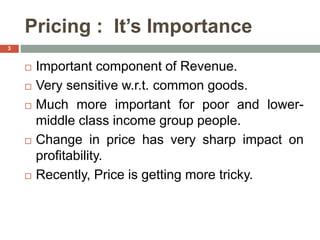

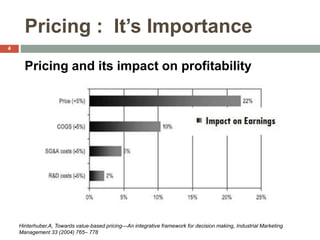

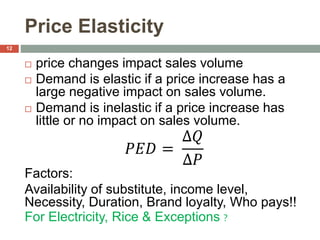

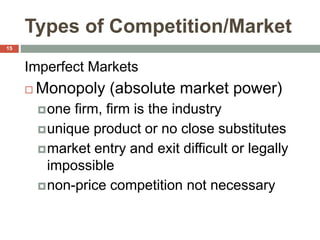

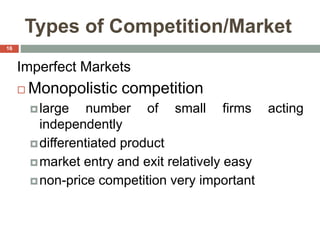

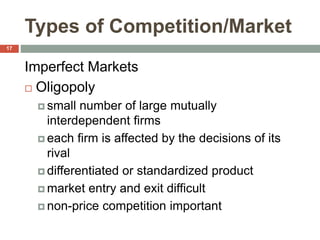

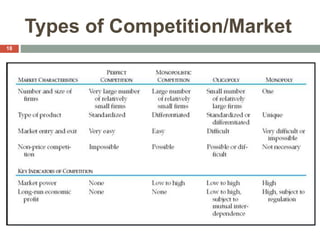

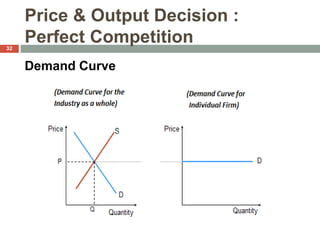

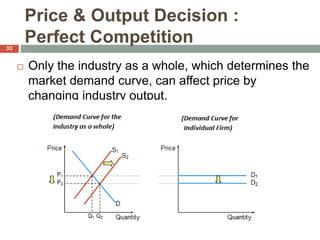

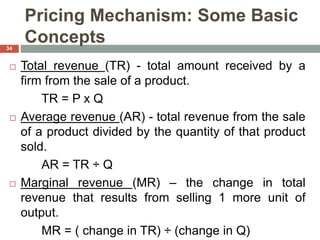

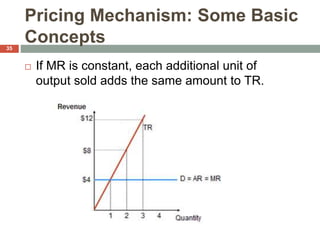

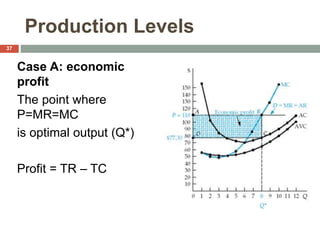

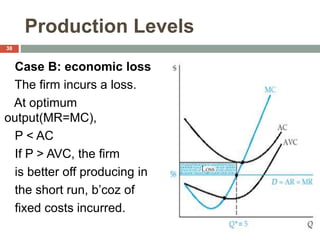

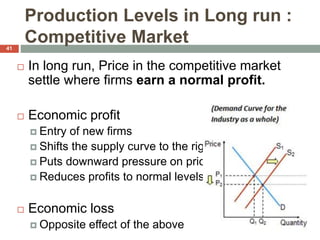

The document discusses pricing decisions in managerial economics, emphasizing its significance for revenue, particularly for lower-income groups. It explores various pricing approaches, market structures, and factors affecting prices, such as demand, competition, and cost structures. It also details the dynamics of pricing in competitive markets, including perfect competition and its implications for firms' profitability.