GST Annual Audit -GSTR-9 for the FY 2022-23

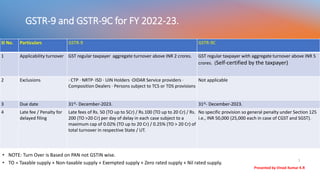

- 1. GSTR-9 and GSTR-9C for FY 2022-23. • NOTE: Turn Over is Based on PAN not GSTIN wise. • TO = Taxable supply + Non-taxable supply + Exempted supply + Zero rated supply + Nil rated supply. Sl No. Particulars GSTR-9 GSTR-9C 1 Applicability turnover GST regular taxpayer aggregate turnover above INR 2 crores. GST regular taxpayer with aggregate turnover above INR 5 crores. (Self-certified by the taxpayer) 2 Exclusions · CTP · NRTP· ISD · UIN Holders ·OIDAR Service providers · Composition Dealers · Persons subject to TCS or TDS provisions Not applicable 3 Due date 31st- December-2023. 31st- December-2023. 4 Late fee / Penalty for delayed filing Late fees of Rs. 50 (TO up to 5Cr) / Rs.100 (TO up to 20 Cr) / Rs. 200 (TO >20 Cr) per day of delay in each case subject to a maximum cap of 0.02% (TO up to 20 Cr) / 0.25% (TO > 20 Cr) of total turnover in respective State / UT. No specific provision so general penalty under Section 125 i.e., INR 50,000 (25,000 each in case of CGST and SGST). Presented by Vinod Kumar K.R 1

- 2. GSTR-9 – Annual return Table No. Particulars Reporting 4A to 4 N Taxable turnover & Taxes ( B2B, B2C, Exports DN, CN, Amendments, RCM) All tables mandatory. 5A to 5F No tax turnover (Zero rated, SEZ, RCM, Exempted, Nil rated , Non-GST) All tables mandatory except Nil rated can be clubbed with exempt and reported in 5D. Non-GST (incl NO supply) to be reported separately in 5F 5H to 5K Credit Note (CN) / Debit Note (DN) / Amendments. Optional. 6A to 6O ITC claims (Auto populated from GSTR-3B Table 4A) All tables mandatory except Input services could be merged & reported in Inputs. 7A to 7H ITC reversal – Rule 37,39,42,43,section 17(5),Tran-1&2 and Others. Mandatory. 8A to 8K ITC Reco with 2A & related break ups. Mandatory. 9 Tax payable & paid. Tax payable is editable & If additional payable through Form DRC03. 10,11&14 Supplies & Tax of FY 22-23 reported in Apr to Oct-23 returns filed within 30th Nov-23. Mandatory. 12 and 13 ITC Of FY 22-23 availed/reversed in Apr to Oct-23 returns filed within 30th Nov- 23. Optional. 15 Refunds, Demands. Optional. 16 Supplies received from Composition , Deemed supply and Goods sent on Approval. Optional.

- 3. Table 4 - Details of advances, inward and outward supplies made during the year on which tax is payable. (This Table will auto Populated from GSTR-1) Note: The liability declared in Table 4 net of adjustments in Table 10 and 11 shall be considered as final tax liability irrespective of the amount of tax paid through GSTR-3B as well DRC-03 filed during the financial year. Any additional liability arising as a result of such disclosure as per books shall be paid through DRC-03 while filing the annual return. Table Particulars 4A to 4G B2C (4A) and B2B (4B) supplies, Export (4C) and SEZ (4D) supplies on payment of tax, Deemed exports (4E), Advances on which tax paid but invoice not issued (4F), and Inward supplies on which tax is paid on RCM basis (4G). 4I & 4J Credit Notes and Debit Notes issued in respect of transactions specified in Table 4B to 4E. Have to be reported separately. 4K and 4L Supplies / tax declared through Amendments & Supplies / tax reduced through Amendments. The amendments have to be reported separately. Presented by Vinod Kumar K.R 3

