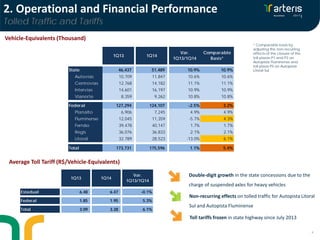

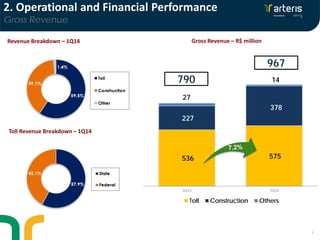

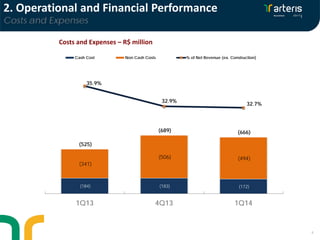

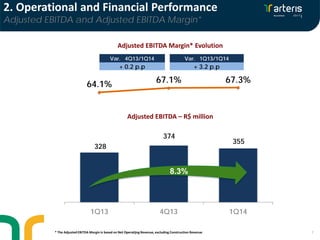

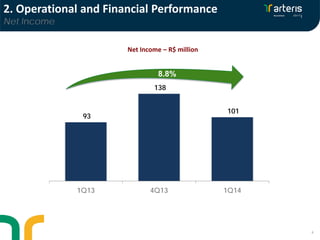

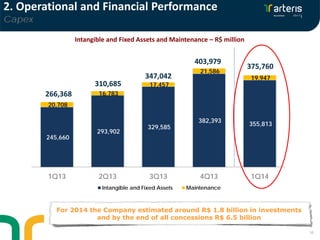

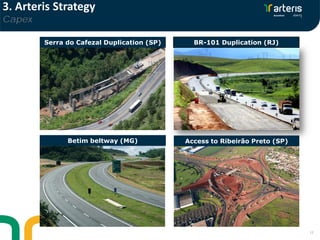

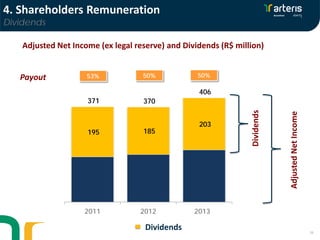

The document summarizes Arteris' 1Q14 results conference call. It discusses the company's operational and financial performance for the quarter, including a 5.4% increase in tolled traffic and growth in revenue and EBITDA. It also outlines the company's strategy going forward, which focuses on efficient capex delivery, sustainability, operations, and strengthening its corporate image. The document notes Arteris plans to pay a 50% dividend for fiscal year 2013 results.