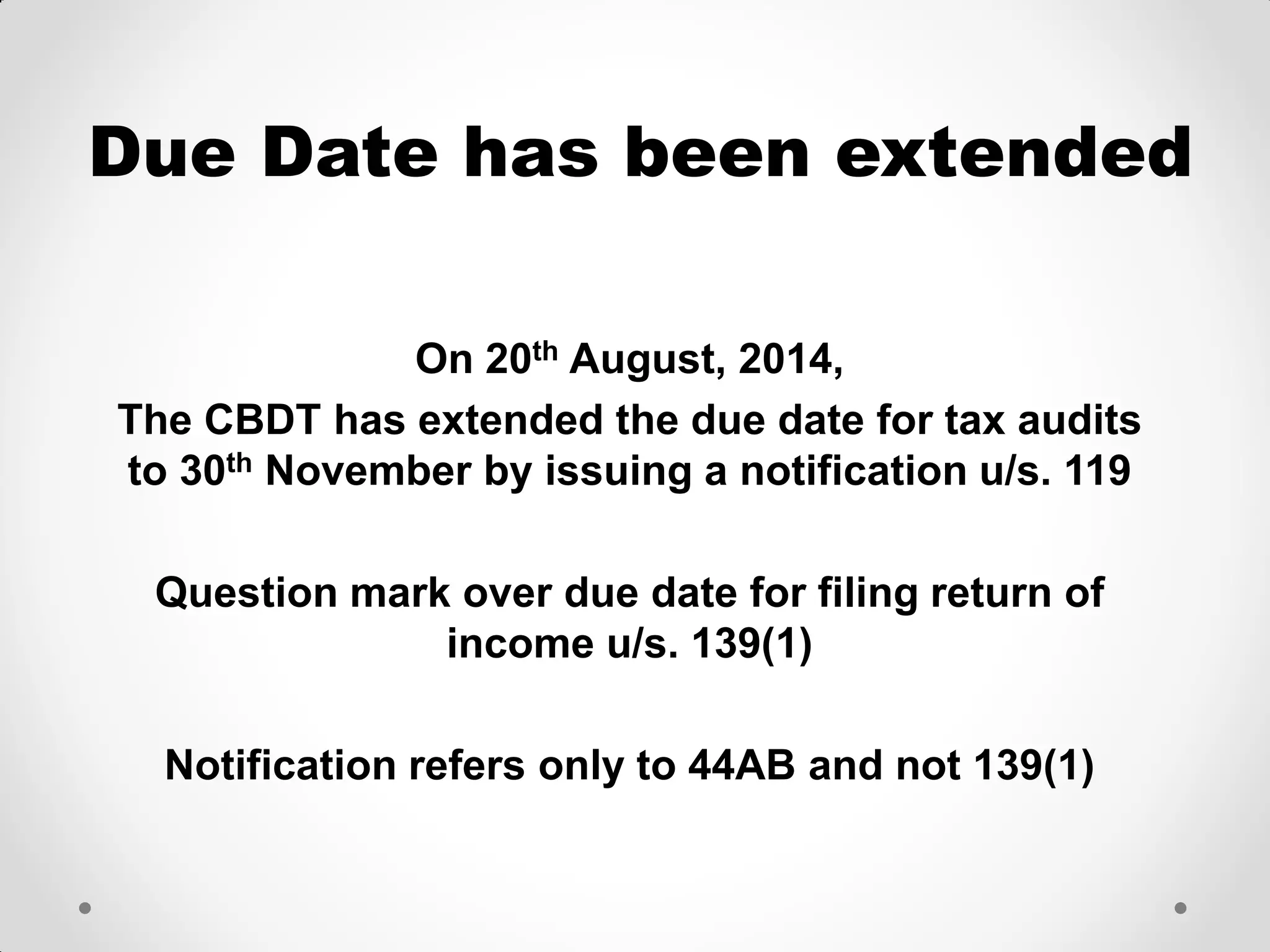

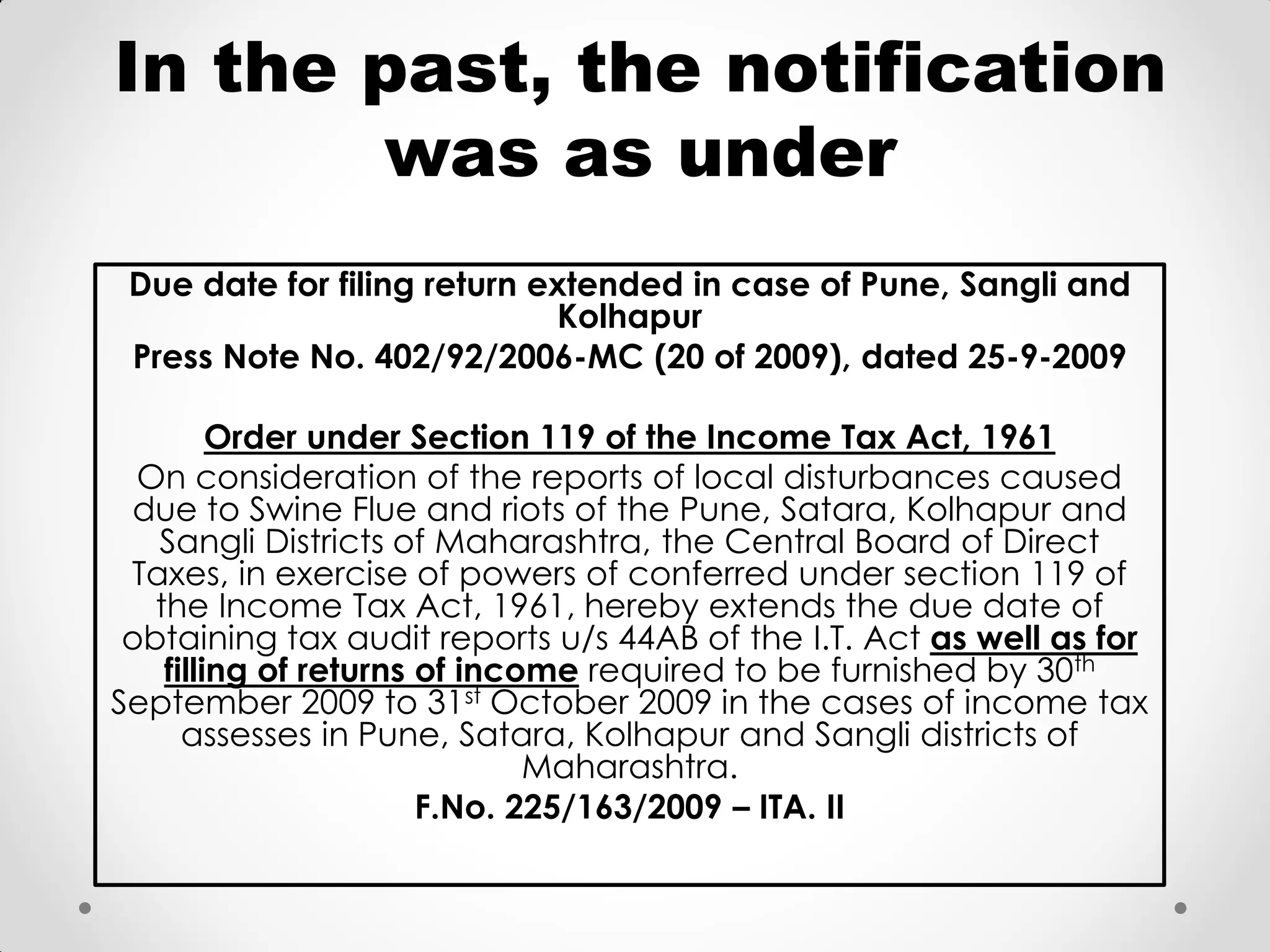

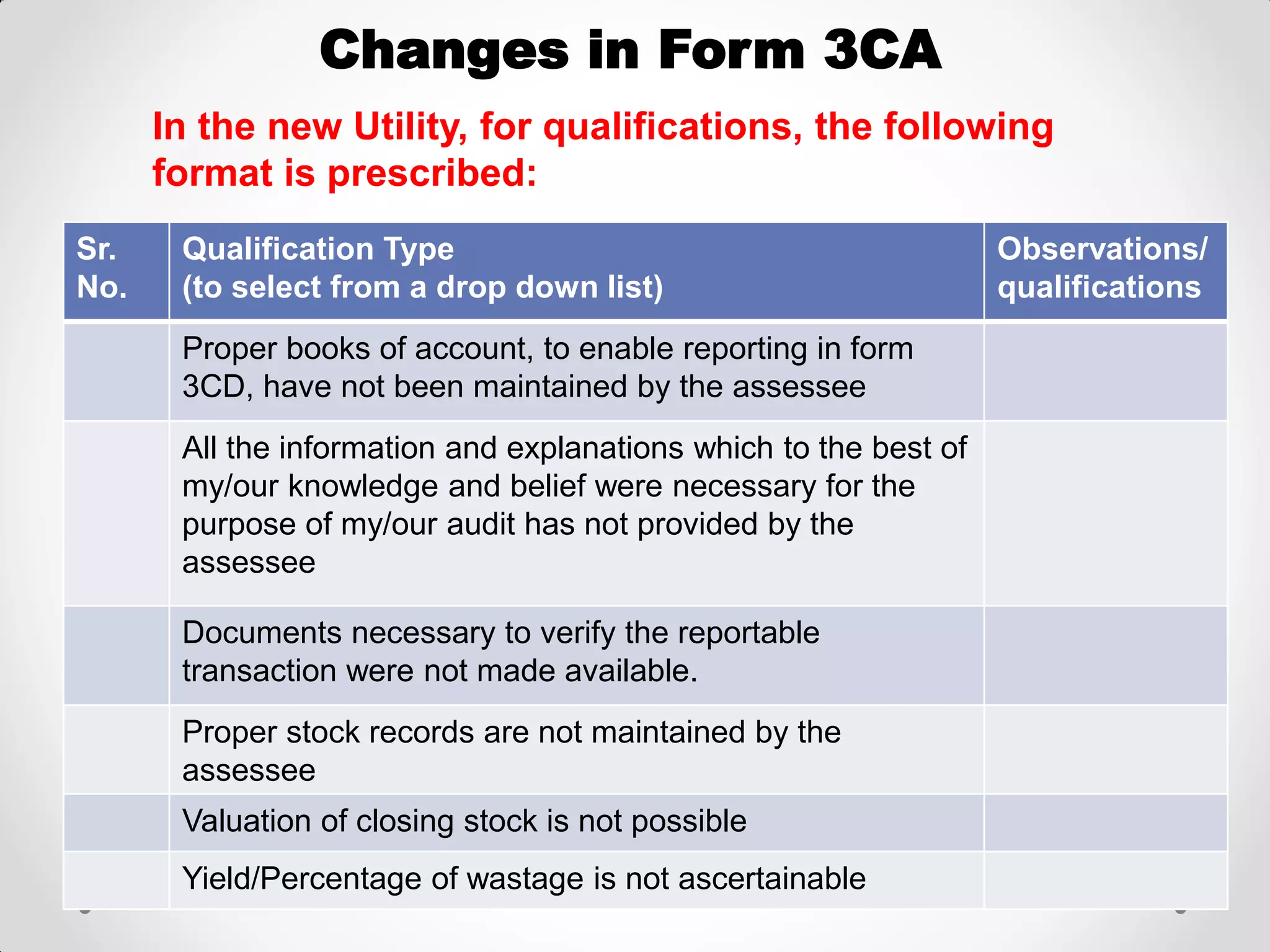

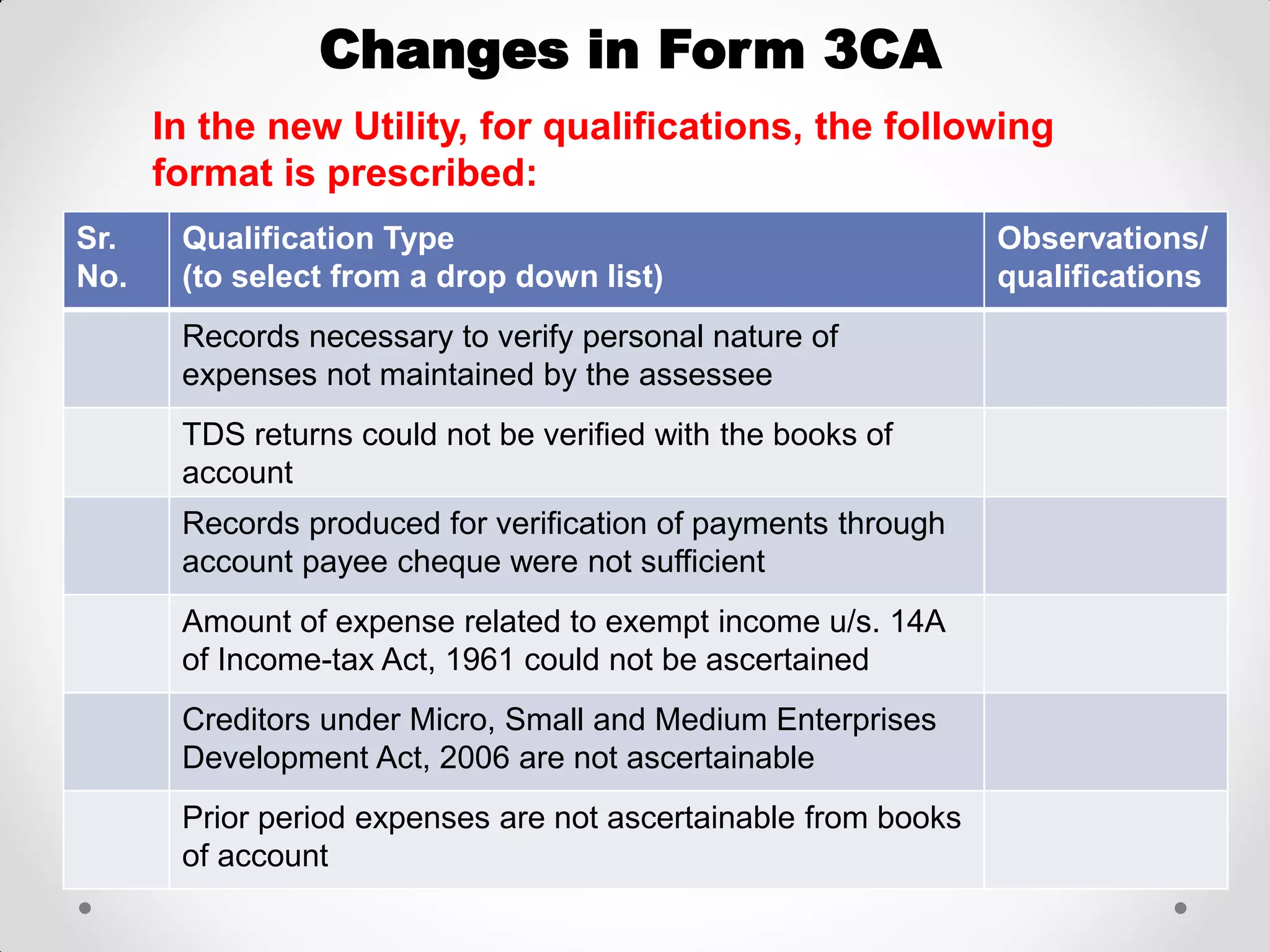

