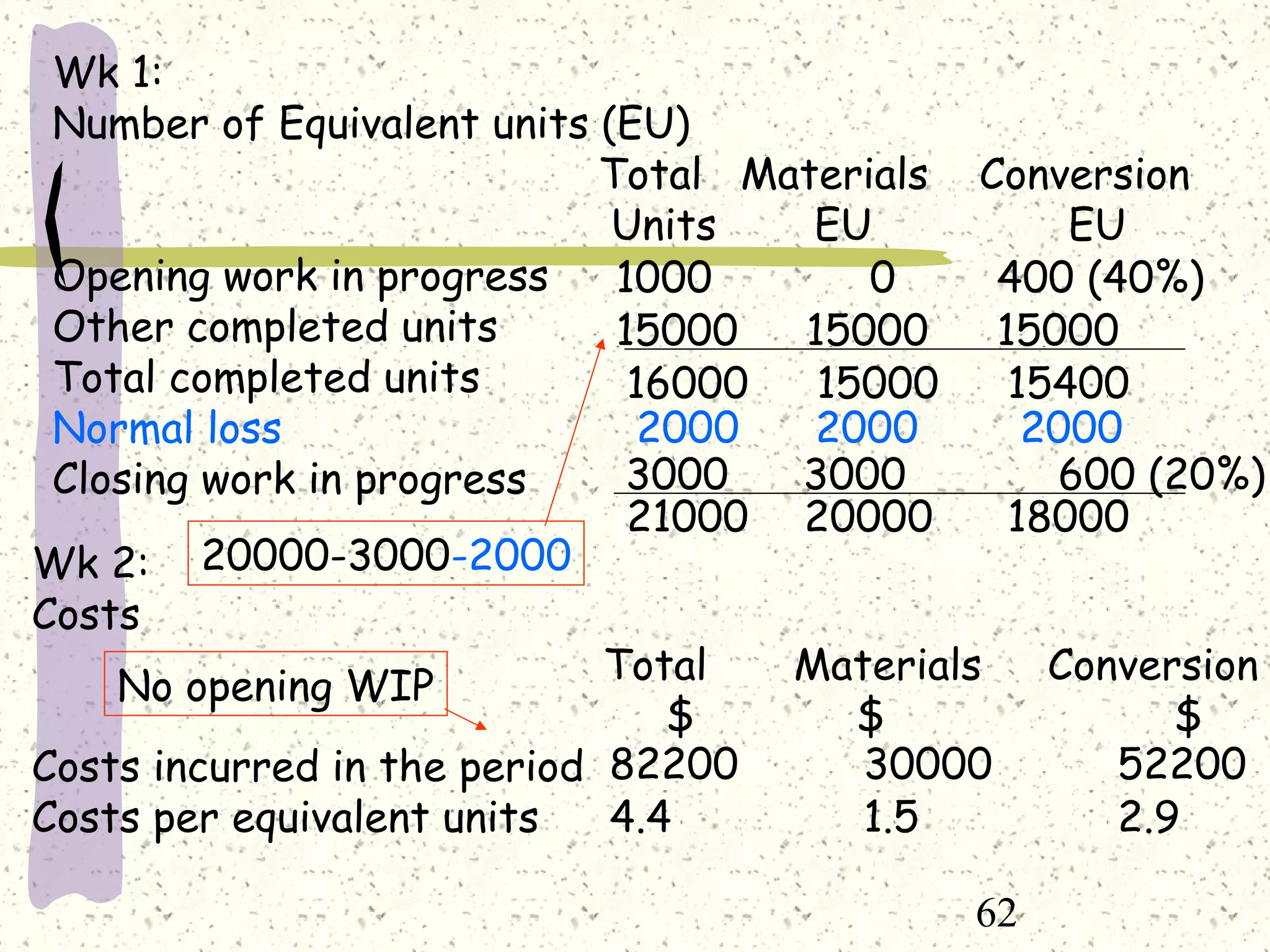

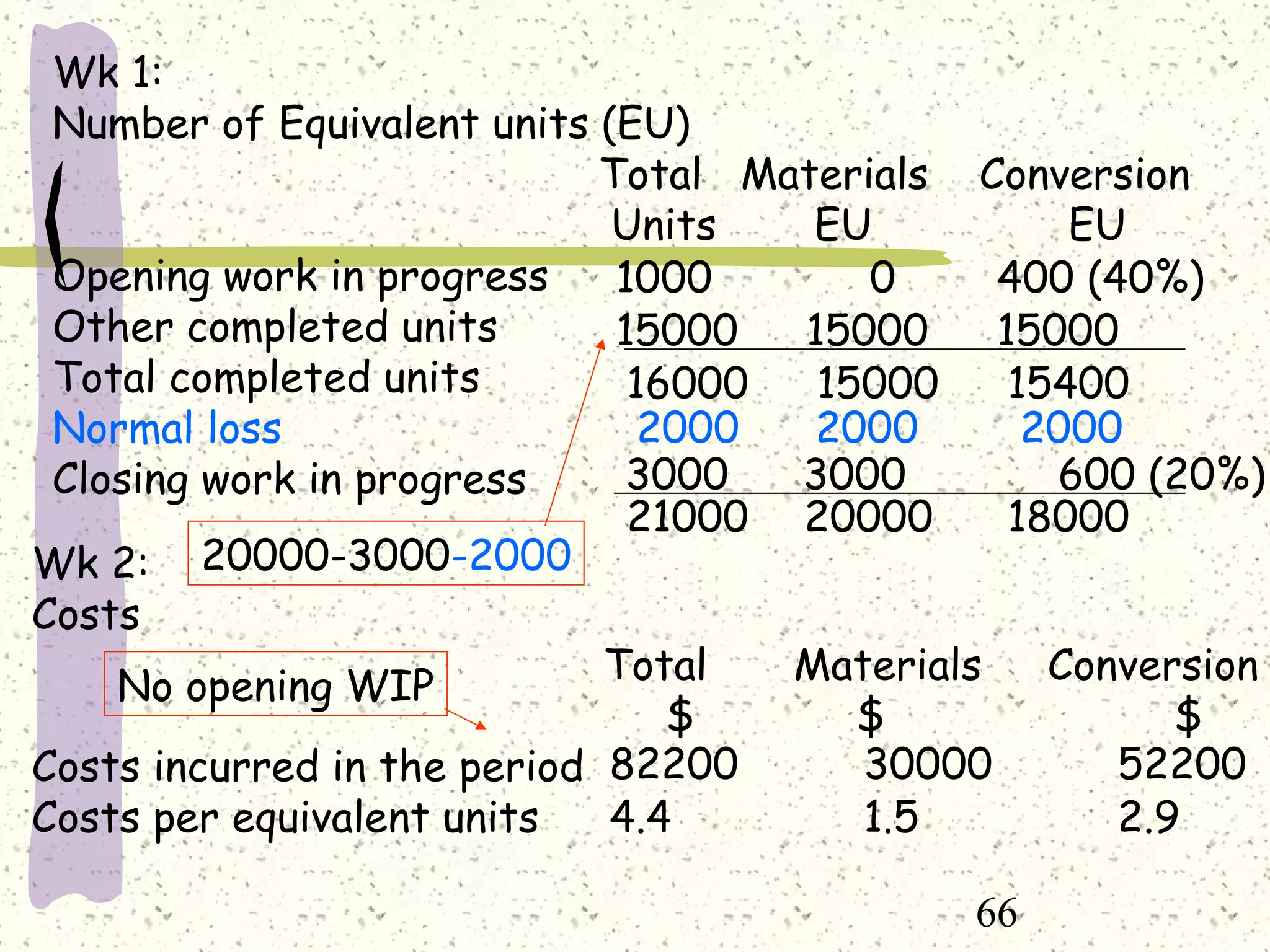

