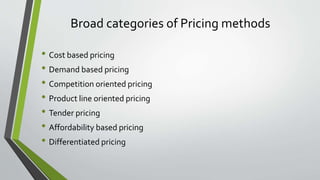

The document provides an extensive overview of pricing management, including pricing processes, objectives, methods, and the factors influencing pricing strategies. It outlines various strategies such as market penetration and market skimming, along with ways to capture value through pricing that reflects customer perceptions and demand elasticity. Additionally, the document discusses the importance of analyzing competitor pricing and the impact of digital transformation on pricing strategies.

![Selecting A Pricing Method

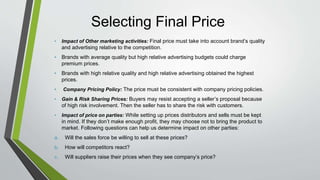

• Costs set the floor for pricing.

• Competitors’ pricing and price of substitutes provide an orienting point.

• Customers’ assessment of unique features set the ceiling for pricing.

Based on these three assumptions pricing method is chosen.

• Mark-up Pricing: Standard mark-up is added to product’s cost. Mark-ups are usually higher

on seasonal items, slower moving items, items with high storage and handling costs and

demand inelastic items such as prescription drugs.

• Mark-up ignores current demand, perceived value and competition.

• Mark-up Price = Unit Cost/(1-Desired return on sales)

• Target Return Pricing: Firm determines the price that yields its target return on investment.

• Achieving break even volume is very important.

• TRP ignores price elasticity and competitor’s strategy.

• Ways to lower fixed and variable cost must be implemented.

• Target Return Price = Unit Cost+[(Desired return X Invested Capital)÷Unit

Sales]](https://image.slidesharecdn.com/pricing1-190917200744/85/Pricing-17-320.jpg)

![COST BASED PRICING

• Mark up pricing:: Standard mark-up is added to product’s cost. Mark-ups are usually

higher on seasonal items, slower moving items, items with high storage and handling

costs and demand inelastic items such as prescription drugs.

• Mark-up ignores current demand, perceived value and competition.

• Target rate return pricing: Firm determines the price that yields its target return on

investment.

• Achieving break even volume is very important.

• TRP ignores price elasticity and competitor’s strategy.

• Ways to lower fixed and variable cost must be implemented.

• Target Return Price = Unit Cost+[(Desired return X Invested Capital)÷Unit Sales]

• Marginal cost pricing

• Absorption Cost pricing](https://image.slidesharecdn.com/pricing1-190917200744/85/Pricing-20-320.jpg)