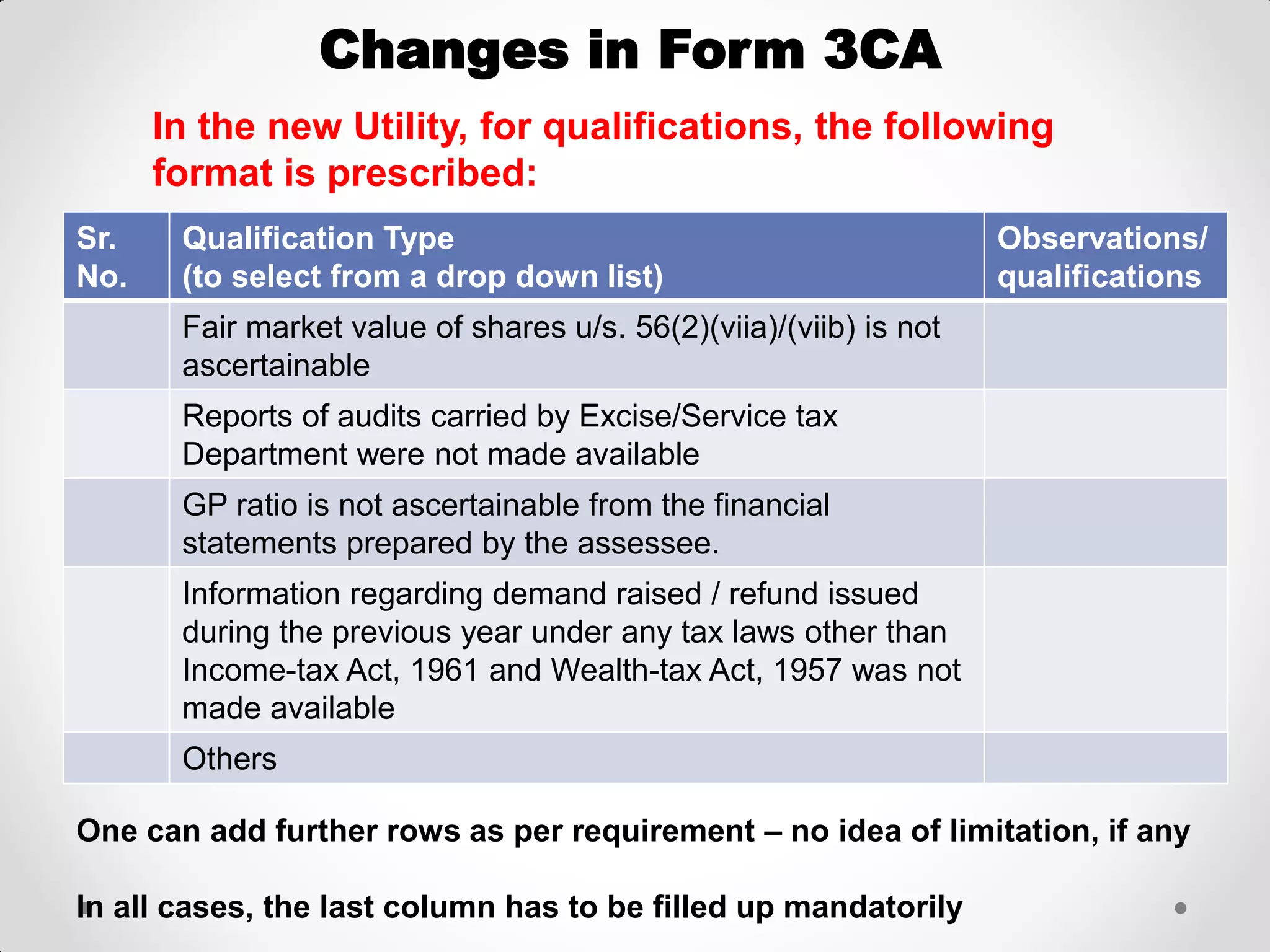

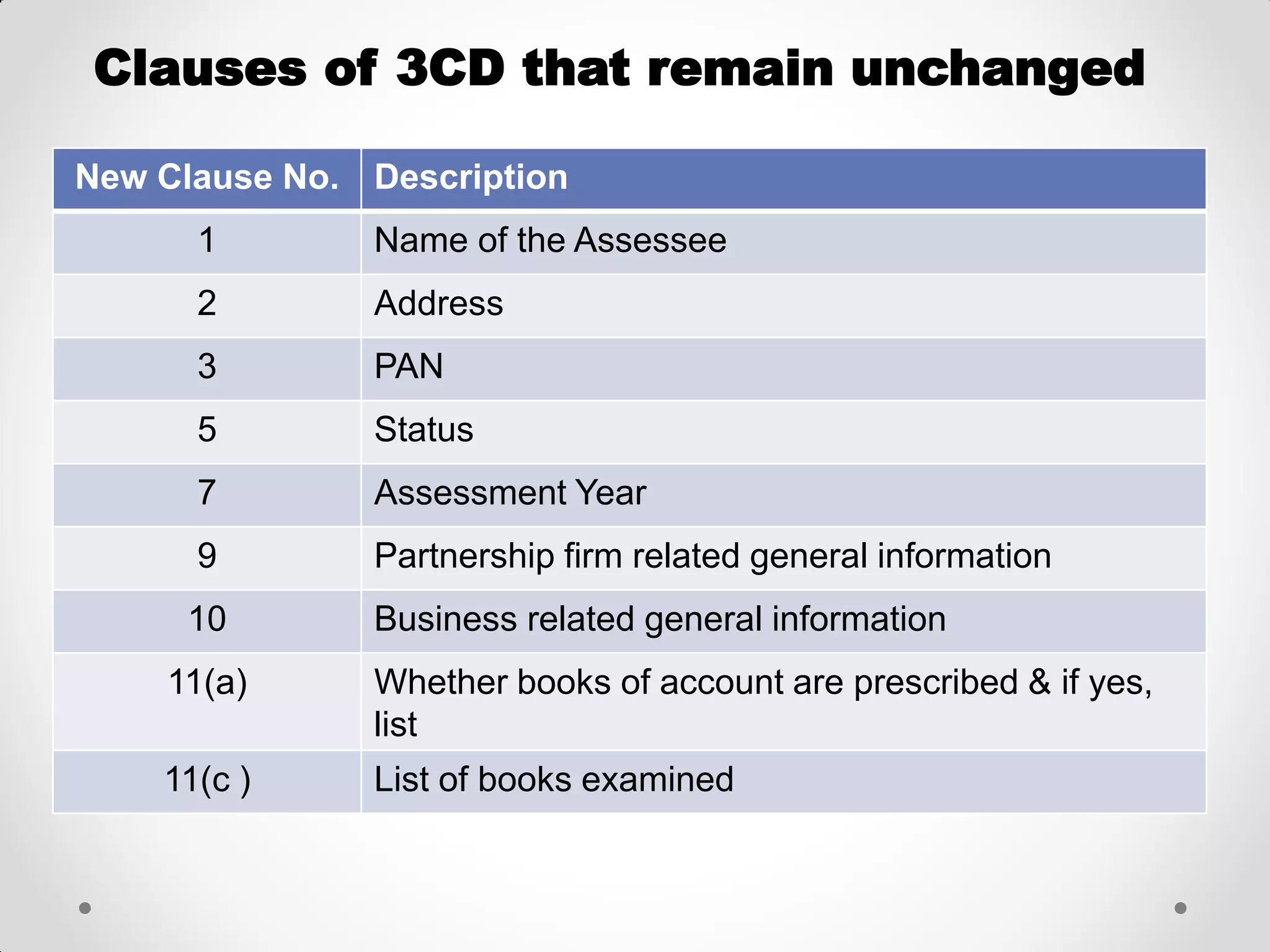

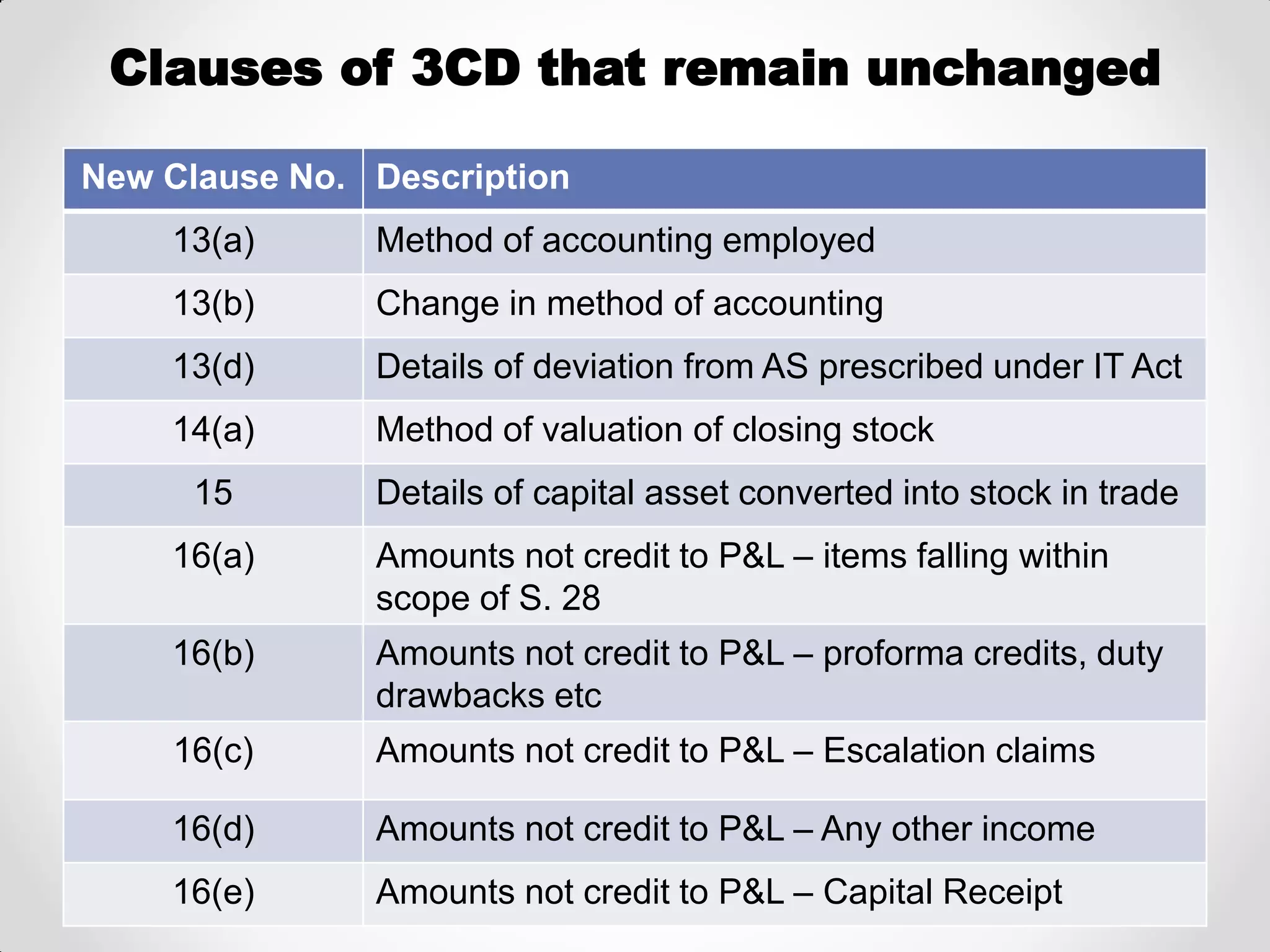

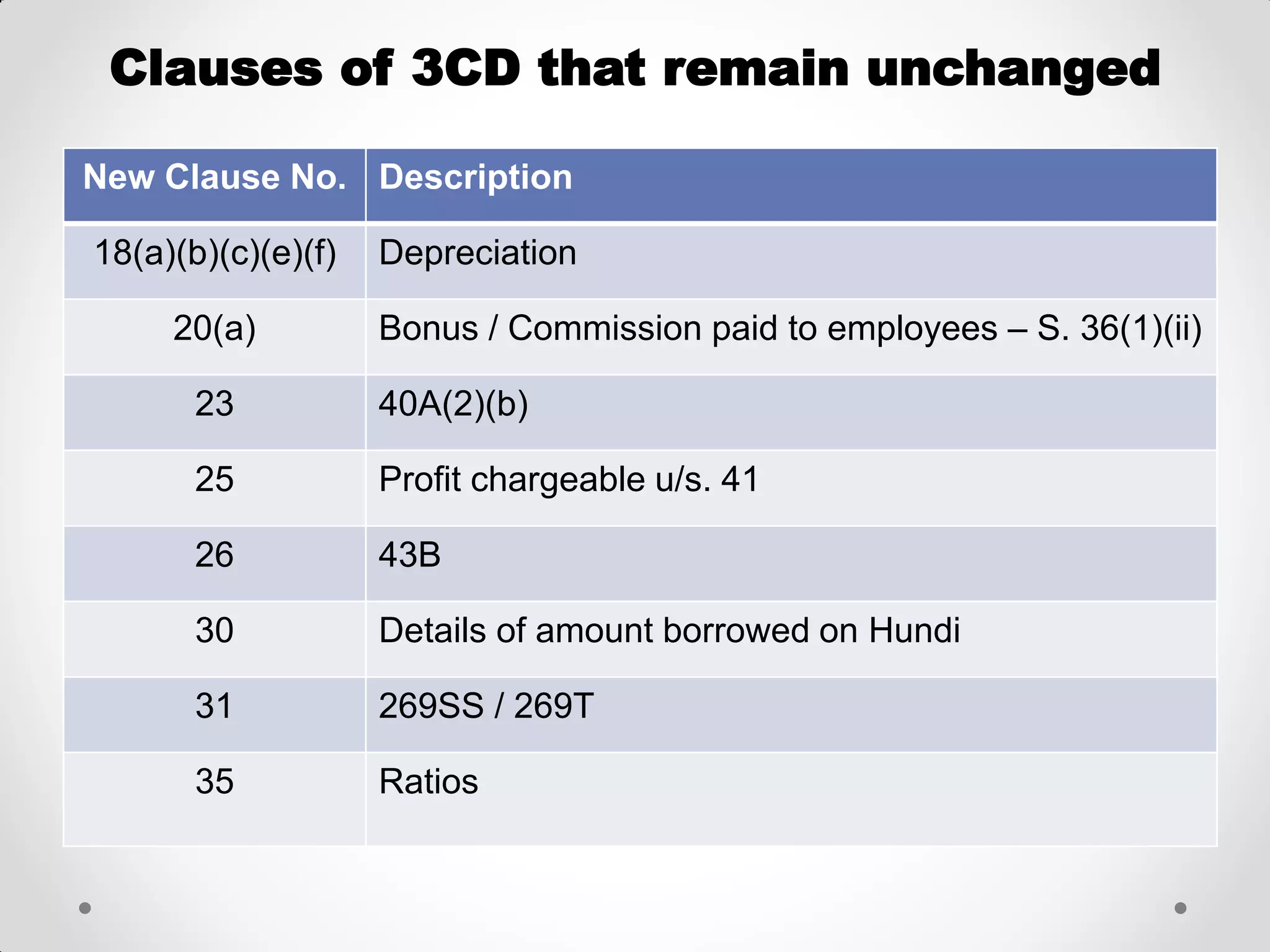