1. Calculate equivalent units (EUP)

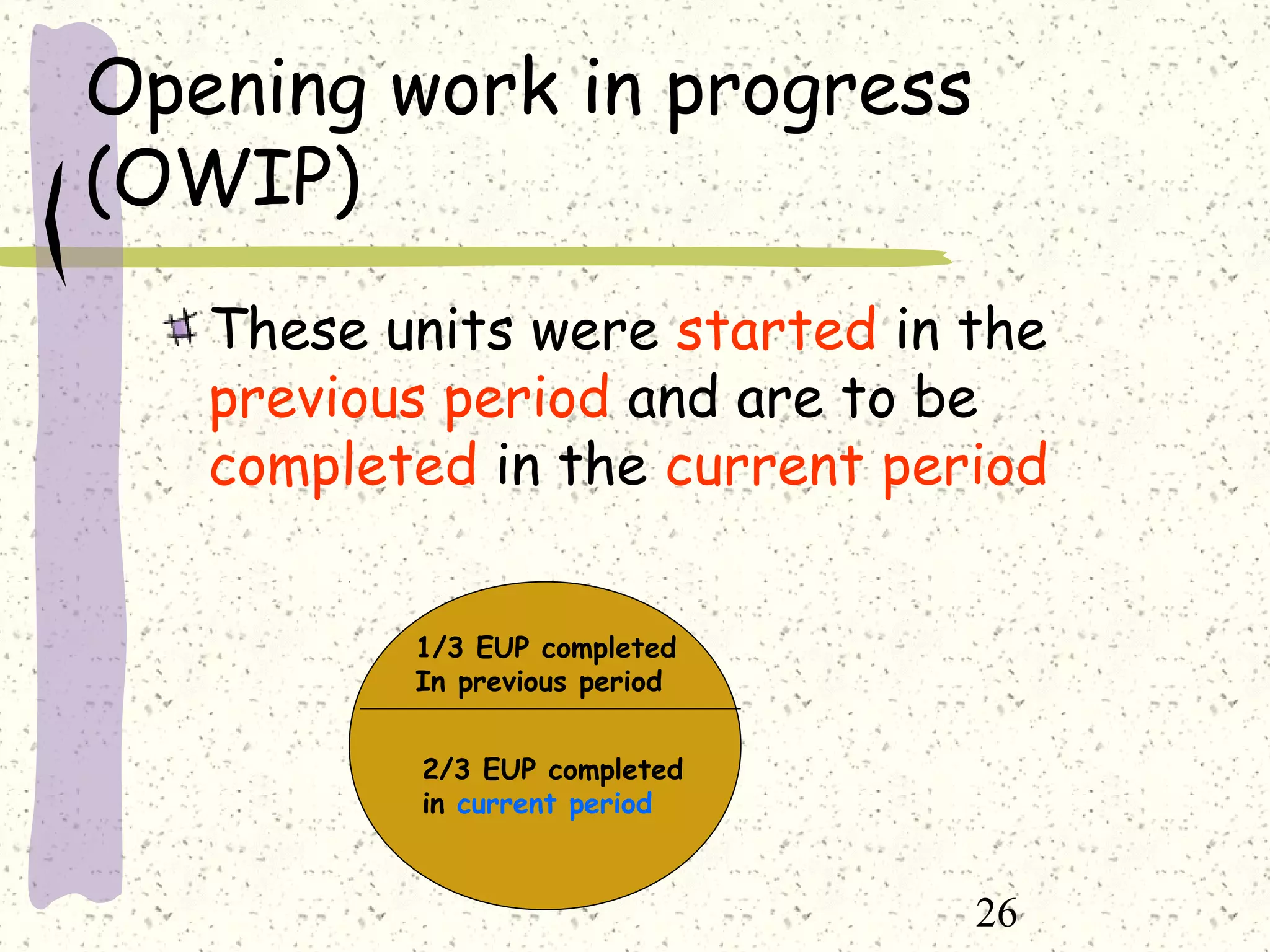

- Opening WIP: 1000 units (60% complete) = 600 EUP

- Production: 20000 units

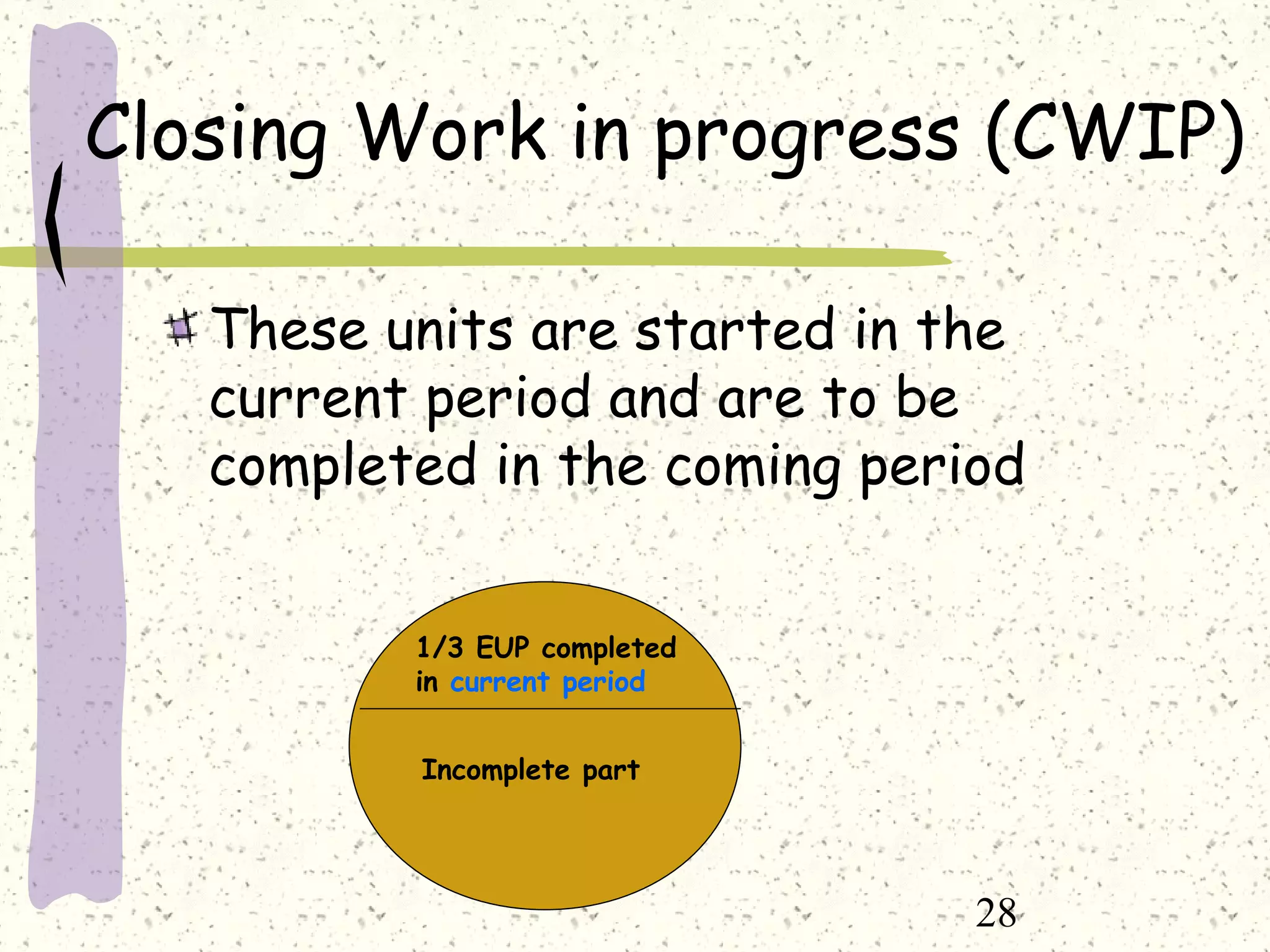