- 4. Table 5 - Details of Outward supplies made during the financial year on which tax is not payable(This Table will auto Populated from GSTR-1). Table Particulars 5A, 5B and 5C. Export (5A) and SEZ (5B) supplies without payment of tax, supplies on which tax is to be paid by recipient on reverse charge basis (5C). 5D and 5E. Exempted (5D) and Nil Rated (5E) 5F Non-GST supply 5H and 5I Credit Notes and Debit Notes issued in respect of transactions specified in Table 5A to 5F. 5J & 5K Supplies declared through Amendments & Supplies reduced through Amendments. 5N Total Turnover (4N+5M-4G) Presented by Vinod Kumar K.R 4

- 5. Table 6 - Details of ITC availed during the financial year. Note: The details of capital goods need to be reported separately. However, details of inputs and input services can be reported on a consolidated basis under the head ‘Inputs’. Table Particulars 6A Total amount of ITC claimed in GSTR-3B (Table 4A). - This amount is auto-populated from filed GSTR-3B for April – March-23 period. It is a non-editable field. 6B Inward supplies (other than imports and inward supplies liable to reverse charge but includes services received from SEZs) 6C Inward supplies received from unregistered persons liable to reverse charge (other than 6B above) on which tax is paid & ITC availed. 6D Inward supplies received from registered persons liable to reverse charge (other than B above) on which tax is paid and ITC availed. 6E & F Import of goods/Services (including supplies from SEZ). 6G ITC received from ISD. 6H Amount of ITC reclaimed (Rule 37 ITC reclaimed). 6K&L TRAN-I & II ITC. 6M Any other ITC availed but not specified in 6B to 6L above.- E.g. ITC claimed in GST ITC-01(ITC on stock for newly registered taxpayers) and GST ITC-02 (ITC transferred in case of change in business constitution example merger, demerger, amalgamation etc.) shall be declared here. Presented by Vinod Kumar K.R 5

- 6. Details of ITC reconciliation with GSTR-2A and ITC Reversed and Ineligible ITC as declared in returns filed during the financial year. Table Particulars 7A, 7B, 7C, 7D, 7E, 7F, 7G and 7H1. As per Rule 37 (180 days), Rule 39 (ISD CN), Rule 42 (Inputs), Rule 43 (Capital Goods), Section 17(5) (Blocked credit), Reversal of TRAN-I credit, Reversal of TRAN-II credit, Other reversals. 8A ITC from GSTR-2A - The total credit available for inwards supplies (other than imports and inwards supplies liable to reverse charge but includes services received from SEZs) pertaining to the FY 2022-23 and reflected in Form GSTR-2A (table 3 & 5 only) shall be auto-populated in this table. 8B ITC as per Table 6B + 6H - This table is auto-populated basis the details furnished in Table 6B and Table 6H in the annual return. 8C ITC on inward supplies (other than imports and inward supplies liable to reverse charge but includes services received from SEZs) received during the financial year but availed in the next FY up to specified period. 8E & 8F & 8J ITC available but not availed (8E) and ITC available but ineligible (8F) other than Imports and ITC available but not availed on Imports of Goods. 8G IGST paid on import of goods (including supplies from SEZ). 8K Total ITC to be lapsed in current financial year - 8E & 8F & 8J. Presented by Vinod Kumar K.R 6

- 7. Details of Tax paid and payable, Refunds & Demands, and HSN wise summary. Table Particulars 9 Details of tax paid as declared in returns filed during the financial year. - basis of tax payable and paid as declared in GSTR-1 and GSTR-3B. 10 & 11 Supplies / tax declared through amendments and Supplies / tax reduced through amendments 12 & 13 Reversal of ITC availed / ITC availed during previous financial year. - ITC availed in FY 2022-23 reversed in GSTR-3B for the period between April 2023 to October 2023 filed up to 30th November 2023 is required to be declared here. 14 Differential tax paid on account of declaration in Table 10 & 11. 15 Details of Refunds and Demands. 16 Information on supplies received from composition taxpayers, Deemed supply and sent on approval basis. 17 HSN wise summary of Outward supplies. 18 HSN wise summary of Inward supplies. Presented by Vinod Kumar K.R 7