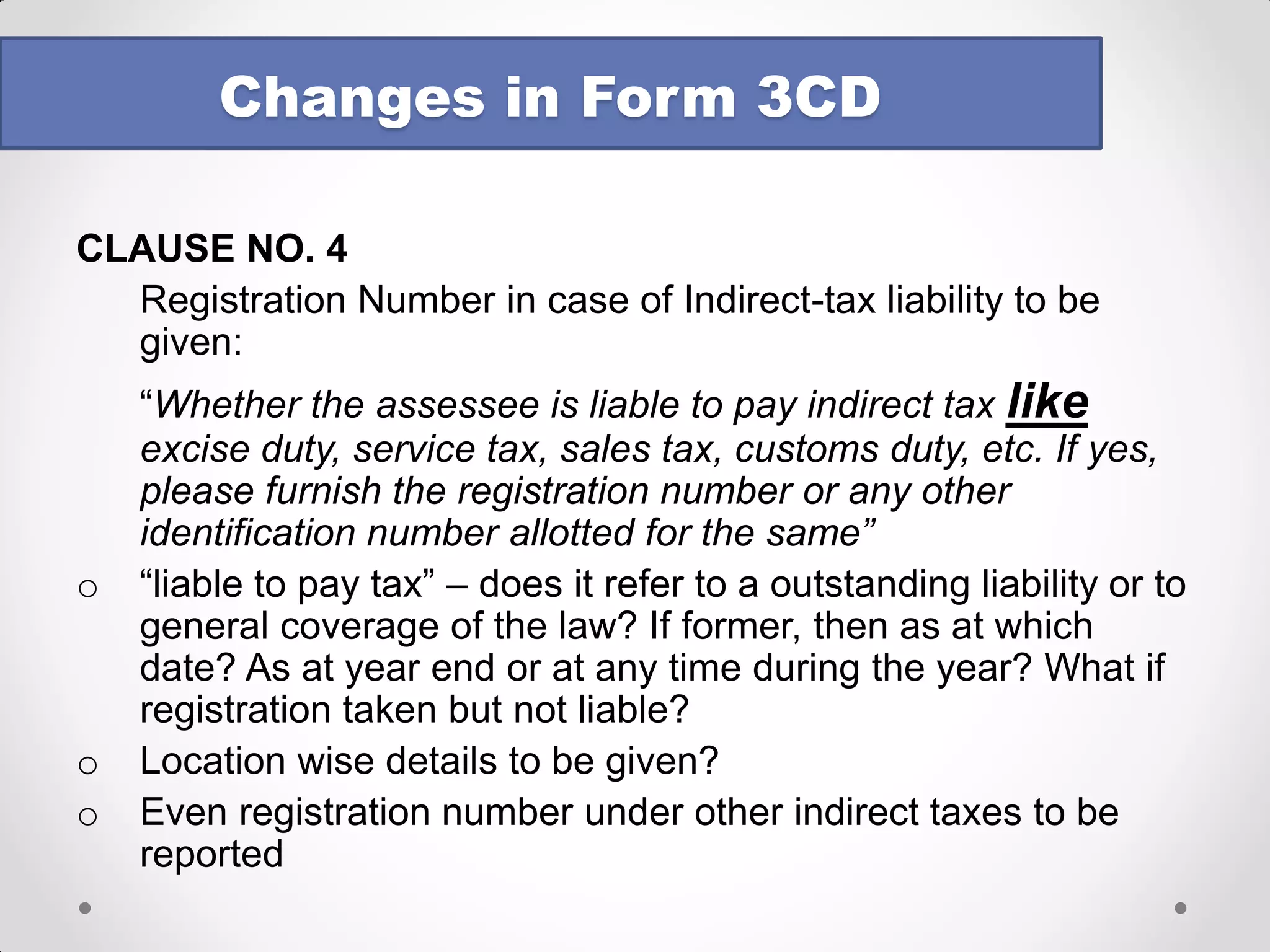

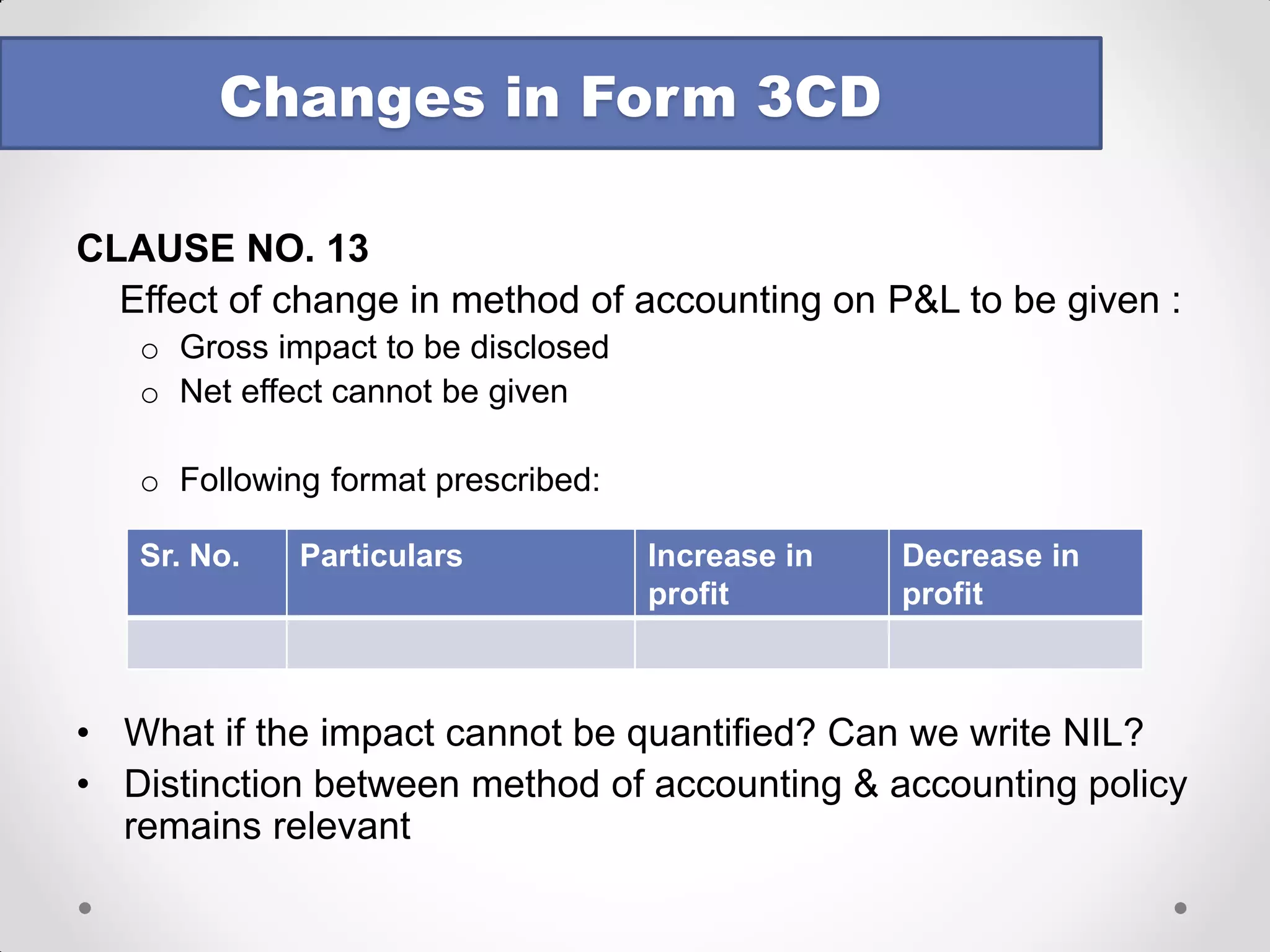

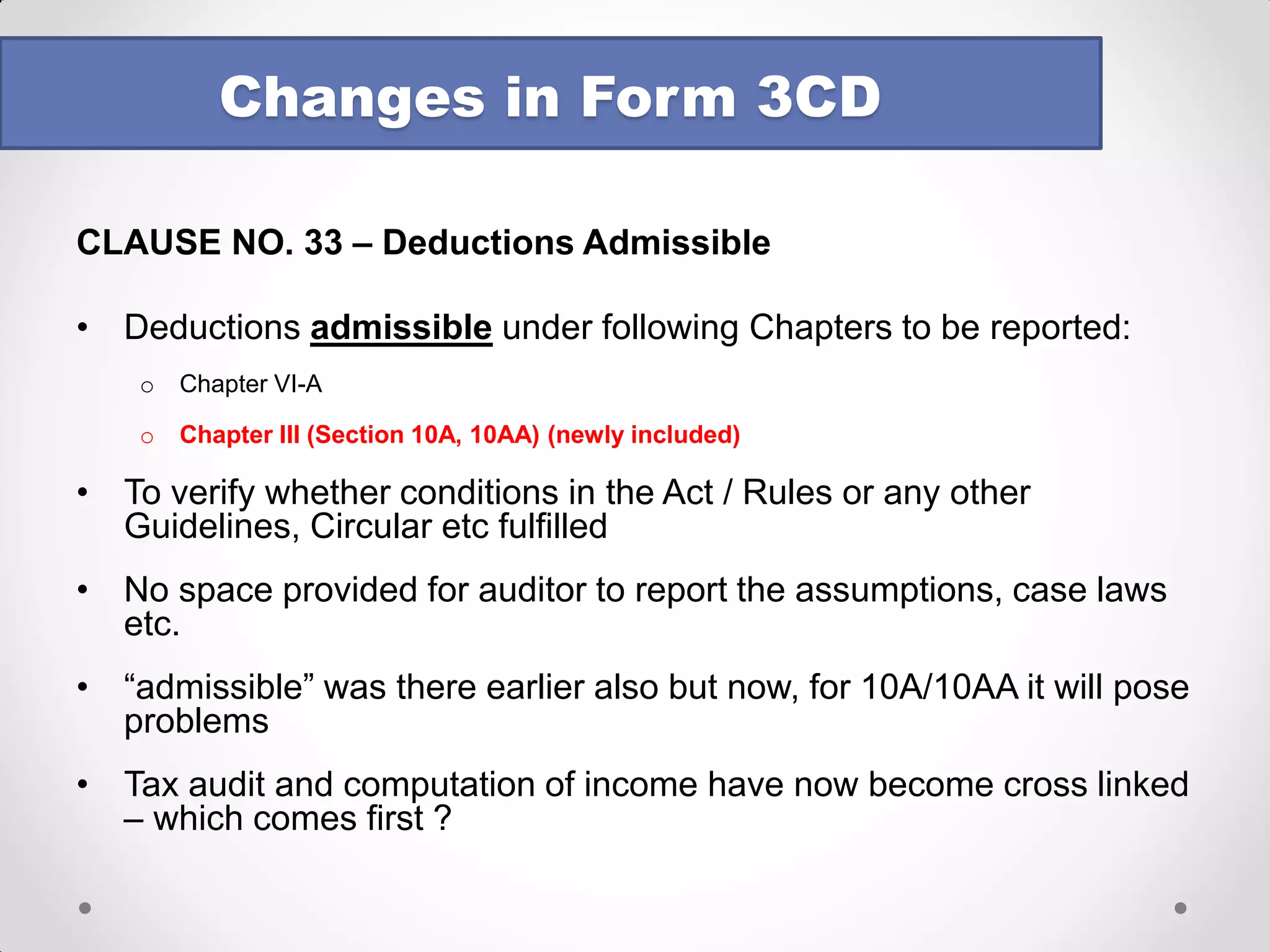

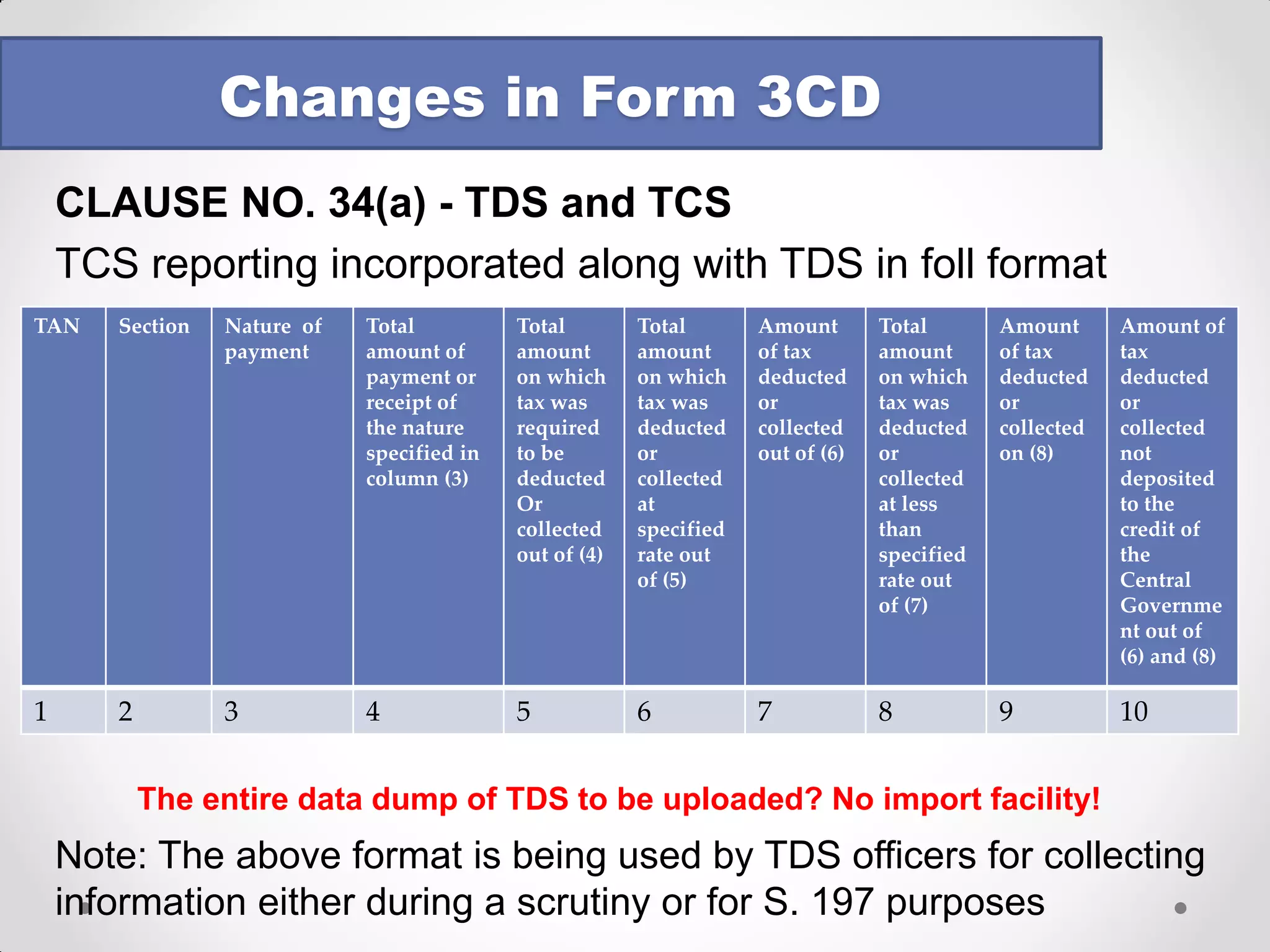

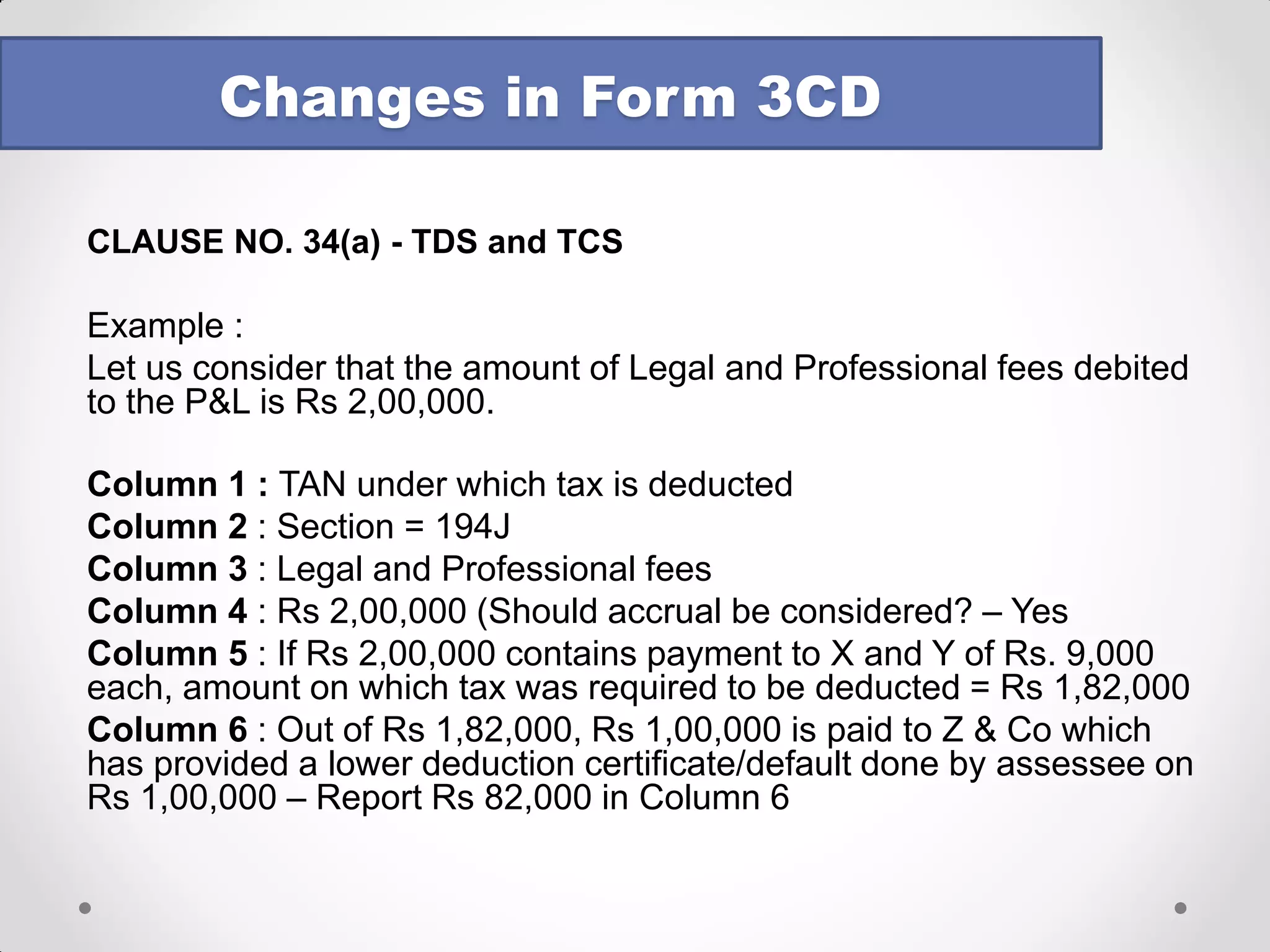

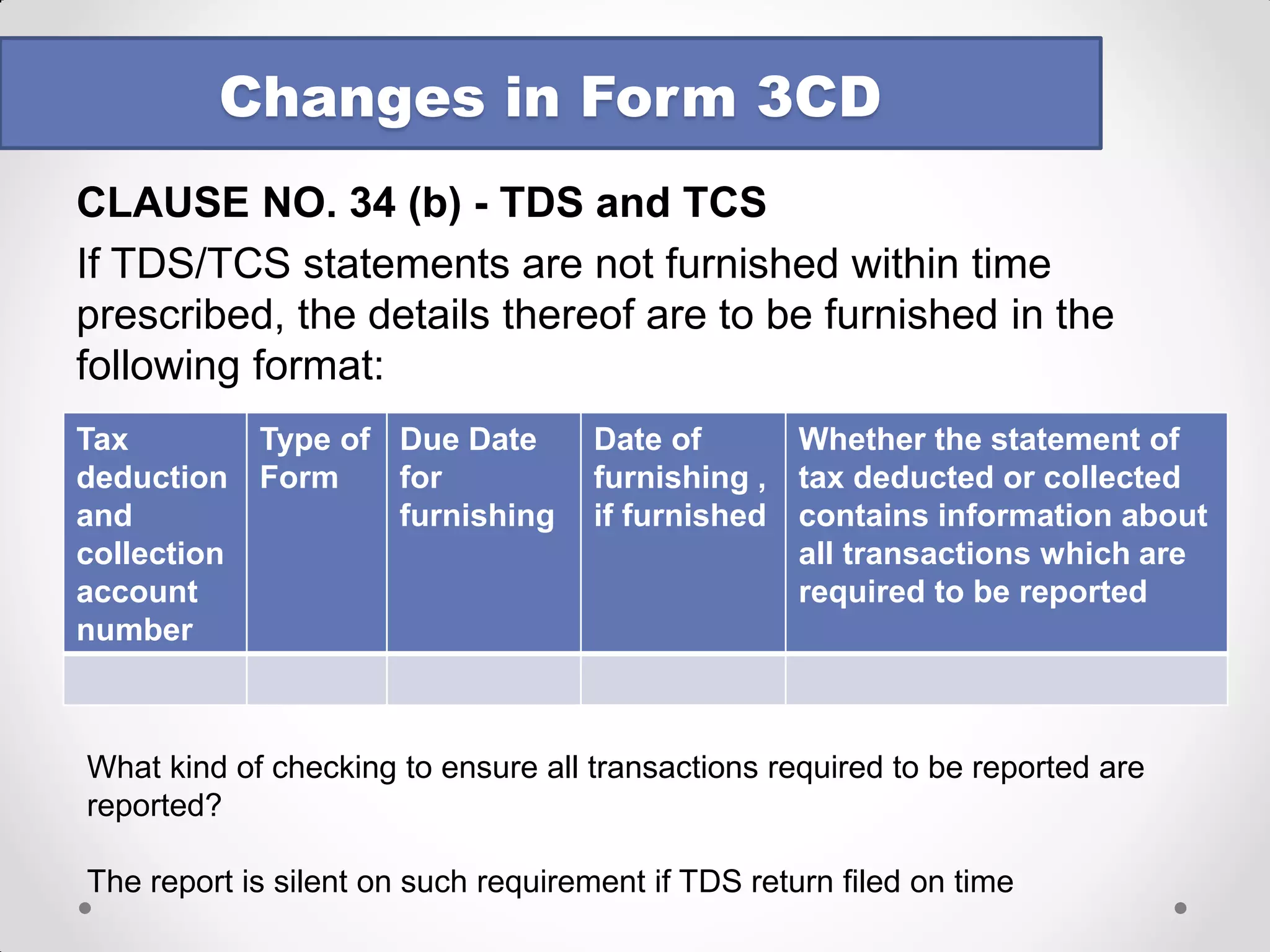

The document outlines significant amendments to Form 3CD and their implications for tax audits as of September 2014, including an extended due date for tax audits to November 30, 2014. It details the changes in reporting requirements, including the introduction of new clauses in the forms and specific qualifications that auditors must address. Additionally, the revised guidance note emphasizes the importance of accurate documentation and highlights various considerations for auditors in the context of tax regulations.

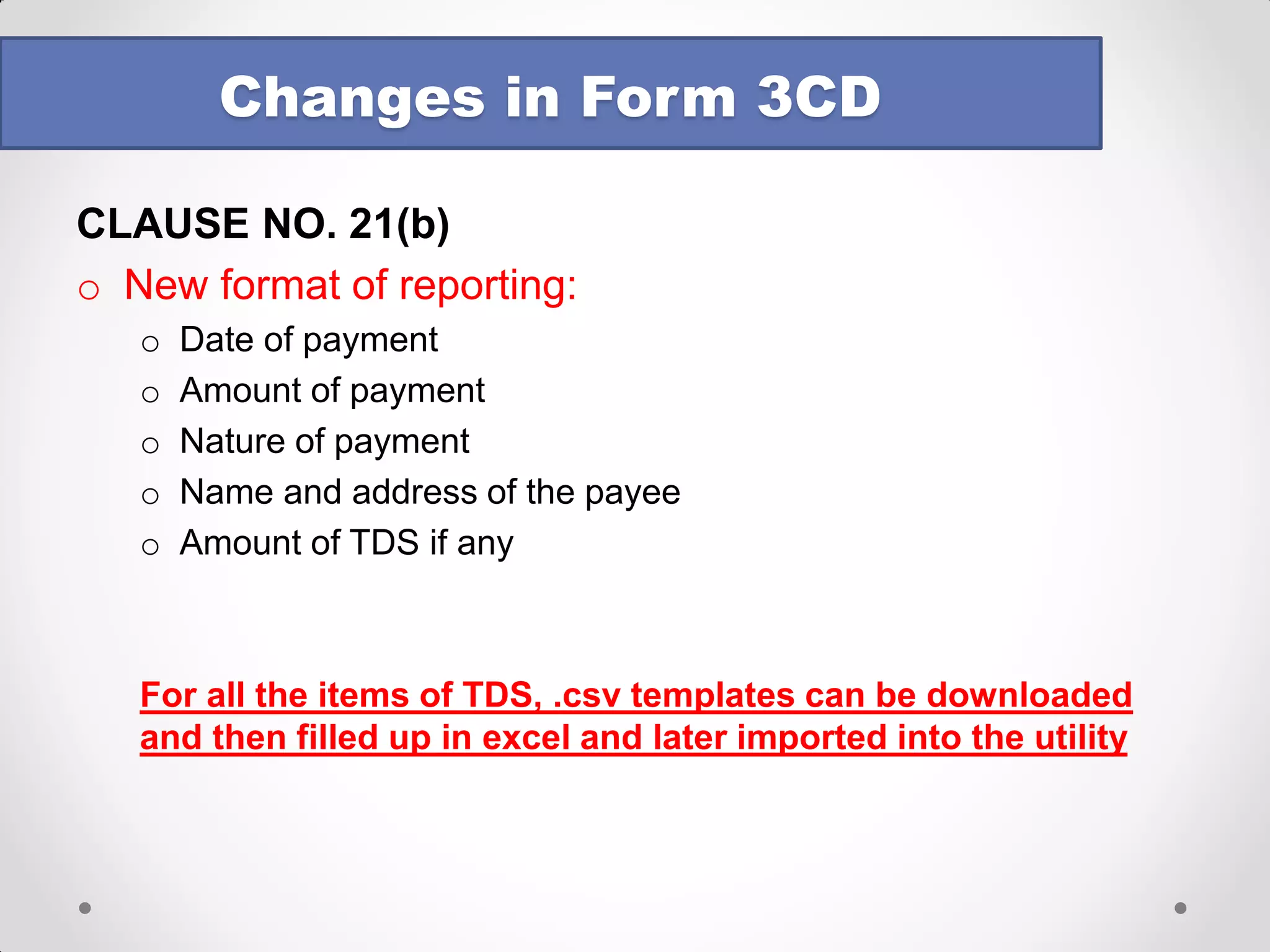

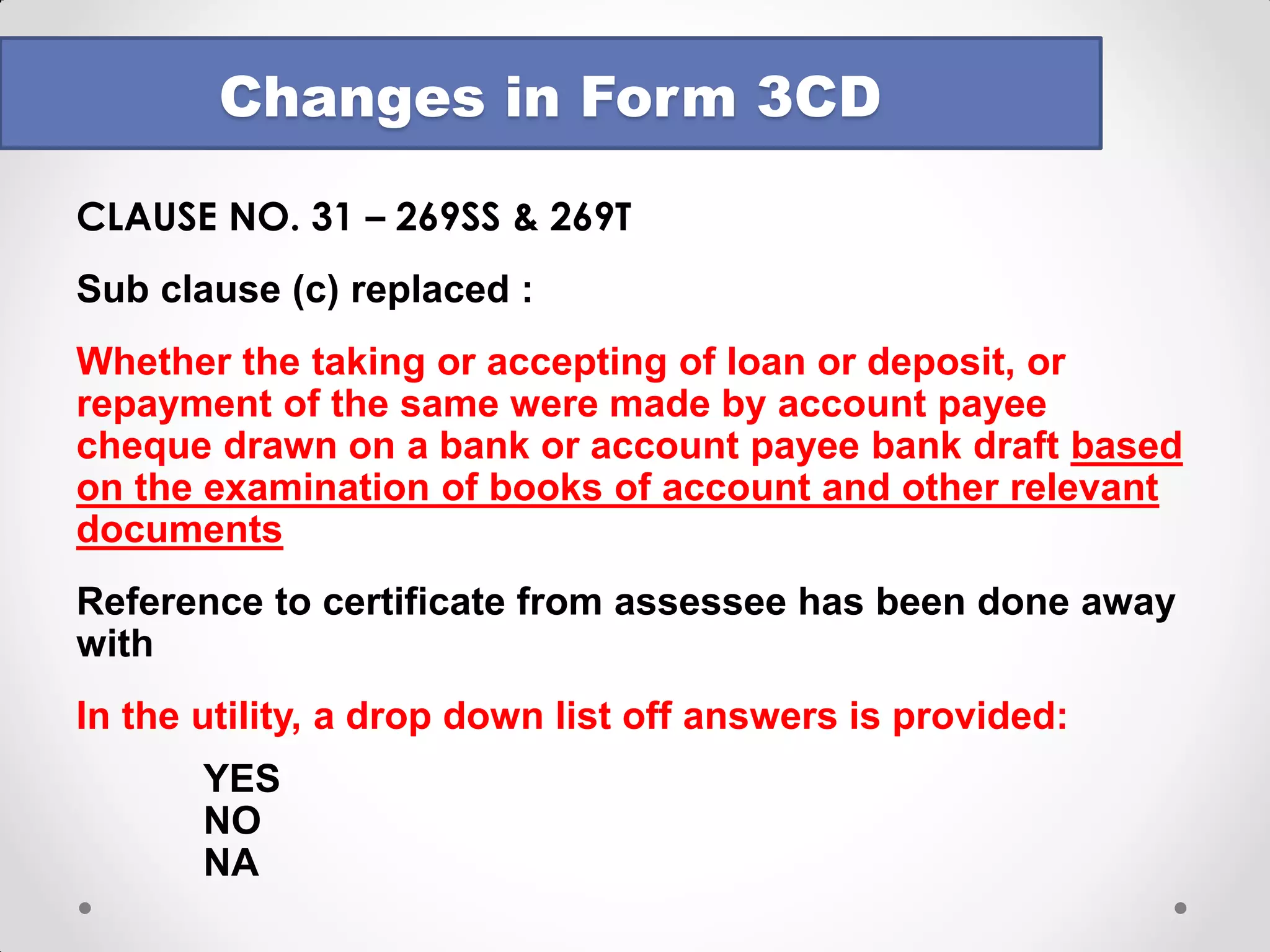

![CLAUSE NO. 31 – 269SS & 269T – Revised Guidance Note

•Where evidence is not available, the auditor should make a suitable comment

•E-payments NOT to be reported [reference is made to amendment brought in by Finance (No. 2) Act, 2014]

•Where reporting solely on the basis of the certificate, the fact shall be mentioned in Form 3CA or 3CB in the observations section

•The note re: necessary evidence not being available continues

Changes in Form 3CD](https://image.slidesharecdn.com/taxaudit-changesinform3cdaugust2014-140825053343-phpapp02/75/Tax-Audit-Changes-in-form-3CD-August-2014-51-2048.jpg)