- Closing WIP: 3000 units (20% complete) = 600 EUP

- Total EUP = 21000 units

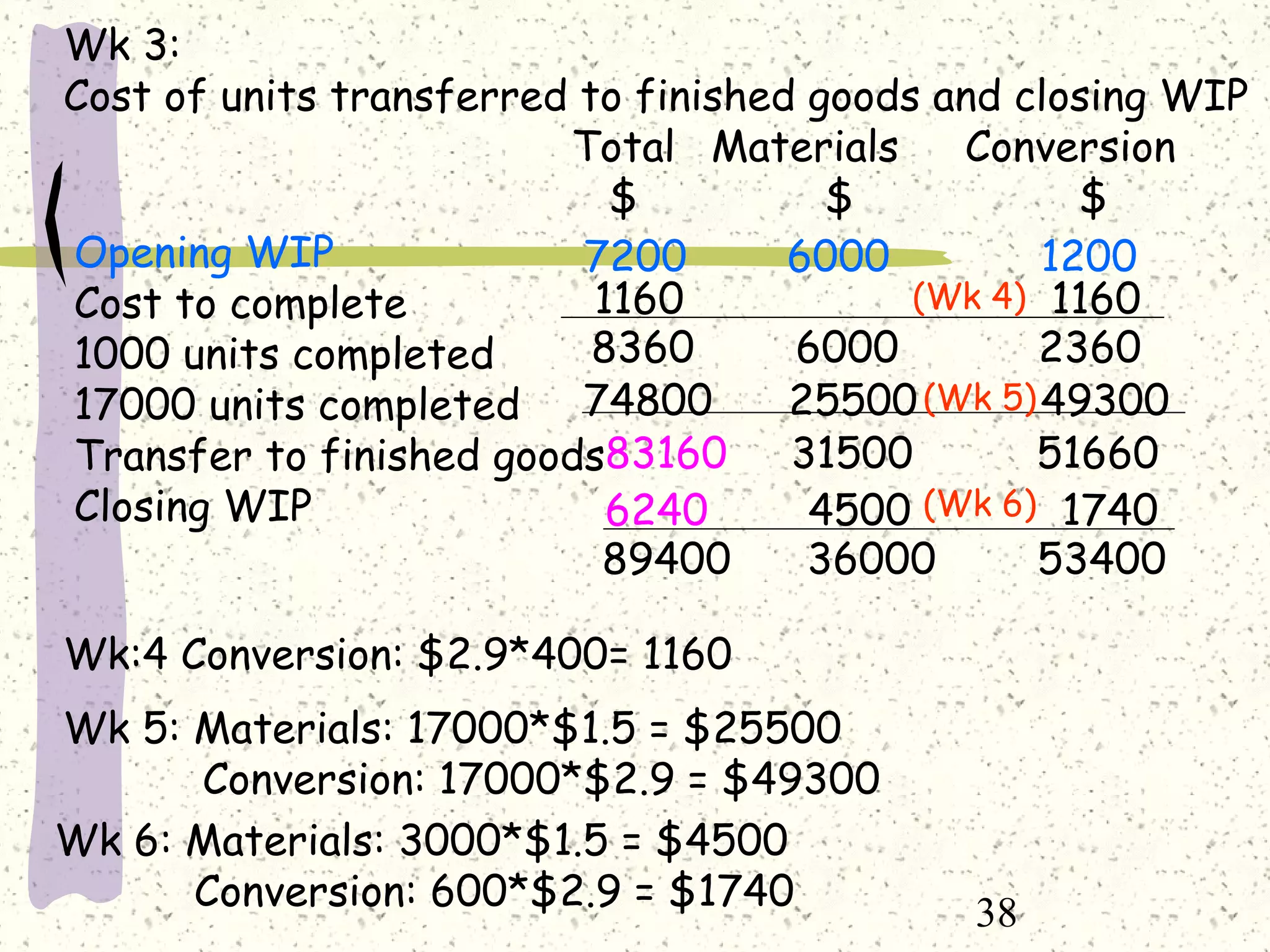

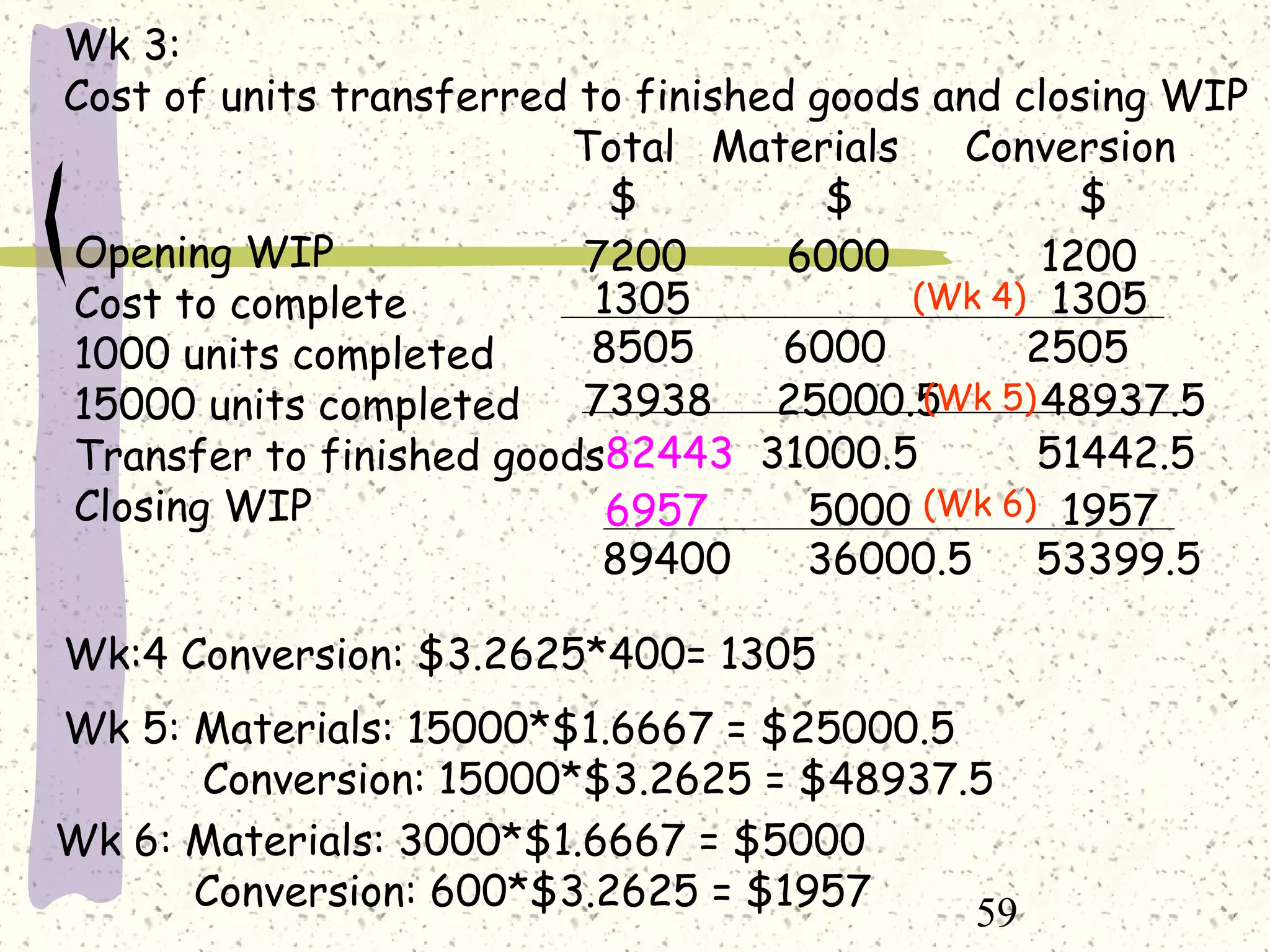

2. Calculate costs:

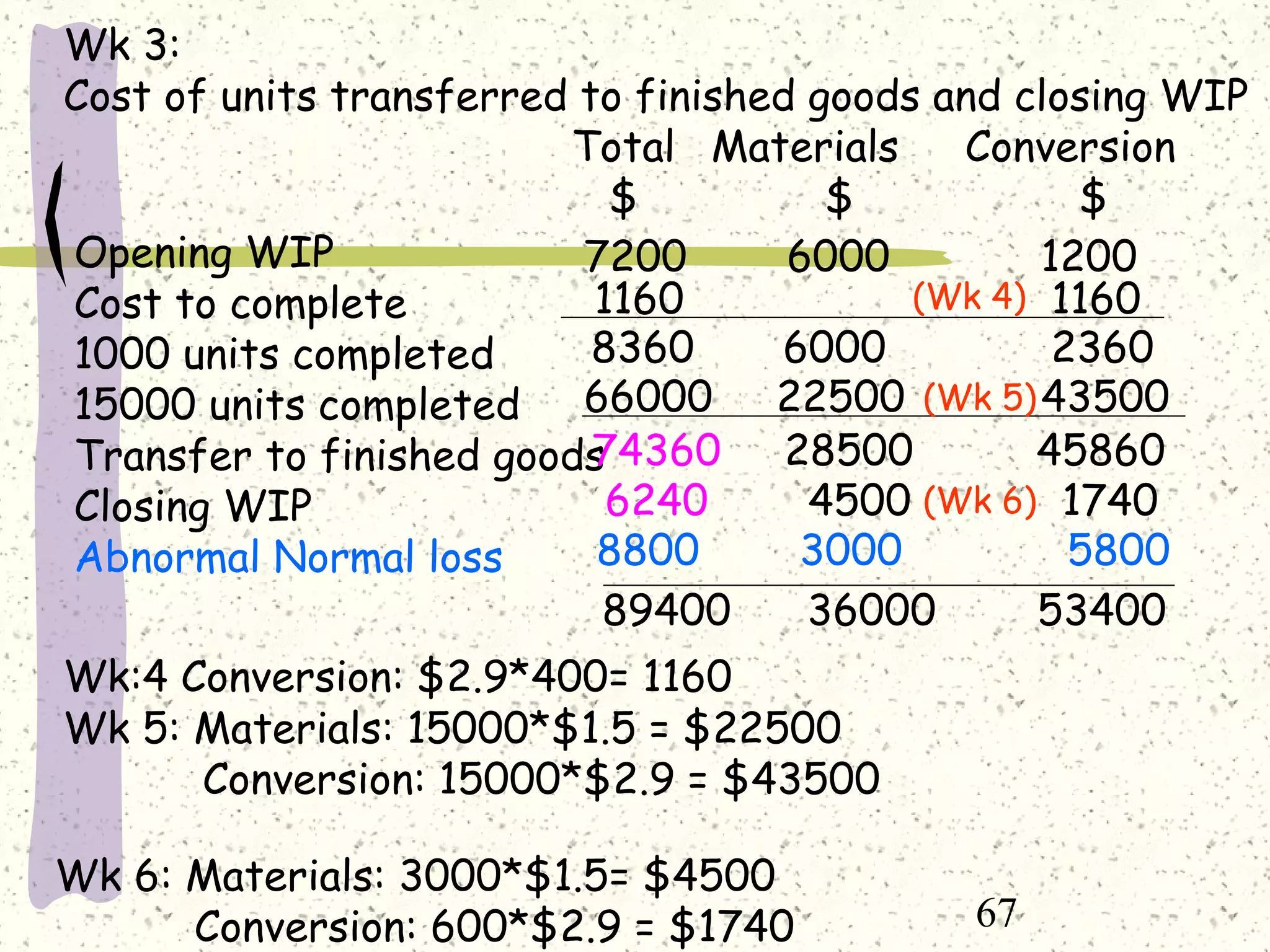

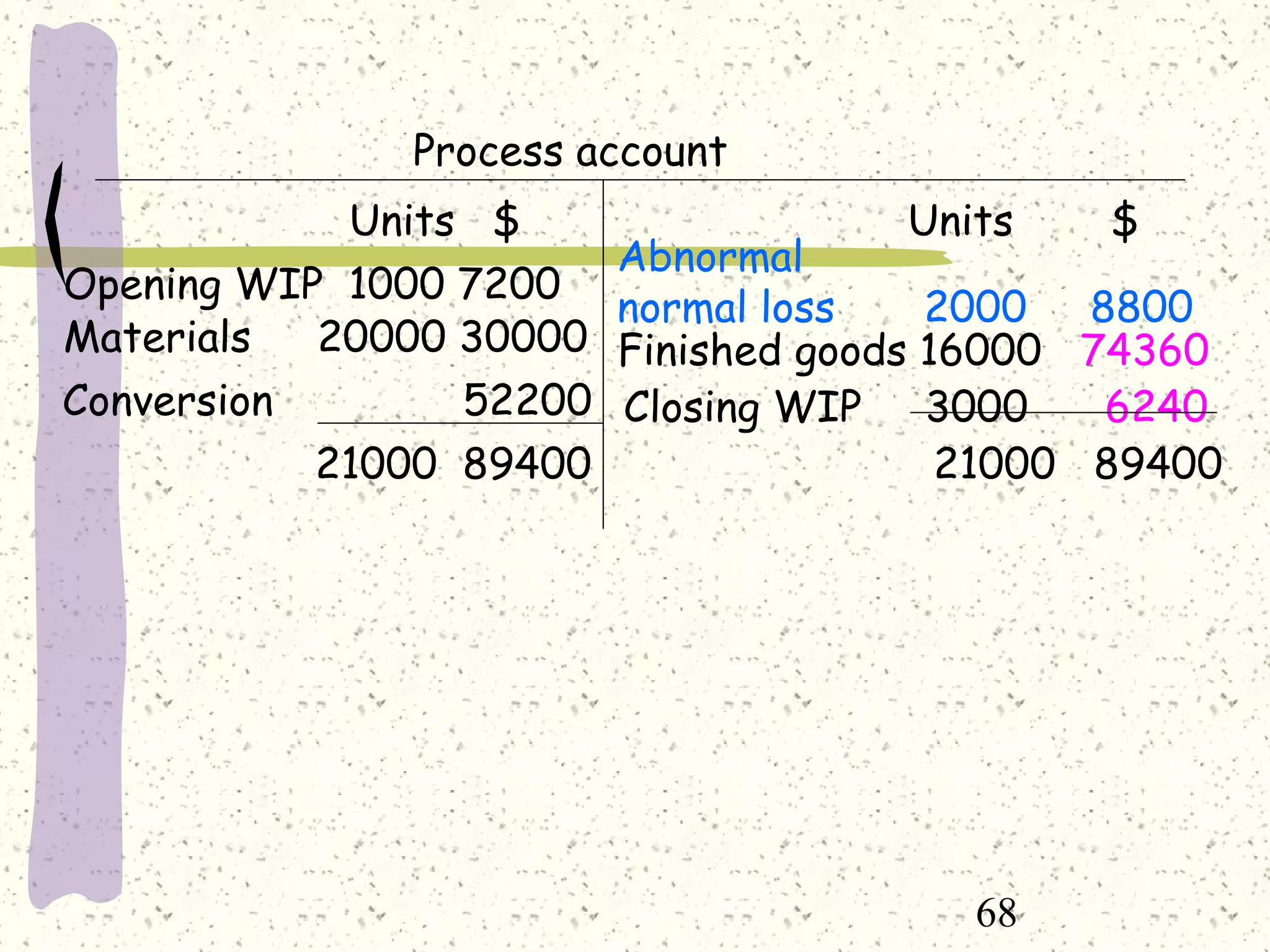

- Opening WIP costs: Materials $6000, Conversion $1200 = $7200

- Current period costs: Materials $30000, Conversion $52200 = $82200

- Total costs = $82200 + $7200 = $89400

3. Calculate cost per EUP: