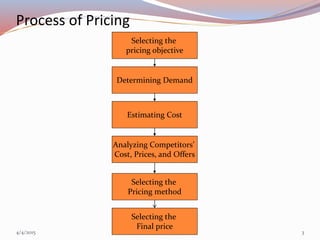

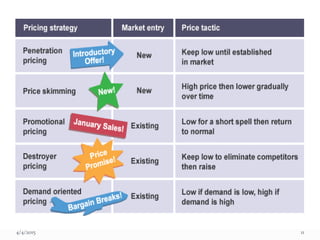

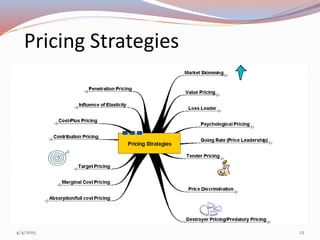

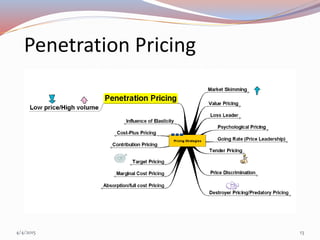

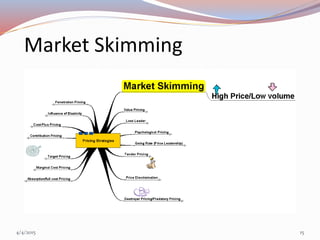

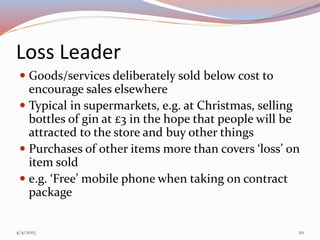

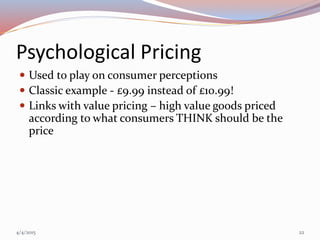

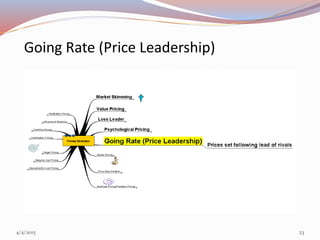

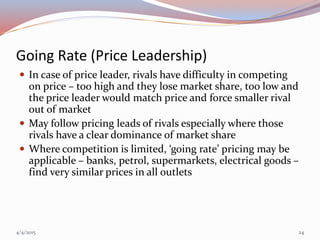

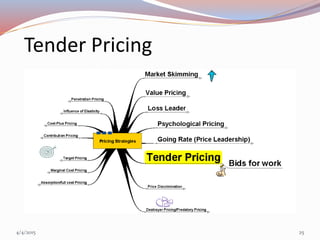

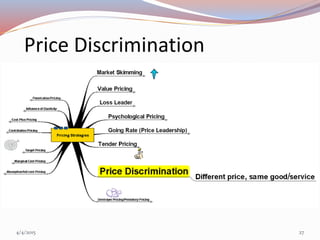

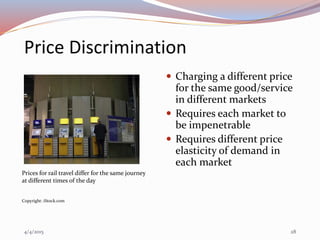

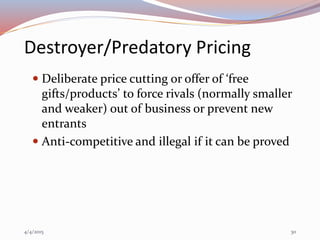

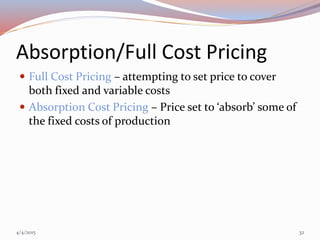

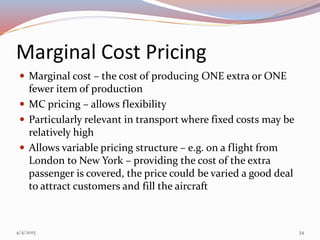

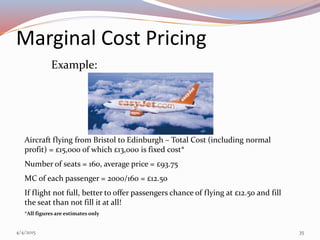

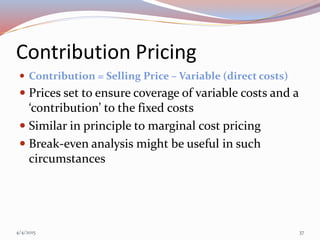

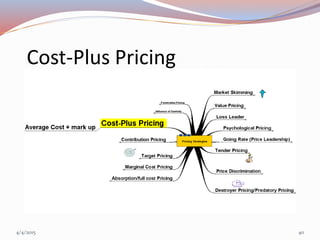

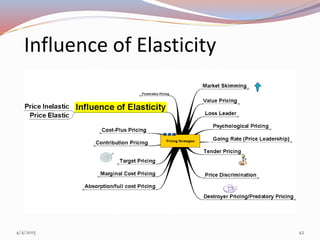

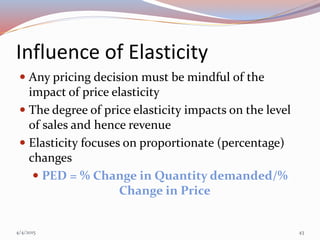

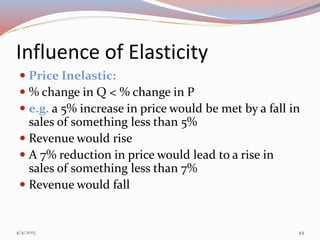

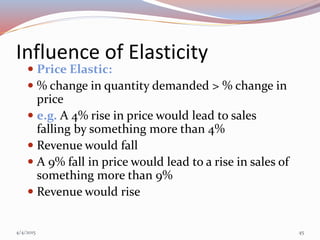

The document discusses various factors involved in pricing decisions and strategies. It describes how pricing objectives, demand analysis, cost analysis, competitor analysis, and various pricing methods all feed into the process of determining the final price. Different pricing strategies are outlined, including penetration pricing, market skimming, value pricing, loss leaders, and psychological pricing. The document also discusses the influence of elasticity on pricing and revenue.