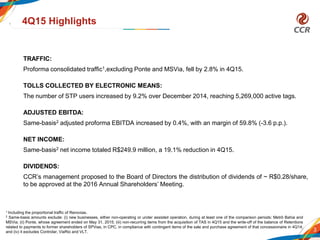

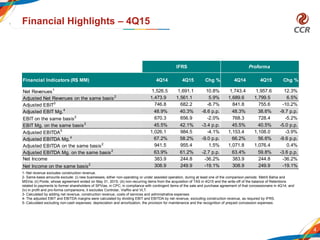

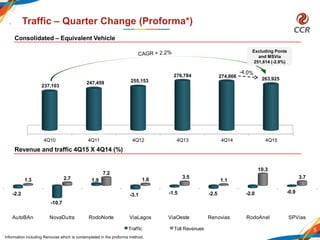

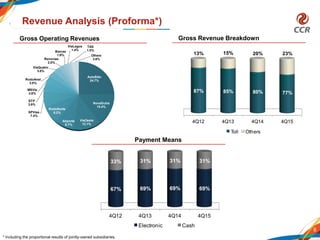

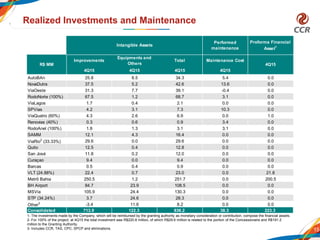

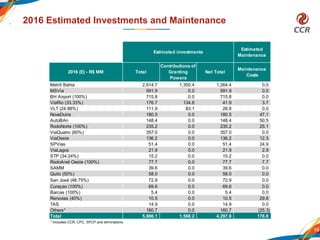

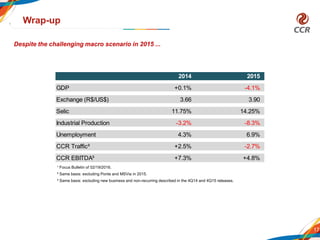

- Traffic fell 2.8% in 4Q15 excluding new businesses. Toll collection via electronic means increased to 69% of total.

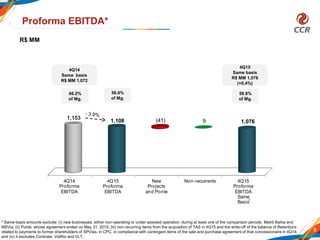

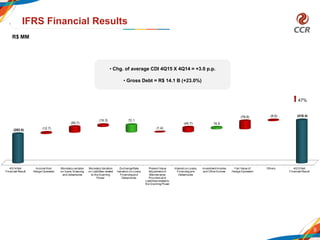

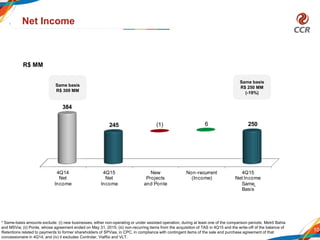

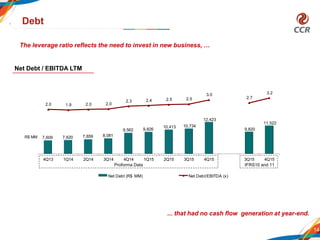

- Adjusted EBITDA on a same-basis increased slightly by 0.4% with margins of 59.8%. Net income on the same basis fell 19.1%.

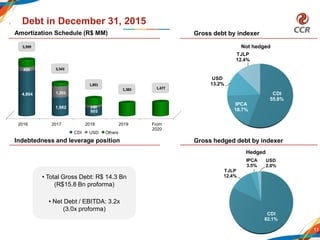

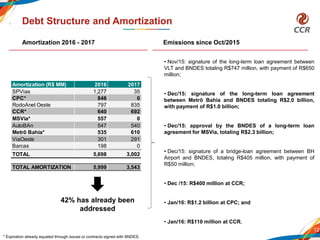

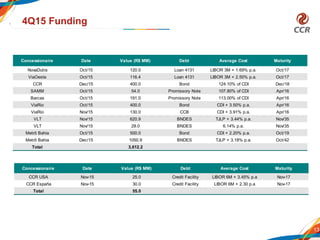

- The company addressed 42% of debt maturing in 2016-2017 and obtained new funding of over R$3.6 billion in 4Q15 at favorable rates.