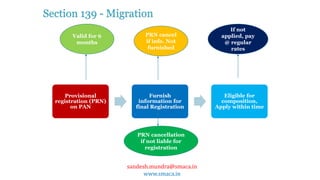

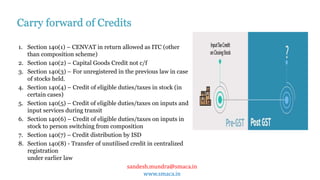

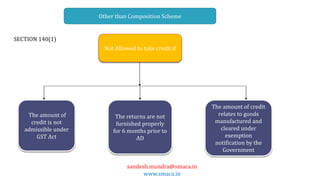

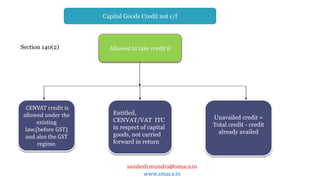

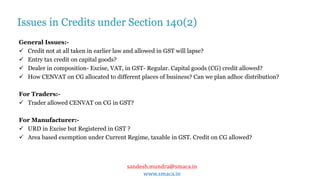

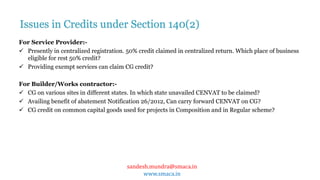

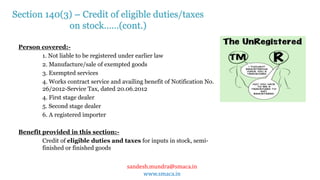

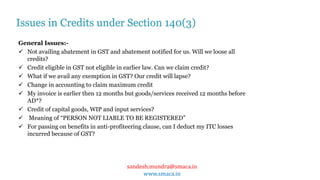

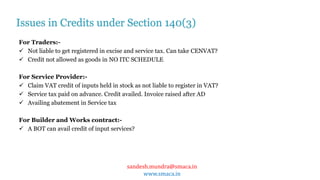

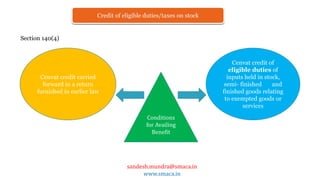

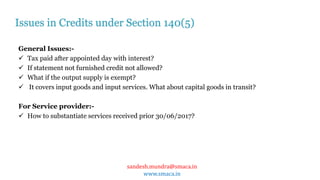

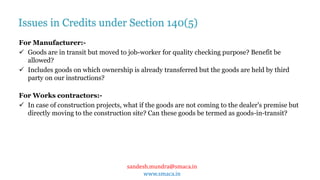

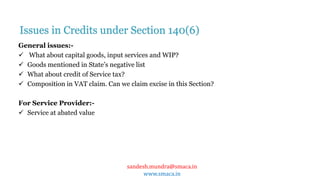

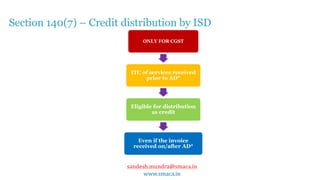

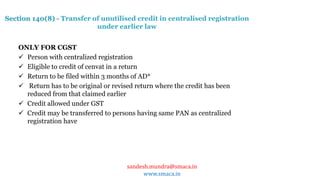

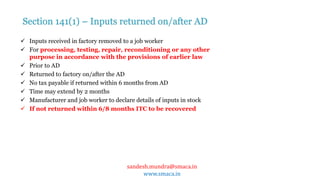

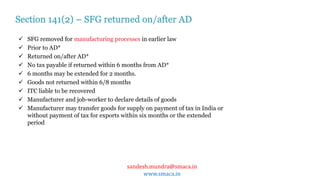

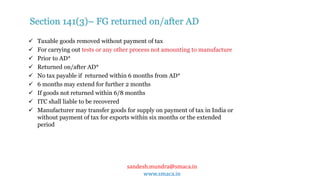

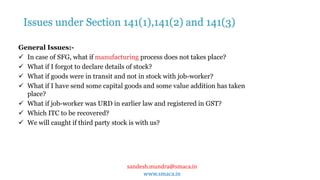

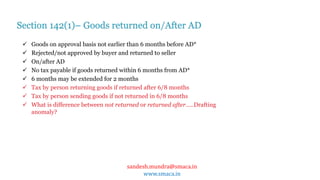

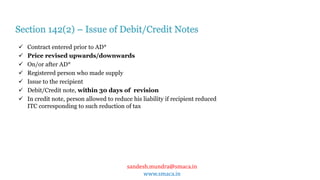

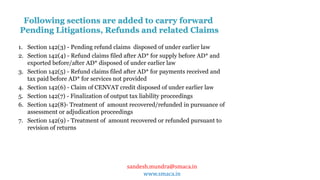

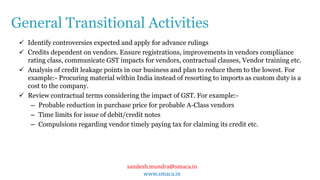

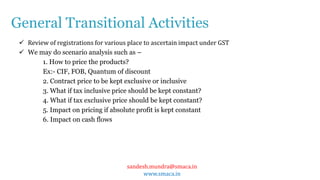

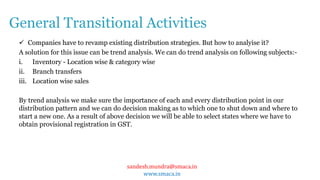

This document discusses various transitional provisions under GST relating to migration, credits, returns from job work, price revision, pending litigations and claims. It addresses common issues around availment of credits for inputs, capital goods and input services held in stock, in transit or under job work. It also summarizes provisions for carry forward of credits, distribution of credits by Input Service Distributors and transfer of unutilized credits in centralized registrations.