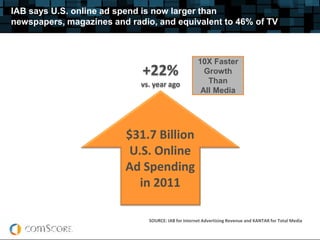

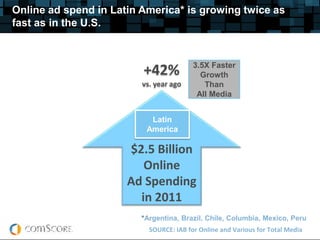

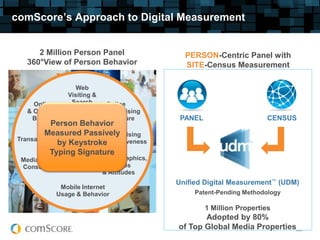

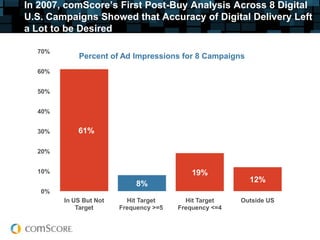

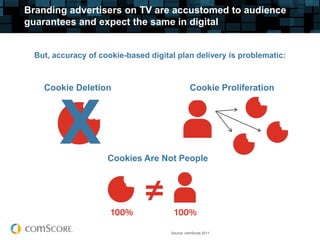

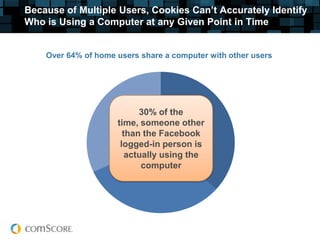

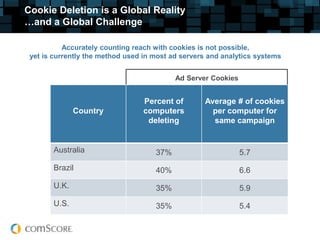

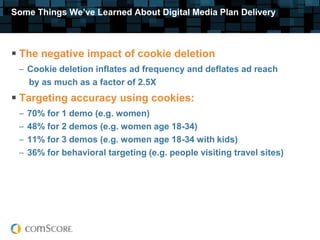

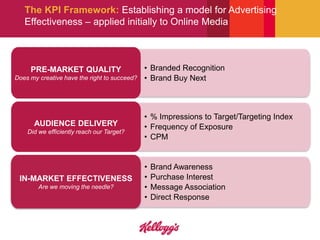

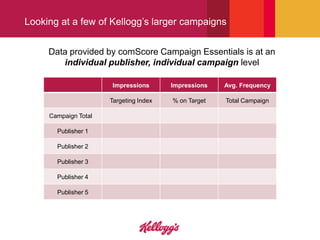

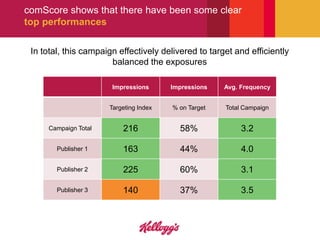

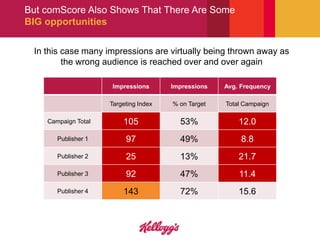

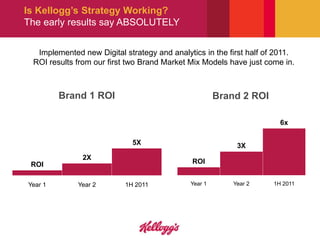

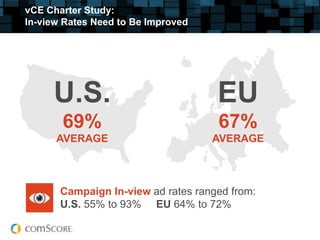

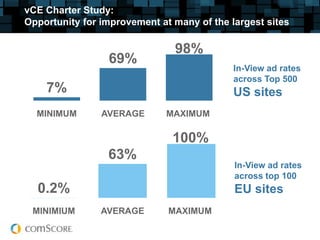

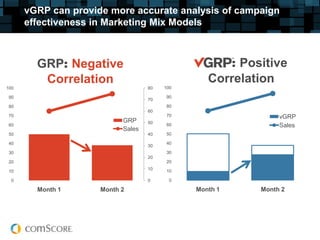

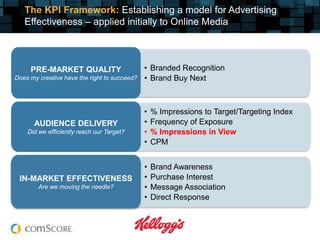

The document discusses the evolving landscape of digital advertising, highlighting the rapid growth of online ad spending compared to traditional media and the challenges brands face in establishing effective online branding strategies. It emphasizes the importance of accurate measurement methods, like Comscore's unified digital measurement, to overcome issues related to cookie-based targeting and optimize ad delivery to the right audience. Through Kellogg's advertising effectiveness model, the document illustrates the potential for improved ROI and campaign performance in the digital ecosystem.