The document discusses company distribution policies to shareholders, including dividends and stock repurchases, examining investor preferences and the impact of taxes. It outlines various theories related to dividend relevance, signaling effects, and the residual distribution model, along with empirical evidence affecting dividend policies. The document also provides a comprehensive analysis of payout ratios across industries, trends over time, and the procedural aspects of dividend payments and stock repurchases.

![© 2020 Cengage Learning. All Rights Reserved. May not be

copied, scanned, or duplicated, in whole or in part, except for

use as permitted in a license distributed with a certain product

or service or otherwise on a password-protected website for

classroom use.

Choosing the Optimal Capital Structure: Example

b = 1.0; rRF = 6%; RPM = 6%.

Cost of equity using CAPM:

rs = rRF +b (RPM)= 6% + 1(6%) = 12%

Currently has no debt: wd = 0%.

WACC = rs = 12%.

Tax rate is T = 25%.

© 2020 Cengage Learning. All Rights Reserved. May not be

copied, scanned, or duplicated, in whole or in part, except for

use as permitted in a license distributed with a certain product

or service or otherwise on a password-protected website for

classroom use.

Current Value of Operations

Expected FCF = $90 million.

Firm expects zero growth: g = 0.

Vop = [FCF(1+g)]/(WACC − g)

Vop = [$90(1+0)]/(0.12 − 0)

Vop = $750 million.

© 2020 Cengage Learning. All Rights Reserved. May not be

copied, scanned, or duplicated, in whole or in part, except for

use as permitted in a license distributed with a certain product

or service or otherwise on a password-protected website for

classroom use.

Other Data for Valuation Analysis

Company has no ST investments.](https://image.slidesharecdn.com/distributionstoshareholdersdividendsandrepurchaseschapt-230104133714-692a1c2e/85/Distributions-to-ShareholdersDividends-and-RepurchasesCHAPT-docx-39-320.jpg)

![Company has no preferred stock.

10 million shares outstanding

© 2020 Cengage Learning. All Rights Reserved. May not be

copied, scanned, or duplicated, in whole or in part, except for

use as permitted in a license distributed with a certain product

or service or otherwise on a password-protected website for

classroom use.

Current Valuation Analysis Vop$750 + ST Inv. 0

VTotal$750 − Debt 0S$750 ÷ n 10 P$75.00

© 2020 Cengage Learning. All Rights Reserved. May not be

copied, scanned, or duplicated, in whole or in part, except for

use as permitted in a license distributed with a certain product

or service or otherwise on a password-protected website for

classroom use.

Investment bankers provided estimates of rd for different

capital

structures.wd0%20%30%40%50%rd0.0%8.0%8.5%10.0%12.0%

If company recapitalizes, it will use proceeds from debt

issuance to repurchase stock.

© 2020 Cengage Learning. All Rights Reserved. May not be

copied, scanned, or duplicated, in whole or in part, except for

use as permitted in a license distributed with a certain product

or service or otherwise on a password-protected website for

classroom use.

The Cost of Equity at Different Levels of Debt: Hamada’s

Formula

MM theory implies that beta changes with leverage.

bU is the beta of a firm when it has no debt (the unlevered beta)

b = bU [1 + (1 - T)(wd/ws)]](https://image.slidesharecdn.com/distributionstoshareholdersdividendsandrepurchaseschapt-230104133714-692a1c2e/85/Distributions-to-ShareholdersDividends-and-RepurchasesCHAPT-docx-40-320.jpg)

![© 2020 Cengage Learning. All Rights Reserved. May not be

copied, scanned, or duplicated, in whole or in part, except for

use as permitted in a license distributed with a certain product

or service or otherwise on a password-protected website for

classroom use.

The Cost of Equity for wd = 20%

Use Hamada’s equation to find beta:

b = bU [1 + (1 - T)(wd/ws)]

= 1.0 [1 + (1-0.25) (20% / 80%) ]

= 1.188

Use CAPM to find the cost of equity:

rs= rRF + bL (RPM)

= 6% + 1.188 (6%) = 13.13%

© 2020 Cengage Learning. All Rights Reserved. May not be

copied, scanned, or duplicated, in whole or in part, except for

use as permitted in a license distributed with a certain product

or service or otherwise on a password-protected website for

classroom use.

The WACC for wd = 20%

WACC = wd (1-T) rd + ws rs

WACC =

0.2 (1 – 0.25) (8%) + 0.8 (13.13%)

WACC = 11.7%

Repeat this for all capital structures under consideration.

© 2020 Cengage Learning. All Rights Reserved. May not be

copied, scanned, or duplicated, in whole or in part, except for

use as permitted in a license distributed with a certain product

or service or otherwise on a password-protected website for

classroom use.

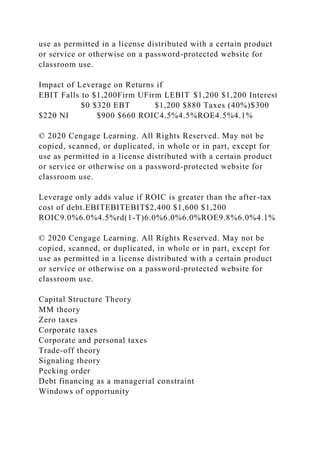

Beta, rs, and

WACCwd0%20%30%40%50%rd0.0%8.0%8.5%10.0%12.0%ws1](https://image.slidesharecdn.com/distributionstoshareholdersdividendsandrepurchaseschapt-230104133714-692a1c2e/85/Distributions-to-ShareholdersDividends-and-RepurchasesCHAPT-docx-41-320.jpg)

![00%80%70%60%50%b1.001.1881.321.501.75rs12.00%13.13%1

3.93%15.00%16.50%WACC12.00%11.70%11.66%12.00%12.75

%

The WACC is minimized for wd = 30%. This is the optimal

capital structure.

© 2020 Cengage Learning. All Rights Reserved. May not be

copied, scanned, or duplicated, in whole or in part, except for

use as permitted in a license distributed with a certain product

or service or otherwise on a password-protected website for

classroom use.

Corporate Value for wd = 20%

Vop = [FCF(1+g)]/(WACC − g)

Vop = [$90(1+0)]/(0.117 − 0)

Vop = $769.23 million.

Debt = DNew = wd …](https://image.slidesharecdn.com/distributionstoshareholdersdividendsandrepurchaseschapt-230104133714-692a1c2e/85/Distributions-to-ShareholdersDividends-and-RepurchasesCHAPT-docx-42-320.jpg)