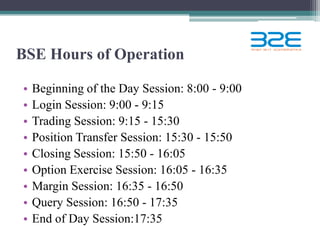

The document provides information about the National Stock Exchange of India (NSE) and Bombay Stock Exchange (BSE). It discusses the founding, location, leadership, and operations of both exchanges. NSE was founded in 1992 in Mumbai and electronic screen-based trading was introduced. BSE was established in 1875 in Mumbai and was the first stock exchange in Asia. Both exchanges facilitate trading of various financial instruments and have listings of over 2000 and 5000 companies respectively.

![Board of Directors

• Mr. Ravi Narain

National Stock Exchange of India Limited

Managing Director

• Ms. Chitra Ramkrishna

National Stock Exchange of India Limited

Joint Managing Director

[Shareholder Director ]](https://image.slidesharecdn.com/nse-121211023234-phpapp01/85/Nse-Bse-3-320.jpg)