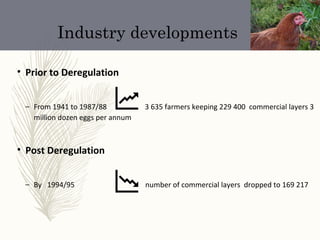

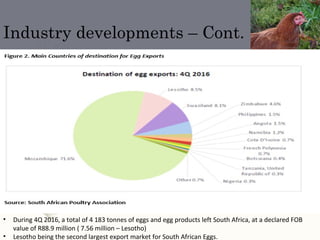

The document analyzes the poultry value chain in Lesotho, finding opportunities and challenges. It details the history and development of the industry. Key challenges include the lack of hatcheries and suppliers within Lesotho, requiring imports, as well as high costs and infrastructure issues. However, opportunities exist through abundant local demand and advantages over imports. The report recommends training, creating a national hatchery and supplier database, and restricting imports to support local egg production business opportunities.