- Traffic fell 1.8% in 3Q15 excluding new businesses, while toll revenue increased 1.9% due to toll increases.

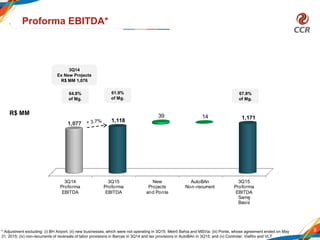

- Adjusted EBITDA on a same-basis increased 8.8% to R$1.17 billion in 3Q15, with a margin of 67.8%.

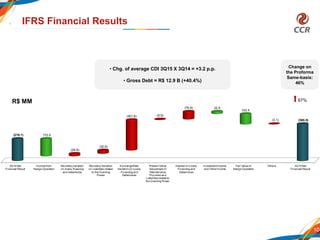

- Net income on a same-basis was R$352 million, a 0.7% reduction, impacted by higher financial expenses due to increased debt levels related to investments in new projects.